Complete If the Organization Answered Yes on Form 990, Part IV, Line 17, 18, or 19; or If the 2024-2026

Understanding the Requirements for Form 990

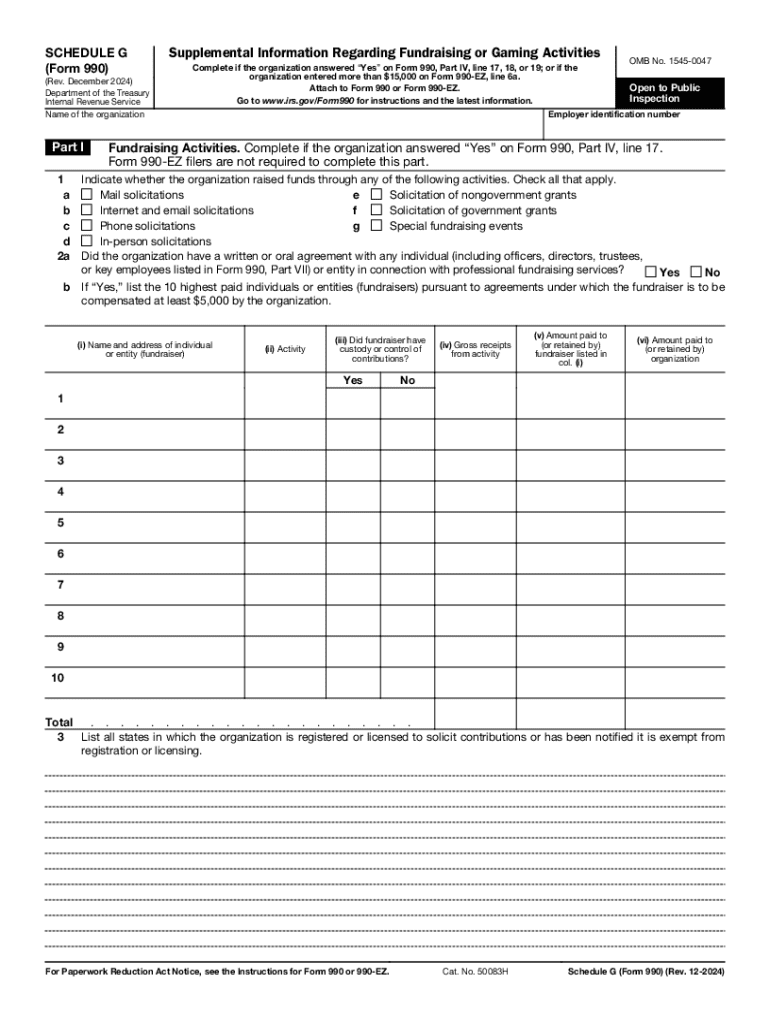

Form 990 is a crucial document for tax-exempt organizations in the United States, providing transparency about their financial activities. Organizations must complete this form if they meet specific criteria, including annual gross receipts exceeding $200,000 or total assets exceeding $500,000. Understanding the requirements ensures compliance with IRS regulations and helps maintain tax-exempt status.

Steps to Complete Form 990

Completing Form 990 involves several key steps:

- Gather financial records, including income statements, balance sheets, and details of expenses.

- Review the specific sections of the form, particularly Parts IV and V, which require detailed information about governance and financial activities.

- Ensure all required schedules, such as Schedule G, are completed accurately.

- Double-check the form for accuracy and completeness before submission.

Filing Deadlines for Form 990

Organizations must file Form 990 by the 15th day of the fifth month after the end of their fiscal year. For those on a calendar year, the due date is May 15. Extensions are available but must be requested using Form 8868. Timely filing is essential to avoid penalties and maintain compliance with IRS regulations.

IRS Guidelines for Form 990

The IRS provides detailed guidelines for completing Form 990. These guidelines cover eligibility, required disclosures, and specific instructions for each part of the form. Organizations should refer to the IRS website for the most current information and updates to ensure compliance with any changes in tax law.

Penalties for Non-Compliance with Form 990

Failure to file Form 990 or filing it late can result in significant penalties. The IRS imposes fines that can accumulate daily, depending on the size of the organization. Additionally, non-compliance can jeopardize an organization's tax-exempt status, making it vital to adhere to filing requirements.

Required Documents for Form 990

To successfully complete Form 990, organizations need to prepare various documents, including:

- Financial statements for the fiscal year.

- Details of any fundraising activities.

- Information on governance practices.

- Supporting documentation for any claims made on the form.

Examples of Form 990 Usage

Form 990 is utilized by a variety of tax-exempt organizations, including charities, educational institutions, and religious organizations. Each organization must tailor its Form 990 to reflect its unique financial situation and operational practices. Reviewing examples of completed forms can provide valuable insights into best practices for disclosure and transparency.

Create this form in 5 minutes or less

Find and fill out the correct complete if the organization answered yes on form 990 part iv line 17 18 or 19 or if the

Create this form in 5 minutes!

How to create an eSignature for the complete if the organization answered yes on form 990 part iv line 17 18 or 19 or if the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are 990 tax returns and who needs to file them?

990 tax returns are informational tax forms that certain tax-exempt organizations must file with the IRS. These forms provide transparency about the organization's financial activities and ensure compliance with federal regulations. Nonprofits, charities, and other tax-exempt entities typically need to file 990 tax returns annually.

-

How can airSlate SignNow help with filing 990 tax returns?

airSlate SignNow streamlines the process of preparing and submitting 990 tax returns by allowing users to easily send and eSign necessary documents. Our platform ensures that all signatures are collected securely and efficiently, reducing the time spent on paperwork. This helps organizations focus on their mission rather than administrative tasks.

-

What features does airSlate SignNow offer for managing 990 tax returns?

airSlate SignNow offers features such as document templates, automated workflows, and secure eSigning, all tailored to simplify the management of 990 tax returns. Users can create custom templates for their tax documents, ensuring consistency and compliance. Additionally, our platform allows for easy tracking of document status, enhancing organization and efficiency.

-

Is airSlate SignNow cost-effective for organizations filing 990 tax returns?

Yes, airSlate SignNow provides a cost-effective solution for organizations needing to file 990 tax returns. Our pricing plans are designed to accommodate various budgets, making it accessible for small nonprofits and larger organizations alike. By reducing the time and resources spent on document management, users can save money in the long run.

-

Can airSlate SignNow integrate with accounting software for 990 tax returns?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage 990 tax returns alongside your financial records. This integration allows for a smoother workflow, ensuring that all necessary documents are readily available and up-to-date. Users can streamline their tax preparation process by connecting their existing tools.

-

What are the benefits of using airSlate SignNow for 990 tax returns?

Using airSlate SignNow for 990 tax returns offers numerous benefits, including enhanced efficiency, improved compliance, and secure document handling. Our platform simplifies the eSigning process, allowing for faster approvals and submissions. Additionally, users can maintain a clear audit trail, which is crucial for transparency and accountability.

-

How secure is airSlate SignNow when handling 990 tax returns?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like 990 tax returns. Our platform employs advanced encryption and security protocols to protect your data throughout the signing process. Users can trust that their information is safe and secure, ensuring compliance with privacy regulations.

Get more for Complete If The Organization Answered Yes On Form 990, Part IV, Line 17, 18, Or 19; Or If The

- Ice form i 395 fillable

- Uia 1733 65922846 form

- Exhibit b county of hamilton hotel lodging excise tax return to be filed and the tax due paid therewith for each separate form

- Ls 201 form

- As 52 form

- Established ccsghpp client service authorization request sar dhcs ca form

- International fuel tax agreement tax return if washington dol wa form

- Pa petition modify custody form

Find out other Complete If The Organization Answered Yes On Form 990, Part IV, Line 17, 18, Or 19; Or If The

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors