Portal Ct GovDRSDRS FormsTrust and Estate Forms Ct 2022

IRS Guidelines

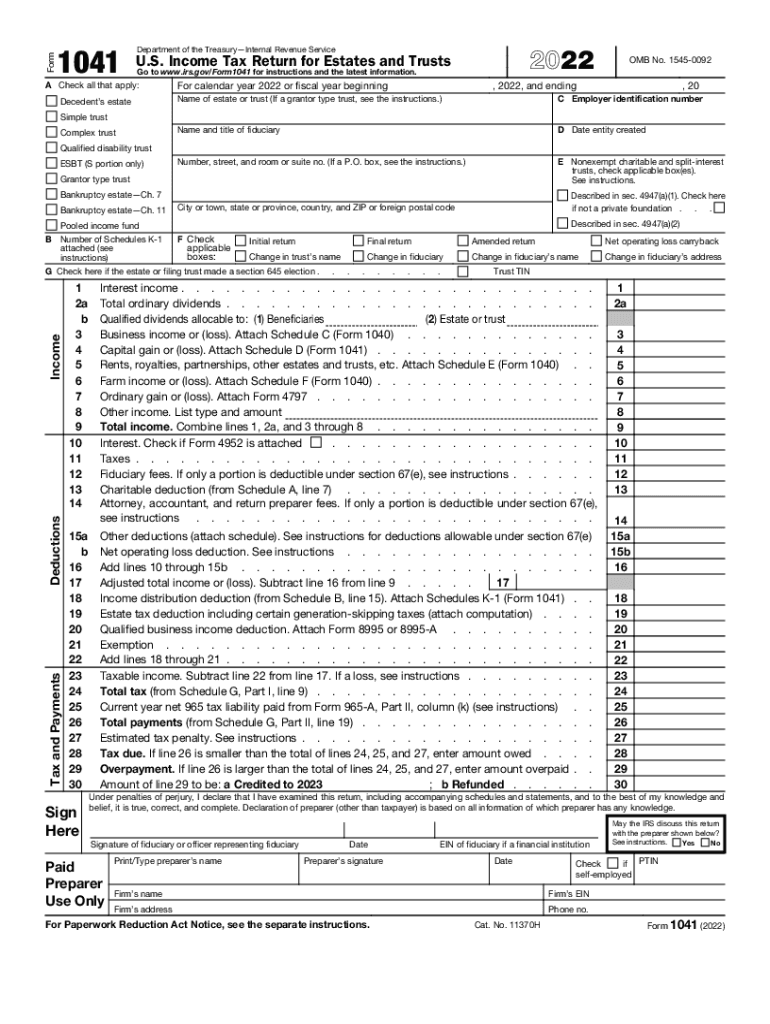

The IRS provides specific guidelines for the completion and submission of the 2016 US return, particularly for various forms like the 1041. Understanding these guidelines is crucial for ensuring compliance with federal tax laws. Taxpayers must familiarize themselves with the requirements for reporting income, deductions, and credits accurately. The IRS also emphasizes the importance of maintaining proper documentation to support claims made on the return.

Filing Deadlines / Important Dates

Filing deadlines for the 2016 US return are essential to avoid penalties. Typically, the deadline for individual tax returns is April 15 of the following year, unless it falls on a weekend or holiday. For the 2016 return, the due date was April 18, 2017. Extensions may be available, but they do not extend the time to pay any taxes owed. It is important to mark these dates on your calendar to ensure timely submission.

Required Documents

To complete the 2016 US return accurately, taxpayers need to gather several key documents. These include W-2 forms from employers, 1099 forms for other income sources, and documentation for any deductions or credits claimed. Keeping organized records of receipts, bank statements, and investment documents will facilitate a smoother filing process and help substantiate claims if audited.

Form Submission Methods (Online / Mail / In-Person)

The 2016 US return can be submitted through various methods. Taxpayers may choose to file electronically using IRS-approved software or through a tax professional. Alternatively, paper forms can be mailed to the appropriate IRS address, which varies based on the taxpayer's location and whether they are enclosing payment. In-person submissions are generally not available at IRS offices for tax returns, but assistance can be sought at designated locations.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the 2016 US return may result in penalties. The IRS imposes fines for late filing, which can accumulate daily until the return is filed. Additionally, underreporting income or failing to pay taxes owed can lead to further penalties and interest charges. Understanding these potential consequences emphasizes the importance of timely and accurate filing.

Digital vs. Paper Version

When filing the 2016 US return, taxpayers have the option to choose between digital and paper versions. The digital version often provides benefits such as faster processing times and immediate confirmation of receipt. Conversely, paper versions may take longer to process and require mailing time. Choosing the right method depends on individual preferences and circumstances, including comfort with technology and the need for quick resolution.

Quick guide on how to complete portalctgovdrsdrs formstrust and estate forms ct

Complete Portal ct govDRSDRS FormsTrust And Estate Forms Ct effortlessly on any device

Online document management has become increasingly popular with companies and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without interruptions. Handle Portal ct govDRSDRS FormsTrust And Estate Forms Ct on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to edit and eSign Portal ct govDRSDRS FormsTrust And Estate Forms Ct with ease

- Find Portal ct govDRSDRS FormsTrust And Estate Forms Ct and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a traditional pen-and-ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form—via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Portal ct govDRSDRS FormsTrust And Estate Forms Ct and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct portalctgovdrsdrs formstrust and estate forms ct

Create this form in 5 minutes!

People also ask

-

What is the airSlate SignNow process for submitting a 2016 US return?

airSlate SignNow streamlines the process of submitting your 2016 US return by allowing you to securely sign and send important documents online. Once you upload your forms, you can easily add signatures and initials, making the submission process faster and more efficient.

-

How can airSlate SignNow help me with my 2016 US return?

With airSlate SignNow, you can simplify your 2016 US return filing by efficiently managing all necessary documentation in one secure platform. Our electronic signatures ensure compliance and enhance the overall security of your sensitive tax information.

-

Is there a cost associated with using airSlate SignNow for my 2016 US return?

Yes, airSlate SignNow offers various pricing plans to suit your needs, including a free trial. The cost-effective solutions make it accessible for individuals and businesses to manage their 2016 US return and other documents with ease.

-

What features does airSlate SignNow provide for handling a 2016 US return?

airSlate SignNow provides features such as customizable templates, in-person signing, and integration with various third-party applications. These capabilities enhance the efficiency of preparing and managing your 2016 US return paperwork.

-

Can I track the status of my 2016 US return using airSlate SignNow?

Absolutely! airSlate SignNow allows you to track your documents in real time. You will receive notifications when your documents are viewed or signed, helping you stay informed about the status of your 2016 US return.

-

Are my documents secure when using airSlate SignNow for my 2016 US return?

Yes, document security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to ensure that your documents related to the 2016 US return are protected at all times.

-

Does airSlate SignNow integrate with tax software to assist with the 2016 US return?

Yes, airSlate SignNow integrates with various tax software programs, making it easier to manage your 2016 US return. This integration streamlines your workflow, allowing for seamless import and export of documents without manual entry.

Get more for Portal ct govDRSDRS FormsTrust And Estate Forms Ct

- Plumbing contract for contractor kentucky form

- Brick mason contract for contractor kentucky form

- Roofing contract for contractor kentucky form

- Electrical contract for contractor kentucky form

- Sheetrock drywall contract for contractor kentucky form

- Flooring contract for contractor kentucky form

- Ky deed form

- Notice of intent to enforce forfeiture provisions of contact for deed kentucky form

Find out other Portal ct govDRSDRS FormsTrust And Estate Forms Ct

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe