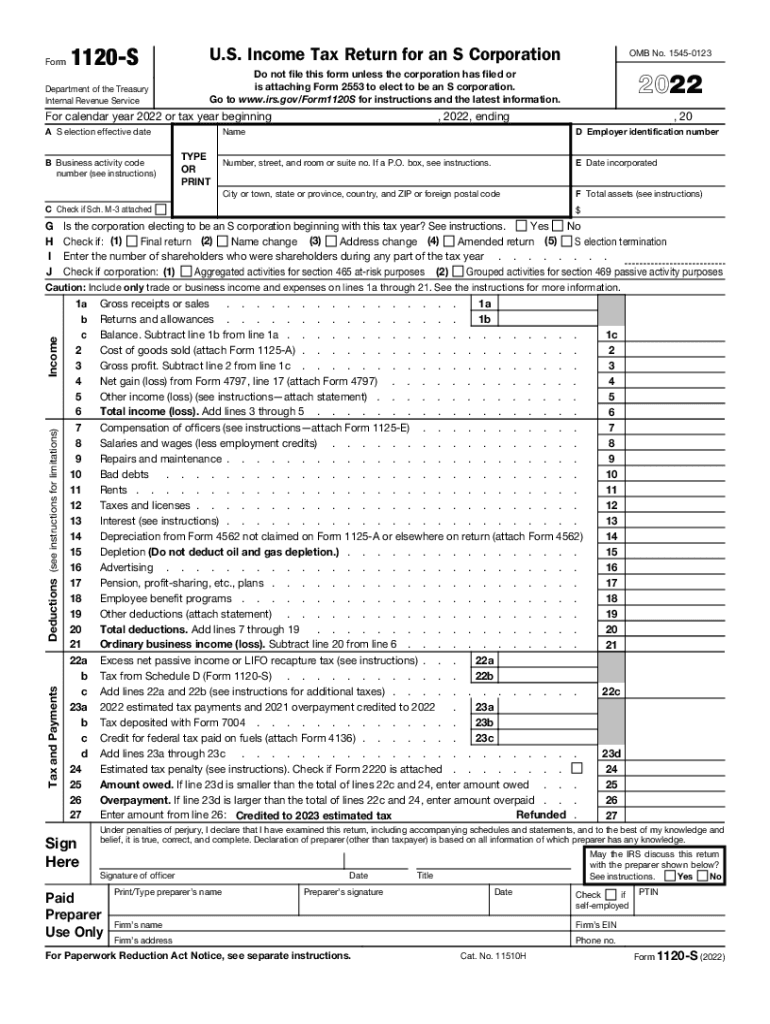

F1120s PDF Form 1120S Department of the Treasury Internal Revenue 2022

What is the F1120S PDF Form 1120S?

The F1120S PDF Form 1120S is a tax return form used by S corporations to report income, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for S corporations, which are unique business entities that pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. The form must be filed annually, and it provides a comprehensive overview of the corporation's financial activities over the tax year.

Steps to Complete the F1120S PDF Form 1120S

Completing the F1120S PDF Form 1120S involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and records of expenses.

- Fill out the basic information section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report income by listing all revenue sources and calculating total income.

- Detail deductions, including business expenses, salaries, and other allowable deductions.

- Calculate the tax owed or refund due, ensuring all calculations are accurate.

- Review the completed form for accuracy and completeness before submission.

Filing Deadlines / Important Dates

It is crucial for S corporations to adhere to specific filing deadlines to avoid penalties. The F1120S must typically be filed by the fifteenth day of the third month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the due date is March 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day.

Form Submission Methods

The F1120S PDF Form 1120S can be submitted through various methods:

- Online: Many tax software programs allow for electronic filing of the F1120S, which can expedite processing and reduce errors.

- Mail: The completed form can be printed and mailed to the appropriate IRS address, based on the corporation's location.

- In-Person: Some taxpayers may choose to deliver the form directly to an IRS office, although this method is less common.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the F1120S PDF Form 1120S. These guidelines include instructions on how to report income, claim deductions, and ensure compliance with tax laws. It is important to consult the latest IRS publications and resources to stay updated on any changes to the form or filing requirements.

Penalties for Non-Compliance

Failure to file the F1120S on time or inaccuracies in the form can result in penalties imposed by the IRS. These penalties may include fines for late filing, failure to pay taxes owed, and interest on unpaid amounts. Understanding these penalties can help S corporations prioritize timely and accurate submissions.

Quick guide on how to complete f1120spdf form 1120s department of the treasury internal revenue

Effortlessly prepare F1120s pdf Form 1120S Department Of The Treasury Internal Revenue on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage F1120s pdf Form 1120S Department Of The Treasury Internal Revenue on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-centric operation today.

How to alter and electronically sign F1120s pdf Form 1120S Department Of The Treasury Internal Revenue with ease

- Obtain F1120s pdf Form 1120S Department Of The Treasury Internal Revenue and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you prefer to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign F1120s pdf Form 1120S Department Of The Treasury Internal Revenue to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f1120spdf form 1120s department of the treasury internal revenue

Create this form in 5 minutes!

People also ask

-

What features should I look for in business tax software 2014?

When evaluating business tax software 2014, consider features like easy document management, e-signature capabilities, and real-time collaboration tools. Look for software that simplifies filing and offers integrations with accounting programs. Comprehensive reporting and accuracy checks are also essential to ensure compliance.

-

How does business tax software 2014 help streamline tax processes?

Business tax software 2014 can signNowly streamline tax processes by automating calculations and reducing manual data entry. This minimizes errors and saves time, allowing businesses to focus on growth rather than paperwork. Additionally, integration with other financial tools can further enhance efficiency.

-

Is business tax software 2014 suitable for small businesses?

Yes, business tax software 2014 is well-suited for small businesses looking to simplify their tax compliance efforts. Many solutions are designed with user-friendly interfaces and offer scalable features that grow with your business. Investing in the right software can lead to signNow time and cost savings.

-

What is the pricing structure for business tax software 2014?

Pricing for business tax software 2014 varies depending on the provider and the features included. Many software packages offer tiered pricing plans, allowing small businesses to select a plan that caters to their needs. Be sure to look for any hidden costs for updates or additional features.

-

Can business tax software 2014 integrate with other financial tools?

Many business tax software 2014 solutions offer seamless integration with popular accounting and bookkeeping software. This integration allows for easy data transfer and consistent information across platforms, reducing the chance of errors. Check if the software you choose has integration capabilities that suit your business needs.

-

What are the benefits of using business tax software 2014 over traditional methods?

Using business tax software 2014 provides several advantages over traditional methods, such as increased accuracy, faster processing times, and easy access to templates and forms. Additionally, e-signature features allow for quicker document turnaround, making the tax filing process more efficient. These benefits can lead to better compliance and less stress during tax season.

-

Is customer support available with business tax software 2014?

Yes, most reputable business tax software 2014 providers include customer support options ranging from live chat to phone assistance. Good customer support can help resolve issues quickly, ensuring your business can operate smoothly during tax season. Always check the support hours and resources available before committing.

Get more for F1120s pdf Form 1120S Department Of The Treasury Internal Revenue

- Non marital cohabitation living together agreement ohio form

- Paternity law and procedure handbook ohio form

- Bill of sale in connection with sale of business by individual or corporate seller ohio form

- Ohio dissolution no form

- Office lease agreement ohio form

- Separation no children contract form

- Oh disclosure form

- Oh waiver form

Find out other F1120s pdf Form 1120S Department Of The Treasury Internal Revenue

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document