Tax Clearance Application Form Bureau of Internal BIR 2018-2026

Understanding the sworn application for tax clearance

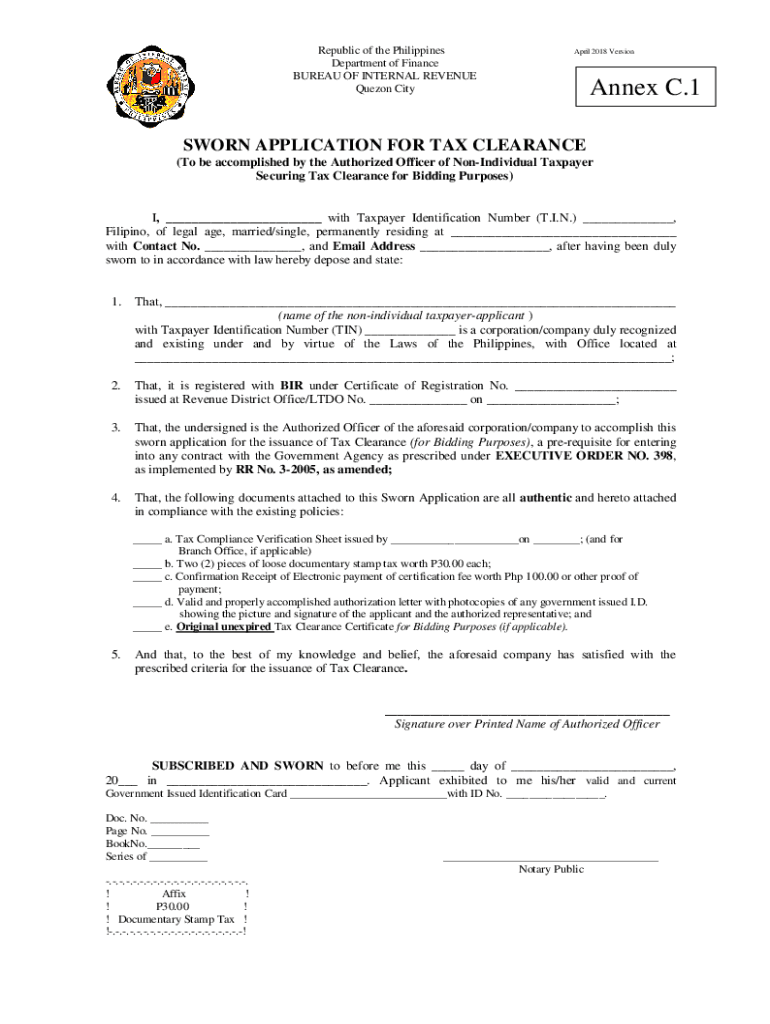

The sworn application for tax clearance is a formal document required by the Bureau of Internal Revenue (BIR) in the Philippines. This application serves as a declaration of a taxpayer's compliance with tax obligations. It is essential for individuals and businesses that need to secure a tax clearance certificate, which is often necessary for various transactions, including bidding for government contracts or applying for loans. The sworn application must be filled out accurately to reflect the taxpayer's financial status and tax history.

Steps to complete the sworn application for tax clearance

Completing the sworn application for tax clearance involves several important steps:

- Gather necessary documents, such as previous tax returns, payment receipts, and identification.

- Fill out the application form accurately, ensuring all sections are completed.

- Provide any required supporting documentation that verifies your tax compliance.

- Sign the application electronically or in person, depending on submission requirements.

- Submit the application through the appropriate channel, whether online or in person.

Key elements of the sworn application for tax clearance

The sworn application for tax clearance includes several key elements that must be addressed:

- Taxpayer Information: Full name, address, and taxpayer identification number.

- Declaration of Compliance: A statement affirming that all tax obligations have been met.

- Signature: A sworn statement must be signed by the taxpayer or authorized representative.

- Supporting Documents: Attachments that substantiate the claims made in the application.

Legal use of the sworn application for tax clearance

The sworn application for tax clearance is legally binding once submitted. It serves as a formal declaration to the BIR regarding a taxpayer's compliance with tax laws. To ensure its legal validity, the application must adhere to the requirements set forth by the BIR, including proper signatures and supporting documentation. Failure to comply with these requirements may result in delays or rejections of the application.

Form submission methods for the sworn application for tax clearance

The sworn application for tax clearance can be submitted through various methods, providing flexibility for taxpayers:

- Online Submission: Many taxpayers prefer submitting the application electronically through the BIR's online portal.

- In-Person Submission: Taxpayers can also submit the form directly at their local BIR office.

- Mail Submission: For those who prefer traditional methods, mailing the application is also an option, though it may take longer to process.

Examples of using the sworn application for tax clearance

The sworn application for tax clearance is commonly used in various scenarios, such as:

- Individuals applying for a loan that requires proof of tax compliance.

- Businesses bidding on government contracts that mandate a tax clearance certificate.

- Taxpayers seeking to settle their tax obligations before selling property or assets.

Quick guide on how to complete tax clearance application form bureau of internal bir

Effortlessly Prepare Tax Clearance Application Form Bureau Of Internal BIR on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Handle Tax Clearance Application Form Bureau Of Internal BIR on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

How to Alter and Electronically Sign Tax Clearance Application Form Bureau Of Internal BIR with Ease

- Obtain Tax Clearance Application Form Bureau Of Internal BIR and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important parts of the documents or obscure sensitive information with tools specifically designed for that by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Tax Clearance Application Form Bureau Of Internal BIR to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax clearance application form bureau of internal bir

Create this form in 5 minutes!

How to create an eSignature for the tax clearance application form bureau of internal bir

The way to generate an electronic signature for a PDF document online

The way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is a sworn application for tax clearance?

A sworn application for tax clearance is a formal request submitted to tax authorities that serves as a declaration of an individual's or business's tax compliance status. It often includes affirmations regarding outstanding tax liabilities. Using airSlate SignNow allows you to create and send this document efficiently, ensuring it meets all required legal standards.

-

How does airSlate SignNow facilitate sworn application for tax clearance?

airSlate SignNow streamlines the process of preparing a sworn application for tax clearance by providing customizable templates and secure eSignature features. Users can easily fill out, sign, and send their applications without the hassle of printing or physically mailing documents. This enhances both efficiency and compliance throughout the process.

-

What are the costs associated with using airSlate SignNow for my sworn application for tax clearance?

airSlate SignNow offers various pricing plans, which are designed to cater to different business needs. Depending on the features required, costs can be competitive, making it a cost-effective solution for managing the sworn application for tax clearance. You can check their website for specific pricing details and potential discounts.

-

Can I integrate airSlate SignNow with other software for my sworn application for tax clearance?

Yes, airSlate SignNow supports integration with numerous applications and systems, ensuring a seamless workflow for your sworn application for tax clearance. Whether you use CRM software, accounting tools, or document management systems, airSlate SignNow can enhance your overall process by connecting with your existing technology.

-

What benefits does airSlate SignNow offer for the sworn application for tax clearance process?

Using airSlate SignNow for the sworn application for tax clearance simplifies document management and accelerates the approval process. Key benefits include reduced turnaround time, improved accuracy, and enhanced security through encrypted eSignatures. This means you can manage your tax matters more effectively and worry less about compliance issues.

-

Is it safe to submit my sworn application for tax clearance using airSlate SignNow?

Absolutely! airSlate SignNow employs advanced security measures to protect sensitive information contained in your sworn application for tax clearance. This includes data encryption and authentication protocols that ensure only authorized personnel can access your documents, giving you peace of mind throughout the submission process.

-

How can I track the status of my sworn application for tax clearance using airSlate SignNow?

airSlate SignNow provides tracking features that allow you to monitor the status of your sworn application for tax clearance in real-time. You will receive notifications when your document is viewed, signed, or completed, ensuring transparency throughout the process. This helps you stay informed and avoids unnecessary delays.

Get more for Tax Clearance Application Form Bureau Of Internal BIR

- Technology jobs and research and development tax bb new mexico form

- Purpose of this form to claim the technology jobs tax credit attach this completed technology jobs tax credit claim

- Disabled license plates form

- Non taxable transaction certificates nttcforms ampamp publications taxation and revenue new mexiconon taxable transaction

- Fillable online understanding your forms w 2 wage ampampamp

- Pdf instructions for form ct 54 taxnygov

- Form ct 3 abc fill and sign printable template onlineus legal forms

- It 558 form

Find out other Tax Clearance Application Form Bureau Of Internal BIR

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer