Form 990 Schedule G 2018

What is the Form 990 Schedule G

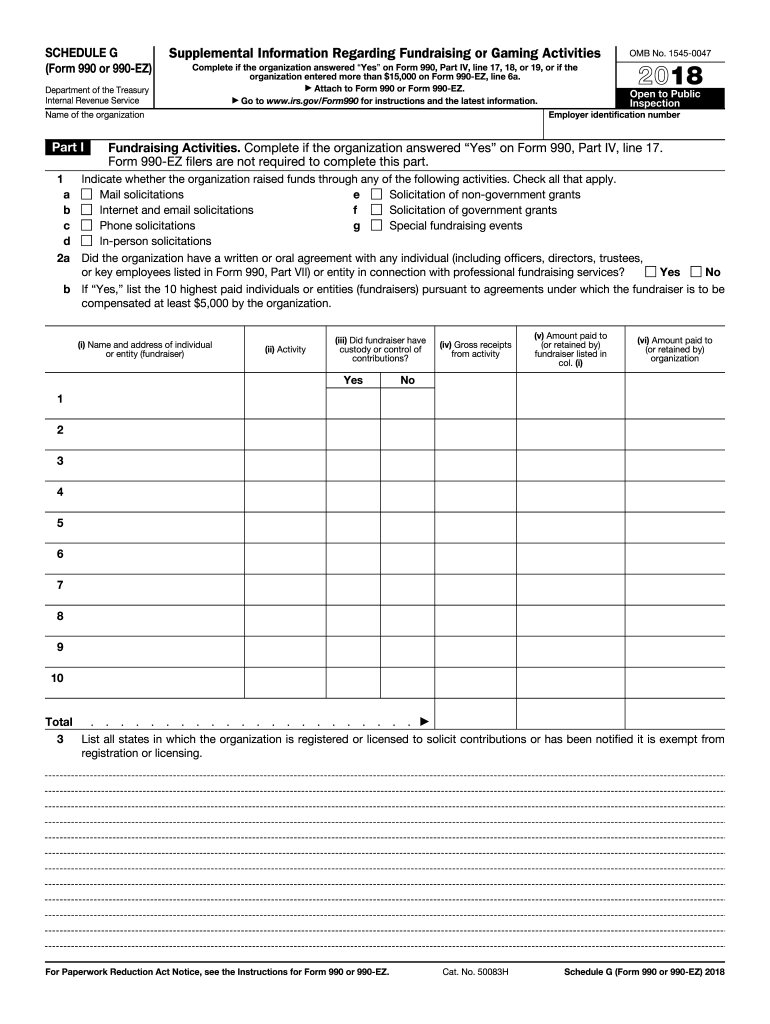

The Form 990 Schedule G is a supplementary form used by tax-exempt organizations to provide detailed information about professional fundraising services. This form is essential for organizations that engage in fundraising activities, as it outlines the relationships with fundraising professionals and the compensation arrangements involved. It helps ensure transparency and accountability in fundraising practices, which is crucial for maintaining public trust.

How to use the Form 990 Schedule G

To use the Form 990 Schedule G, organizations must first determine if they are required to file it based on their fundraising activities. If applicable, they should complete the form by providing information about each fundraising professional engaged, including their names, addresses, and the nature of their services. Organizations must also disclose any compensation paid to these professionals, ensuring that all details are accurate and complete to comply with IRS regulations.

Steps to complete the Form 990 Schedule G

Completing the Form 990 Schedule G involves several steps:

- Gather necessary information about fundraising professionals, including their contact details and services provided.

- Document any compensation arrangements, including fees and commissions paid.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for accuracy and completeness before submission.

- Submit the form along with the main Form 990 by the designated filing deadline.

Filing Deadlines / Important Dates

Organizations must adhere to specific deadlines when filing the Form 990 Schedule G. Typically, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For example, if the fiscal year ends on December 31, the form must be filed by May 15 of the following year. It is crucial to keep track of these dates to avoid penalties for late submissions.

Penalties for Non-Compliance

Failure to file the Form 990 Schedule G when required can result in significant penalties for organizations. The IRS may impose fines for each month the form is late, which can accumulate quickly. Additionally, non-compliance may lead to increased scrutiny from the IRS and potential loss of tax-exempt status. Therefore, it is vital for organizations to understand their filing obligations and ensure timely submissions.

Legal use of the Form 990 Schedule G

The legal use of the Form 990 Schedule G is governed by IRS regulations that require transparency in fundraising practices. Organizations must use the form to disclose all relevant information regarding their fundraising professionals and any compensation arrangements. This legal obligation helps protect the interests of donors and the public by ensuring that funds raised are used appropriately and ethically.

Quick guide on how to complete schedule g 2018 form

Discover the simplest method to complete and sign your Form 990 Schedule G

Are you still spending time preparing your official documents on paper instead of doing it digitally? airSlate SignNow provides a superior approach to complete and sign your Form 990 Schedule G and associated forms for public services. Our advanced electronic signature platform equips you with all the necessary tools to handle paperwork promptly and in compliance with official standards - comprehensive PDF editing, managing, securing, signing, and sharing capabilities readily available within a user-friendly interface.

Only a few steps are needed to finish filling out and signing your Form 990 Schedule G:

- Upload the fillable template to the editor via the Get Form button.

- Identify what information you need to include in your Form 990 Schedule G.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to populate the fields with your information.

- Enhance the content with Text boxes or Images from the top toolbar.

- Emphasize what is important or Obscure sections that are no longer relevant.

- Click on Sign to produce a legally binding electronic signature using your preferred method.

- Add the Date next to your signature and conclude your work with the Done button.

Store your finalized Form 990 Schedule G in the Documents folder within your account, download it, or transfer it to your preferred cloud storage. Our platform also offers versatile form sharing options. There’s no need to print your forms when you must submit them to the appropriate public office - handle it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try now!

Create this form in 5 minutes or less

Find and fill out the correct schedule g 2018 form

FAQs

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

How should I fill out the preference form for the IBPS PO 2018 to get a posting in an urban city?

When you get selected as bank officer of psb you will have to serve across the country. Banks exist not just in urban areas but also in semi urban and rural areas also. Imagine every employee in a bank got posting in urban areas as their wish as a result bank have to shut down all rural and semi urban branches as there is no people to serve. People in other areas deprived of banking service. This makes no sense. Being an officer you will be posted across the country and transferred every three years. You have little say of your wish. Every three year urban posting followed by three years rural and vice versa. If you want your career to grow choose Canara bank followed by union bank . These banks have better growth potentials and better promotion scope

-

How do I schedule a US visa interview of two people together after filling out a DS160 form?

Here is a link that might help answer your question >> DS-160: Frequently Asked QuestionsFor more information on this and similar matters, please call me direct: 650.424.1902Email: heller@hellerimmigration.comHeller Immigration Law Group | Silicon Valley Immigration Attorneys

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

Create this form in 5 minutes!

How to create an eSignature for the schedule g 2018 form

How to create an electronic signature for the Schedule G 2018 Form online

How to generate an eSignature for your Schedule G 2018 Form in Google Chrome

How to make an eSignature for signing the Schedule G 2018 Form in Gmail

How to generate an eSignature for the Schedule G 2018 Form right from your mobile device

How to make an electronic signature for the Schedule G 2018 Form on iOS devices

How to create an eSignature for the Schedule G 2018 Form on Android devices

People also ask

-

What is Form 990 Schedule G and why is it important?

Form 990 Schedule G is a crucial part of the IRS Form 990 that provides information about compensation for the highest-paid employees and contractors of nonprofits. Understanding and completing Form 990 Schedule G accurately is essential for compliance and transparency, ensuring your organization meets federal regulations.

-

How can airSlate SignNow assist with completing Form 990 Schedule G?

AirSlate SignNow streamlines the process of collecting signatures and managing documents needed for Form 990 Schedule G. Our platform allows you to easily send, eSign, and store documents securely, ensuring that all necessary information is gathered efficiently and accurately.

-

Is there a cost associated with using airSlate SignNow for Form 990 Schedule G?

Yes, airSlate SignNow offers a range of pricing plans tailored for different organizational needs. We provide a cost-effective solution that simplifies the eSignature process, making it easier to manage Form 990 Schedule G without breaking your budget.

-

What features does airSlate SignNow offer for managing Form 990 Schedule G?

AirSlate SignNow includes features such as customizable templates, secure document storage, and real-time tracking of document status. These features enhance the efficiency of preparing and submitting Form 990 Schedule G and ensure compliance with IRS requirements.

-

Can I integrate airSlate SignNow with other tools to manage Form 990 Schedule G?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting and document management software, allowing you to streamline your workflow for Form 990 Schedule G. This integration helps maintain accurate records and simplifies collaboration with your finance team.

-

What are the benefits of using airSlate SignNow for Form 990 Schedule G?

Using airSlate SignNow for Form 990 Schedule G offers numerous benefits, including faster document turnaround, enhanced security, and reduced administrative burdens. Our platform empowers organizations to focus on their mission while ensuring compliance with IRS regulations.

-

How secure is airSlate SignNow for handling Form 990 Schedule G documents?

AirSlate SignNow prioritizes security with features like encryption, secure cloud storage, and comprehensive access controls. When handling sensitive Form 990 Schedule G documents, you can trust that your information is protected against unauthorized access.

Get more for Form 990 Schedule G

- Application for construction letter of approval form

- Dnrec division of water application for construction of wastewater form

- Instructions form 2 notice of termination not dnrec delaware

- Chelsea piers certificate of occupancy form

- Bra 25 dcra form

- Home occupation permit application dc form

- Form 50 129 instructionsapplication for 1 d 1

- Mo food pantry tax credit fill out ampamp sign online form

Find out other Form 990 Schedule G

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now