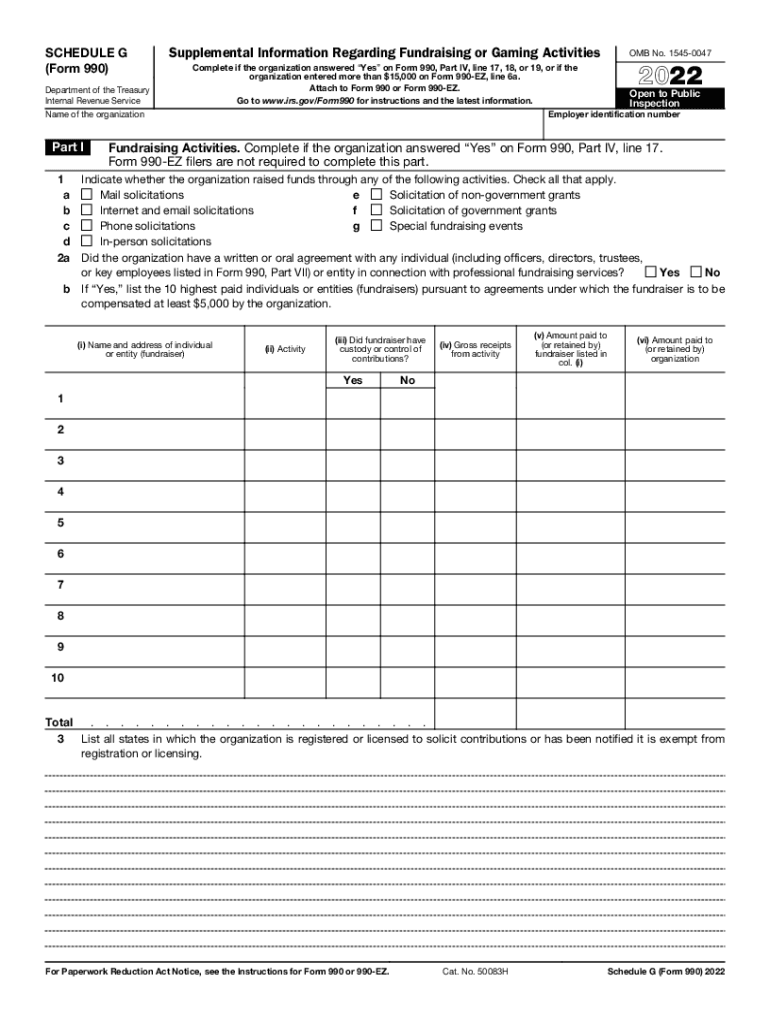

Instructions for Schedule G Form 990 IRS Tax FormsInstructions for Schedule G Form 990 IRS Tax FormsInstructions for Schedule G 2022

What is the 2012 Form 990?

The 2012 Form 990 is a crucial tax document used by tax-exempt organizations in the United States to report their financial information to the Internal Revenue Service (IRS). This form provides transparency regarding the organization’s activities, governance, and financial health. It is designed to ensure that nonprofits adhere to compliance regulations while also allowing the public to access information about their operations.

Organizations that are required to file this form include charities, foundations, and other tax-exempt entities. The 2012 Form 990 consists of several sections, including financial statements, governance practices, and information about the organization’s mission and programs. Accurate completion of this form is essential for maintaining tax-exempt status and for fulfilling federal and state reporting obligations.

Key Elements of the 2012 Form 990

Understanding the key elements of the 2012 Form 990 is essential for accurate filing. The form includes:

- Part I: Summary of the organization’s mission and activities.

- Part II: Signature block for the authorized representative.

- Part III: Statement of program service accomplishments, detailing the organization's primary activities.

- Part IV: Checklist of required schedules, ensuring compliance with IRS regulations.

- Part V: Governance, management, and disclosure practices.

- Part VI: Information on the organization’s board of directors and key employees.

- Part VII: Compensation information for the highest-paid employees and contractors.

Each section requires careful attention to detail to ensure compliance and transparency. Organizations should gather all necessary financial records and documentation before beginning the filing process.

Steps to Complete the 2012 Form 990

Completing the 2012 Form 990 involves several important steps to ensure accuracy and compliance:

- Gather all relevant financial documents, including income statements, balance sheets, and prior year tax returns.

- Review the form's instructions to understand the requirements for each section.

- Complete each part of the form, ensuring that all information is accurate and up-to-date.

- Consult with a tax professional or accountant if necessary to clarify any complex issues.

- Review the completed form for errors or omissions before submission.

- File the form electronically or via mail by the designated deadline.

Following these steps can help organizations avoid penalties and ensure that they meet all IRS requirements.

Filing Deadlines for the 2012 Form 990

Filing deadlines for the 2012 Form 990 vary based on the organization's fiscal year. Typically, the form is due on the fifteenth day of the fifth month after the end of the organization's fiscal year. For organizations operating on a calendar year, the deadline is May fifteen. Extensions may be available, allowing additional time to file, but organizations must apply for this extension before the original deadline.

It is important to adhere to these deadlines to avoid potential penalties and maintain good standing with the IRS.

Legal Use of the 2012 Form 990

The 2012 Form 990 serves as a legal document that provides evidence of an organization’s compliance with federal tax laws. Accurate and timely submission is critical for maintaining tax-exempt status. Failure to file or submitting incorrect information can lead to penalties, including the loss of tax-exempt status.

Organizations should ensure that they are aware of any state-specific regulations that may also apply to their filing process. Understanding the legal implications of the information reported on the form is essential for proper governance and accountability.

Examples of Using the 2012 Form 990

The 2012 Form 990 can be used in various scenarios, including:

- Assessing an organization’s financial health and operational transparency by potential donors.

- Providing necessary documentation for grant applications and funding opportunities.

- Ensuring compliance with IRS regulations to avoid penalties.

These examples highlight the importance of the 2012 Form 990 in promoting accountability and transparency within the nonprofit sector.

Quick guide on how to complete instructions for schedule g form 990 2021 irs tax formsinstructions for schedule g form 990 2021 irs tax formsinstructions for

Prepare Instructions For Schedule G Form 990 IRS Tax FormsInstructions For Schedule G Form 990 IRS Tax FormsInstructions For Schedule G effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can locate the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Handle Instructions For Schedule G Form 990 IRS Tax FormsInstructions For Schedule G Form 990 IRS Tax FormsInstructions For Schedule G on any platform with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest way to alter and electronically sign Instructions For Schedule G Form 990 IRS Tax FormsInstructions For Schedule G Form 990 IRS Tax FormsInstructions For Schedule G seamlessly

- Locate Instructions For Schedule G Form 990 IRS Tax FormsInstructions For Schedule G Form 990 IRS Tax FormsInstructions For Schedule G and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form navigation, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Instructions For Schedule G Form 990 IRS Tax FormsInstructions For Schedule G Form 990 IRS Tax FormsInstructions For Schedule G and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for schedule g form 990 2021 irs tax formsinstructions for schedule g form 990 2021 irs tax formsinstructions for

Create this form in 5 minutes!

People also ask

-

What is the 2012 990 form and why is it important?

The 2012 990 form is an annual information return that tax-exempt organizations must file with the IRS. It provides transparency on a non-profit's financial status, governance, and operations, which is crucial for maintaining public trust and compliance with federal regulations.

-

How can airSlate SignNow help with the 2012 990 filing process?

airSlate SignNow streamlines the document preparation and signing process for your 2012 990 forms. With our easy-to-use platform, you can easily collect signatures from board members and ensure that your return is filed accurately and on time.

-

Is there a cost associated with using airSlate SignNow for 2012 990 documents?

Yes, airSlate SignNow offers various pricing plans that cater to different organizational needs, including features specifically designed for handling documents like the 2012 990. These plans ensure that you can manage costs effectively while benefiting from our robust eSigning solutions.

-

What features does airSlate SignNow offer for managing the 2012 990?

Our platform provides features such as customizable templates, document tracking, secure storage, and team collaboration tools, making it easier to manage the 2012 990 documents. These features enhance efficiency and ensure compliance throughout the filing process.

-

Can airSlate SignNow integrate with other software I use for non-profit management?

Yes, airSlate SignNow offers seamless integrations with various popular software tools used in non-profit management, which can enhance your workflow for preparing the 2012 990. This integration helps streamline your processes and keep everything organized, reducing the administrative burden.

-

What benefits does eSigning offer for the 2012 990 process?

Using eSigning for your 2012 990 forms offers numerous benefits, including faster turnaround times, improved accuracy, and enhanced security. With airSlate SignNow, you can reduce the risk of lost documents and ensure that your submissions are compliant and professional.

-

How secure is airSlate SignNow for handling sensitive 2012 990 information?

airSlate SignNow takes security seriously, implementing advanced encryption and secure data management protocols to protect your sensitive information related to the 2012 990. You can sign and store documents confidently, knowing they are protected by industry-leading security measures.

Get more for Instructions For Schedule G Form 990 IRS Tax FormsInstructions For Schedule G Form 990 IRS Tax FormsInstructions For Schedule G

- New hampshire corporation search form

- Quitclaim deed from individual to two individuals in joint tenancy new hampshire form

- Renunciation and disclaimer of property from will by testate new hampshire form

- Notice of furnishing individual new hampshire form

- Quitclaim deed by two individuals to husband and wife new hampshire form

- Warranty deed from two individuals to husband and wife new hampshire form

- Nh corporation 497318590 form

- Notice to financial institution of furnishing of labor or materials individual new hampshire form

Find out other Instructions For Schedule G Form 990 IRS Tax FormsInstructions For Schedule G Form 990 IRS Tax FormsInstructions For Schedule G

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document