Form W 4P Withholding Certificate for Periodic Pension or Annuity Payments 2022

What is the Form W-4P Withholding Certificate for Periodic Pension or Annuity Payments

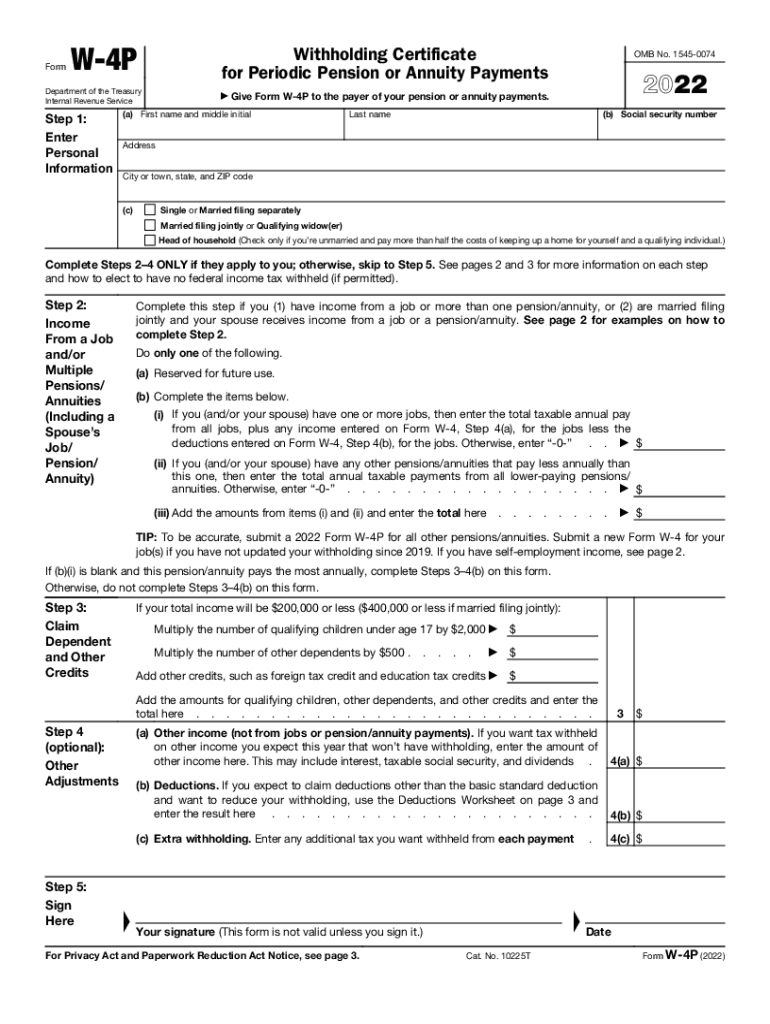

The Form W-4P is a crucial document used by individuals receiving periodic pension or annuity payments. This form allows recipients to specify the amount of federal income tax to withhold from their payments. Proper completion of the W-4P ensures that the correct tax amount is deducted, helping to avoid underpayment penalties at tax time. The form is specifically designed for those who receive pensions, annuities, or similar payments, making it essential for accurate tax planning.

Steps to Complete the Form W-4P Withholding Certificate for Periodic Pension or Annuity Payments

Completing the Form W-4P involves several key steps:

- Personal Information: Fill in your name, address, and Social Security number at the top of the form.

- Filing Status: Indicate your filing status, such as single, married, or head of household.

- Withholding Allowances: Specify the number of allowances you wish to claim. This affects how much tax is withheld.

- Additional Withholding: If you want to withhold an additional amount, specify it in the designated section.

- Signature and Date: Sign and date the form to validate it.

Once completed, submit the form to the payer of your pension or annuity payments.

IRS Guidelines for the Form W-4P Withholding Certificate for Periodic Pension or Annuity Payments

The IRS provides specific guidelines for completing the Form W-4P. It is important to refer to the instructions provided with the form, which outline how to determine your withholding allowances based on your expected annual income and tax situation. The IRS also recommends reviewing your withholding periodically, especially after significant life changes such as marriage, divorce, or retirement. This ensures that your withholding remains appropriate for your financial circumstances.

Legal Use of the Form W-4P Withholding Certificate for Periodic Pension or Annuity Payments

The Form W-4P is legally binding when properly completed and submitted. It serves as an official request to the payer to withhold a specific amount of federal tax from your pension or annuity payments. Compliance with IRS regulations is essential, as failure to provide accurate information can lead to under-withholding or over-withholding of taxes, which may result in penalties or unexpected tax bills. It is advisable to consult with a tax professional if you have questions about your withholding choices.

Examples of Using the Form W-4P Withholding Certificate for Periodic Pension or Annuity Payments

Several scenarios illustrate the use of the Form W-4P:

- Retirement Income: A retiree receiving monthly pension payments may use the form to adjust their withholding based on their expected income and tax bracket.

- Annuity Payments: An individual receiving annuity payments may choose to withhold additional taxes to cover other income sources, ensuring they do not owe taxes at the end of the year.

- Life Changes: A person who recently married may update their W-4P to reflect their new filing status, potentially reducing their withholding amount.

How to Obtain the Form W-4P Withholding Certificate for Periodic Pension or Annuity Payments

The Form W-4P can be easily obtained from the IRS website or through your pension or annuity provider. It is available as a printable PDF, allowing you to fill it out at your convenience. Additionally, many financial institutions and tax preparation services may provide copies of the form. Ensure that you are using the most current version of the form to comply with IRS regulations.

Quick guide on how to complete 2022 form w 4p withholding certificate for periodic pension or annuity payments

Complete Form W 4P Withholding Certificate For Periodic Pension Or Annuity Payments effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form W 4P Withholding Certificate For Periodic Pension Or Annuity Payments on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form W 4P Withholding Certificate For Periodic Pension Or Annuity Payments without hassle

- Locate Form W 4P Withholding Certificate For Periodic Pension Or Annuity Payments and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent parts of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form W 4P Withholding Certificate For Periodic Pension Or Annuity Payments and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form w 4p withholding certificate for periodic pension or annuity payments

Create this form in 5 minutes!

People also ask

-

What is the W4 P 2021 form and why do I need it?

The W4 P 2021 form is used by employees to determine the amount of federal income tax to withhold from their paychecks. Understanding this form is essential for accurate tax withholding, preventing underpayment or overpayment. Using airSlate SignNow, you can easily fill out and eSign your W4 P 2021 form, streamlining the process.

-

How does airSlate SignNow help with the W4 P 2021 process?

airSlate SignNow simplifies the W4 P 2021 process by providing an easy-to-use platform for filling out and eSigning the form. This digital solution allows you to remotely complete documents, making it ideal for remote teams. Plus, it's a cost-effective way to manage employee paperwork.

-

Is there a cost associated with using airSlate SignNow for the W4 P 2021 form?

Yes, there are various pricing plans available for using airSlate SignNow, tailored to different business needs. These plans include options for individual users, small businesses, and larger enterprises, ensuring that everyone can find a suitable solution for handling documents like the W4 P 2021 form.

-

Can I integrate airSlate SignNow with other tools for managing payroll and taxes?

Absolutely! airSlate SignNow offers integrations with a variety of popular productivity and payroll tools. This seamless integration enhances your ability to manage tax documents like the W4 P 2021 more efficiently within your existing workflow.

-

How secure is airSlate SignNow for signing the W4 P 2021 form?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and security measures to protect your personal information while you complete documents like the W4 P 2021 form. You can trust that your sensitive data is safe with us.

-

What features does airSlate SignNow offer specifically for tax documents like the W4 P 2021?

airSlate SignNow provides several features designed for ease of use with tax documents, including templates for the W4 P 2021 form, easy eSigning, and collaborative options. You can also track the progress of your documents and receive notifications upon completion. All these features streamline the paperwork process.

-

How quickly can I complete the W4 P 2021 form using airSlate SignNow?

Using airSlate SignNow, you can complete the W4 P 2021 form in minutes. The user-friendly interface allows you to fill out the required fields quickly, eSign, and send it off without the hassle of printing and scanning. It's designed for efficiency and ease of use.

Get more for Form W 4P Withholding Certificate For Periodic Pension Or Annuity Payments

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497322276 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497322277 form

- Oh letter landlord 497322278 form

- Letter from landlord to tenant for failure to keep all plumbing fixtures in the dwelling unit as clean as their condition 497322279 form

- Ohio landlord tenant form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497322281 form

- Letter landlord tenant notice 497322282 form

- Ohio about law form

Find out other Form W 4P Withholding Certificate For Periodic Pension Or Annuity Payments

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors