About Form 8949, Sales and Other Dispositions of CapitalAbout Form 8949, Sales and Other Dispositions of CapitalFederal Form 894 2022

Understanding Form 8949: Sales and Other Dispositions of Capital

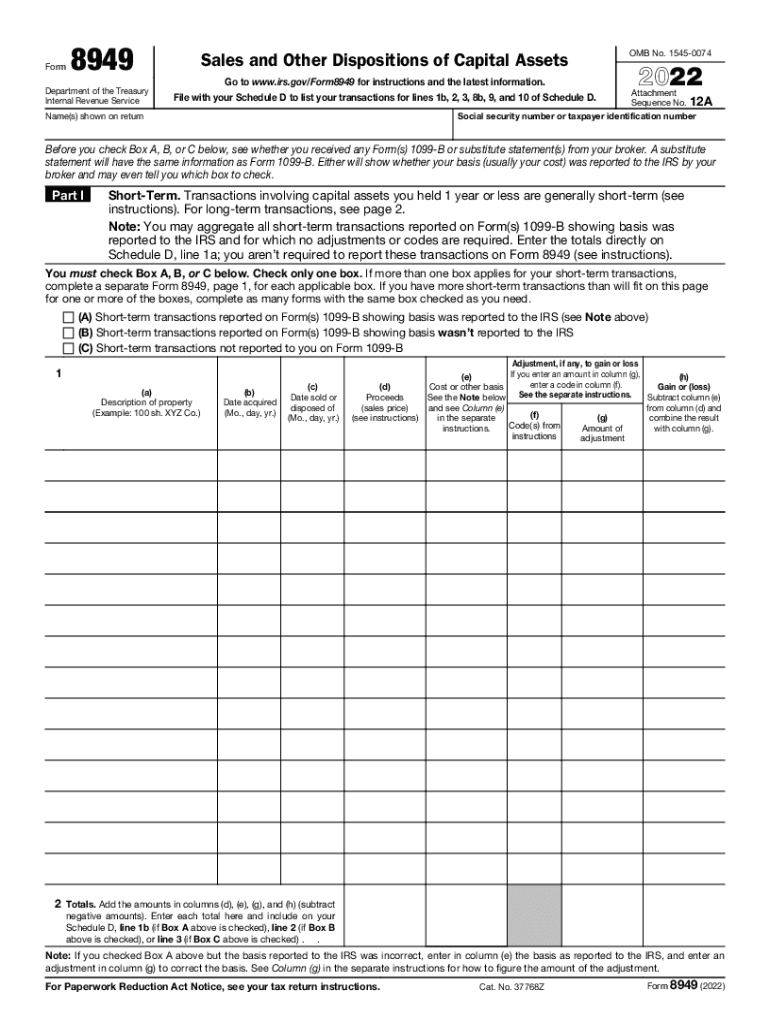

Form 8949 is a tax form used by individuals and businesses to report sales and other dispositions of capital assets. This form is essential for accurately reporting gains and losses from transactions involving stocks, bonds, and real estate. When completing Form 8949 for the year 2021, taxpayers must provide details about each transaction, including the date of acquisition, date of sale, proceeds, cost basis, and the resulting gain or loss.

The IRS requires this form to ensure that taxpayers report their capital gains and losses correctly, which can affect their overall tax liability. Understanding the purpose of Form 8949 is crucial for compliance with tax regulations and for maximizing potential deductions.

Steps to Complete Form 8949 for 2021

Completing Form 8949 involves several important steps. First, gather all relevant documentation for each capital asset transaction. This includes purchase and sale records, brokerage statements, and any other supporting documents. Next, categorize each transaction into short-term or long-term based on the holding period of the asset.

For short-term transactions, report assets held for one year or less, while long-term transactions involve assets held for more than one year. Fill out the form by entering the required information for each transaction in the appropriate sections. Ensure that all calculations for gains and losses are accurate, as errors can lead to penalties or audits. Finally, review the completed form for accuracy before submitting it with your tax return.

Legal Use of Form 8949

Form 8949 serves a legal purpose in the tax reporting process. It is an official document required by the IRS, and its proper completion is essential for compliance with federal tax laws. Filing this form helps to substantiate claims of capital gains and losses, which can be critical if the IRS questions your tax return.

Additionally, the information reported on Form 8949 is used to calculate the capital gains tax owed. Failure to file this form or inaccuracies in reporting can result in penalties, interest on unpaid taxes, and potential legal consequences. Therefore, understanding the legal implications of Form 8949 is vital for all taxpayers engaging in capital asset transactions.

IRS Guidelines for Form 8949

The IRS provides specific guidelines for completing Form 8949, which must be adhered to for accurate reporting. Taxpayers should refer to the IRS instructions for Form 8949, which outline the necessary information to include, the format for reporting transactions, and the distinctions between short-term and long-term transactions.

These guidelines also detail how to handle adjustments to gains and losses, such as those arising from wash sales or other special circumstances. Staying informed about these guidelines ensures that taxpayers can complete Form 8949 correctly and avoid potential issues with the IRS.

Filing Deadlines for Form 8949

Filing deadlines for Form 8949 align with the overall tax return deadlines. For most individual taxpayers, the deadline to file Form 8949 for the tax year 2021 is April 15, 2022. However, if you are unable to meet this deadline, you may file for an extension, which typically extends the deadline by six months.

It is important to note that while an extension allows additional time to file, any taxes owed must still be paid by the original deadline to avoid penalties and interest. Keeping track of these deadlines is crucial for ensuring compliance and avoiding unnecessary complications with your tax filings.

Examples of Using Form 8949

Form 8949 can be utilized in various scenarios involving capital asset transactions. For instance, if an individual sells stock shares for a profit, they must report the sale on Form 8949, detailing the purchase date, sale date, proceeds, and cost basis.

Similarly, if a taxpayer sells a rental property, they need to report the transaction on this form, including any depreciation recapture. These examples illustrate the form's versatility and importance in accurately reporting capital gains and losses across different types of assets.

Quick guide on how to complete about form 8949 sales and other dispositions of capitalabout form 8949 sales and other dispositions of capitalfederal form 8949

Manage About Form 8949, Sales And Other Dispositions Of CapitalAbout Form 8949, Sales And Other Dispositions Of CapitalFederal Form 894 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle About Form 8949, Sales And Other Dispositions Of CapitalAbout Form 8949, Sales And Other Dispositions Of CapitalFederal Form 894 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Steps to edit and eSign About Form 8949, Sales And Other Dispositions Of CapitalAbout Form 8949, Sales And Other Dispositions Of CapitalFederal Form 894 with ease

- Find About Form 8949, Sales And Other Dispositions Of CapitalAbout Form 8949, Sales And Other Dispositions Of CapitalFederal Form 894 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign About Form 8949, Sales And Other Dispositions Of CapitalAbout Form 8949, Sales And Other Dispositions Of CapitalFederal Form 894 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8949 sales and other dispositions of capitalabout form 8949 sales and other dispositions of capitalfederal form 8949

Create this form in 5 minutes!

People also ask

-

What is Form 8949 2021?

Form 8949 2021 is a tax form used by taxpayers to report capital gains and losses from sales and exchanges of capital assets. This form is essential for accurately calculating your total capital gain or loss, which will influence your overall tax liability. Using airSlate SignNow, you can electronically sign and share your completed Form 8949 2021 quickly and securely.

-

How can airSlate SignNow help with Form 8949 2021?

airSlate SignNow provides a seamless digital solution for filling out and signing Form 8949 2021. With its user-friendly platform, you can easily edit, fill out, and prepare the form for signature. This ensures you can submit your tax documents efficiently, saving you time and reducing potential errors.

-

What are the pricing options for using airSlate SignNow for Form 8949 2021?

airSlate SignNow offers various pricing plans to cater to different user needs, including options for individuals and businesses. You can choose a plan that includes essential features for managing documents like Form 8949 2021 or opt for advanced plans with additional functionalities. Evaluating your needs will help you select the most cost-effective solution.

-

Is it safe to sign Form 8949 2021 with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes the security of your documents. When you sign Form 8949 2021 using our platform, you benefit from bank-level encryption and secure cloud storage, ensuring that your sensitive information remains protected and accessible only to you.

-

Can I integrate airSlate SignNow with other software for managing Form 8949 2021?

Yes, airSlate SignNow offers various integrations with popular software applications such as Google Drive, Dropbox, and other document management systems. This allows you to streamline your workflow for handling Form 8949 2021, making it easier to access and share your documents across different platforms.

-

What other forms can I fill out using airSlate SignNow apart from Form 8949 2021?

In addition to Form 8949 2021, airSlate SignNow supports a wide range of documents, including tax forms, contracts, and agreements. This versatility makes it an invaluable tool for businesses and individuals who need a reliable solution for electronic signatures and document management.

-

How does airSlate SignNow improve the efficiency of processing Form 8949 2021?

With airSlate SignNow, you can quickly fill out and electronically sign Form 8949 2021 without the hassle of printing, scanning, or mailing. This digital approach can signNowly reduce processing times, allowing you to focus on other essential aspects of your tax preparation and planning.

Get more for About Form 8949, Sales And Other Dispositions Of CapitalAbout Form 8949, Sales And Other Dispositions Of CapitalFederal Form 894

- Apartment rules and regulations ohio form

- Ohio cancellation form

- Amendment of residential lease ohio form

- Agreement for payment of unpaid rent ohio form

- Ohio assignment 497322402 form

- Tenant consent to background and reference check ohio form

- Residential lease or rental agreement for month to month ohio form

- Residential rental lease agreement ohio form

Find out other About Form 8949, Sales And Other Dispositions Of CapitalAbout Form 8949, Sales And Other Dispositions Of CapitalFederal Form 894

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template