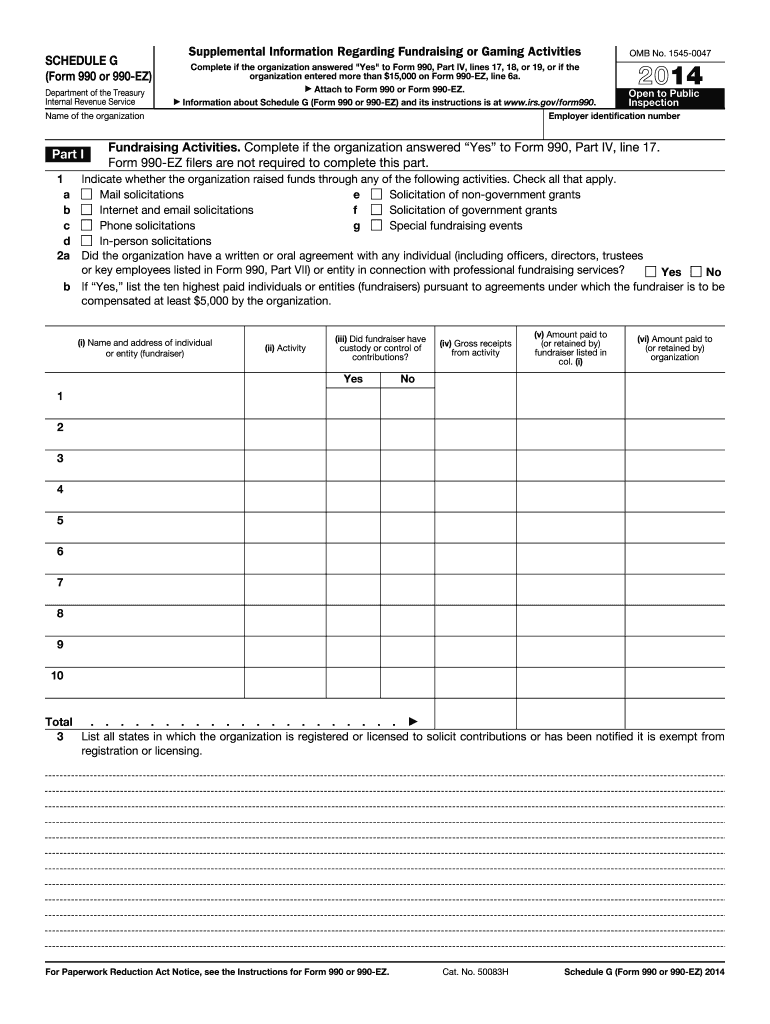

Irs Schedule G Form 2014

What is the Irs Schedule G Form

The IRS Schedule G Form is a tax document used primarily by certain organizations, such as farmers and ranchers, to report income and expenses related to the production of agricultural products. This form is essential for those who wish to claim specific tax benefits associated with farming activities. It helps in detailing the various sources of income and the corresponding expenses incurred, ensuring that taxpayers accurately report their financial situation to the IRS.

How to use the Irs Schedule G Form

To effectively use the IRS Schedule G Form, taxpayers must first gather all relevant financial information related to their farming operations. This includes income from sales, government payments, and any other agricultural revenue. Next, individuals should accurately record their expenses, which may include costs for feed, labor, and equipment. Once all information is compiled, the form can be completed by following the specific instructions provided by the IRS, ensuring that all sections are filled out correctly to avoid issues during processing.

Steps to complete the Irs Schedule G Form

Completing the IRS Schedule G Form involves several key steps:

- Gather financial records: Collect all income and expense documentation related to your farming activities.

- Fill out the form: Start with your personal information, then proceed to report income sources and expenses in the designated sections.

- Double-check entries: Review all information for accuracy, ensuring that figures are correctly calculated and reported.

- Sign and date: Ensure that the form is signed and dated before submission, as this validates the information provided.

Legal use of the Irs Schedule G Form

The legal use of the IRS Schedule G Form is crucial for compliance with federal tax laws. This form must be completed accurately and submitted by the appropriate deadline to avoid penalties. It serves as a formal declaration of income and expenses related to agricultural activities, and any discrepancies or inaccuracies can lead to audits or fines. Therefore, it is important to adhere to IRS guidelines and maintain thorough records to support the information reported on the form.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Schedule G Form typically align with the annual tax return deadlines. For most taxpayers, this means the form must be submitted by April fifteenth of the following year. However, if you are a farmer or rancher who has elected to use a different tax year, the deadline may vary. It is essential to stay informed about specific filing dates to ensure timely submission and avoid any potential penalties.

Examples of using the Irs Schedule G Form

Examples of using the IRS Schedule G Form include reporting income from the sale of crops, livestock, or other agricultural products. For instance, a farmer who sells corn would report the total sales revenue under income, while also detailing expenses such as seed costs, fertilizer, and labor. Another example might involve a rancher reporting income from the sale of cattle, alongside expenses for feed and veterinary care. These examples illustrate the form's role in capturing the financial activities of agricultural businesses.

Quick guide on how to complete 2014 irs schedule g form

Effortlessly complete Irs Schedule G Form on any device

Online document management has gained signNow traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without interruptions. Manage Irs Schedule G Form on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Irs Schedule G Form with ease

- Find Irs Schedule G Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal significance as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Decide how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, cumbersome form searches, or mistakes requiring new printed copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Irs Schedule G Form to ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 irs schedule g form

Create this form in 5 minutes!

How to create an eSignature for the 2014 irs schedule g form

The best way to make an electronic signature for a PDF document in the online mode

The best way to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the Irs Schedule G Form?

The Irs Schedule G Form is used to report certain income and expenses for specific tax purposes. This form helps businesses accurately reflect their financial activities to ensure compliance with IRS regulations. Understanding the details of the Irs Schedule G Form is crucial for effective tax reporting.

-

How can airSlate SignNow help with the Irs Schedule G Form?

airSlate SignNow simplifies the process of completing the Irs Schedule G Form by allowing you to eSign and manage documents electronically. With its user-friendly interface, you can easily customize and share your forms. This efficiency ensures that your submissions are timely and accurate.

-

What features does airSlate SignNow offer for the Irs Schedule G Form?

Key features of airSlate SignNow for the Irs Schedule G Form include seamless eSigning, secure document sharing, and integration with popular financial software. These features streamline your filing process, allowing you to focus on your business rather than paperwork. Moreover, your data is protected with top-notch security measures.

-

Is airSlate SignNow a cost-effective solution for eSigning the Irs Schedule G Form?

Yes, airSlate SignNow offers competitive pricing that is affordable for businesses of all sizes looking to manage the Irs Schedule G Form efficiently. By reducing the time and resources spent on administrative tasks, our solution ultimately saves you money. Explore our pricing plans to find the best fit for your needs.

-

Can I integrate airSlate SignNow with other software for the Irs Schedule G Form?

Absolutely! airSlate SignNow supports numerous integrations with accounting and financial software, making it easier to handle the Irs Schedule G Form along with your other business processes. Whether it’s linking to your CRM or accounting tools, our platform enhances your workflow and productivity.

-

What are the benefits of using airSlate SignNow for tax forms like the Irs Schedule G Form?

Using airSlate SignNow for the Irs Schedule G Form offers numerous benefits, including enhanced accuracy, time savings, and improved compliance. Our electronic signature solutions ensure that your documents are legally binding and securely stored. This allows you to focus on growing your business while we simplify your tax filing.

-

Is it easy to customize the Irs Schedule G Form using airSlate SignNow?

Yes, airSlate SignNow makes it easy to customize the Irs Schedule G Form to meet your specific needs. Our platform allows you to add fields, instructions, and branding elements effortlessly. This customization ensures that the form aligns with your business processes and enhances your professionalism.

Get more for Irs Schedule G Form

Find out other Irs Schedule G Form

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation