Voya Rmd Form 2018-2026

What is the Voya RMD Form

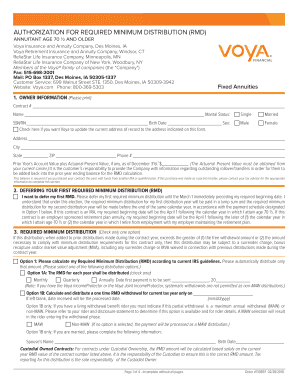

The Voya RMD form is a crucial document for individuals who need to withdraw required minimum distributions from their retirement accounts. This form is specifically designed for use with Voya retirement plans, ensuring compliance with IRS regulations regarding minimum distributions. The purpose of the form is to facilitate the withdrawal process while adhering to the legal requirements set forth by the Internal Revenue Service.

Steps to Complete the Voya RMD Form

Completing the Voya RMD form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including your account details and personal identification. Next, accurately fill in the required fields, which typically include your name, address, and Social Security number. It's important to specify the amount you wish to withdraw and the frequency of distributions. After completing the form, review it carefully for any errors before submitting it.

How to Obtain the Voya RMD Form

The Voya RMD form can be easily obtained through various channels. You can access it directly from the Voya retirement plans website, where it is available for download in PDF format. Alternatively, you may request a physical copy by contacting Voya customer service. Ensure you have the latest version of the form to comply with the current IRS guidelines.

Legal Use of the Voya RMD Form

The legal use of the Voya RMD form is essential for ensuring that your withdrawals meet IRS requirements. This form serves as a formal request for distributions and must be completed accurately to avoid penalties. It is important to understand that failing to withdraw the required minimum amount can result in significant tax penalties. Therefore, using the form correctly is crucial for maintaining compliance with federal tax laws.

IRS Guidelines

The IRS provides specific guidelines regarding required minimum distributions, which are applicable to the Voya RMD form. According to these guidelines, individuals must begin taking distributions from their retirement accounts by April first of the year following the year they turn seventy-two. The amount of the distribution is calculated based on life expectancy tables provided by the IRS, which are updated periodically. Understanding these guidelines is essential for accurate completion of the Voya RMD form.

Filing Deadlines / Important Dates

Filing deadlines for the Voya RMD form are critical to avoid penalties. The primary deadline is April first of the year following the account holder's seventy-second birthday. If you miss this deadline, you may face a penalty equal to fifty percent of the required distribution amount. It is advisable to submit the form well in advance of this date to ensure timely processing and compliance with IRS regulations.

Required Documents

When completing the Voya RMD form, certain documents may be required to support your request. These documents typically include proof of identity, such as a government-issued ID, and any relevant account statements that detail your retirement plan balances. Having these documents ready can streamline the process and help avoid delays in processing your distribution request.

Quick guide on how to complete voya rmd form

Complete Voya Rmd Form effortlessly on any device

Web-based document management has gained traction among companies and individuals alike. It offers a perfect environmentally friendly option to conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Voya Rmd Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to alter and eSign Voya Rmd Form without hassle

- Obtain Voya Rmd Form and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign Voya Rmd Form and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct voya rmd form

Create this form in 5 minutes!

How to create an eSignature for the voya rmd form

How to make an eSignature for a PDF document online

How to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is the required minimum distribution table 2024?

The required minimum distribution table 2024 outlines the minimum amounts that retirement account holders must withdraw starting at age 72. This table is crucial for anyone wanting to understand their retirement distributions and tax liabilities. Familiarizing yourself with this table can help you plan your finances more effectively.

-

How can airSlate SignNow assist with managing required minimum distributions?

AirSlate SignNow offers a seamless platform for eSigning and sending financial documents related to required minimum distributions. Users can easily create, send, and manage documents that pertain to these distributions, ensuring compliance and timely submissions. This service helps streamline the process while keeping all documents secure.

-

What features should I look for in an eSigning platform for required minimum distributions?

When choosing an eSigning platform for managing required minimum distributions, look for features like secure document storage, user authentication, and audit trails. AirSlate SignNow provides all these functionalities while supporting compliance with financial regulations. This ensures your documents are both protected and accountable.

-

Is there a cost associated with using airSlate SignNow for required minimum distributions?

AirSlate SignNow offers a variety of pricing plans designed to fit different business needs and budgets. Depending on the features and volume of documents, your costs will vary. However, the platform is known for its cost-effective solutions, making it accessible for individuals and businesses handling required minimum distributions.

-

Can I integrate airSlate SignNow with my existing financial software for required minimum distributions?

Yes, airSlate SignNow provides integrations with numerous financial software applications, enhancing your workflow when managing required minimum distributions. These integrations help you automatically populate documents and keep all financial records aligned. This ensures a smooth transition and management of your required distributions.

-

What are the benefits of using airSlate SignNow for required minimum distributions?

Using airSlate SignNow for required minimum distributions offers several benefits, such as increasing efficiency and accuracy when handling important documents. The platform simplifies the eSigning process, which helps eliminate delays and errors typically seen with paper-based methods. Ultimately, this contributes to a more organized approach to managing your distributions.

-

Are there templates available for required minimum distributions in airSlate SignNow?

Yes, airSlate SignNow provides templates specifically designed for required minimum distributions, making it easier to create compliant documents swiftly. These templates include the necessary fields and formats to ensure your documents adhere to regulations. This feature is especially useful for users who need to generate multiple documents promptly.

Get more for Voya Rmd Form

- Fillable online florida corporate short form income tax

- Form it 2658 report of estimated tax for nonresident

- 2020 form 8453 llc california e file return authorization for limited liability companies 2020 form 8453 llc california e file

- Florida dept of revenue terminal supplier form

- Passive activity loss internal revenue service fill out form

- Form it 2104 sny certificate of exemption from withholding for start up ny program tax year 2022

- 2020 ftb pub 1001 supplemental guidelines to california adjustments 2020 ftb pub 1001 supplemental guidelines to california form

- Get the free form nyc 245 ampampquotactivities report of

Find out other Voya Rmd Form

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation