the 990 Irs Form 2020

What is the 990 IRS Form

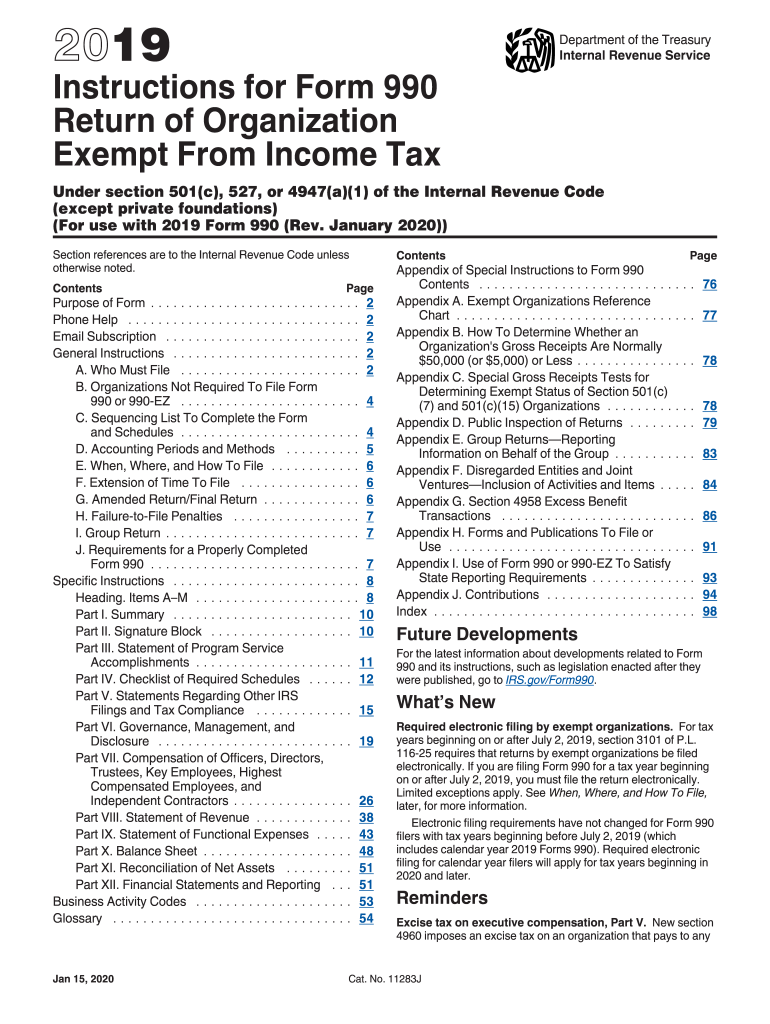

The 990 IRS form, officially known as Form 990, is a crucial document for tax-exempt organizations in the United States. It provides the Internal Revenue Service (IRS) with information about the organization's mission, programs, and finances. This form is essential for maintaining tax-exempt status and ensuring transparency in operations. Nonprofits, charitable organizations, and other tax-exempt entities must file this form annually to report their income, expenditures, and activities. The 990 IRS form comes in several variants, including the 990-EZ for smaller organizations and the 990-N, which is a simplified version for very small nonprofits.

How to Obtain the 990 IRS Form

Obtaining the 990 IRS form is straightforward. Organizations can download the form directly from the IRS website. The form is available in PDF format, making it easy to print and fill out. Additionally, many tax software programs include the 990 form, allowing users to complete and file it electronically. Organizations should ensure they are using the correct version of the form based on their size and type. It is also advisable to check for any updates or changes to the form each tax year to ensure compliance.

Steps to Complete the 990 IRS Form

Completing the 990 IRS form involves several key steps. First, organizations should gather all necessary financial documents, including income statements and balance sheets. Next, they need to fill out the form accurately, providing details about revenue, expenses, and program activities. It is essential to report all sources of income, including donations, grants, and fundraising activities. After completing the form, organizations should review it for accuracy and completeness. Finally, the form can be submitted electronically or by mail, depending on the organization's preference and size.

Legal Use of the 990 IRS Form

The legal use of the 990 IRS form is vital for maintaining a tax-exempt status. Filing the form accurately and on time ensures compliance with IRS regulations. Failure to file can result in penalties, including the loss of tax-exempt status. The information provided in the form is also used by the public, including donors and grantmakers, to assess the organization’s financial health and transparency. Therefore, it is important for organizations to treat the completion and submission of the 990 IRS form with the utmost seriousness.

Filing Deadlines / Important Dates

Filing deadlines for the 990 IRS form vary depending on the organization’s fiscal year. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the form is typically due on May fifteenth. Organizations can apply for an extension if they need more time, but they must still file the extension request by the original due date. Keeping track of these deadlines is crucial to avoid penalties and maintain compliance.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the 990 IRS form can lead to significant penalties. Organizations that fail to file the form may incur a fine for each month the form is late, up to a maximum amount. Additionally, repeated failures to file can result in the automatic revocation of tax-exempt status, which can have severe financial implications. It is essential for organizations to understand these risks and prioritize timely and accurate filing of the 990 IRS form to avoid potential penalties.

Quick guide on how to complete the 990 irs form

Prepare The 990 Irs Form easily on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly replacement for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents quickly and efficiently. Handle The 990 Irs Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign The 990 Irs Form with ease

- Find The 990 Irs Form and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the information and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invite link, or by downloading it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that require printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign The 990 Irs Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct the 990 irs form

Create this form in 5 minutes!

How to create an eSignature for the the 990 irs form

How to create an eSignature for a PDF file online

How to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What are the 990 instructions tax form and why are they important?

The 990 instructions tax form provides detailed guidelines for non-profit organizations to report their financial activities to the IRS. Understanding these instructions is crucial for maintaining tax compliance and transparency while ensuring proper handling of donations and expenditures.

-

How can airSlate SignNow help with the 990 instructions tax form?

airSlate SignNow simplifies the signing and submission process for the 990 instructions tax form. With our platform, you can easily eSign documents, reducing the time and effort required for compliance, so your organization can focus on its mission.

-

Is airSlate SignNow cost-effective for managing the 990 instructions tax form?

Yes, airSlate SignNow offers a cost-effective solution to streamline document management, including the 990 instructions tax form. Our pricing plans are tailored to fit various business sizes and needs, ensuring you only pay for the features that benefit your organization.

-

What features does airSlate SignNow offer that are beneficial for the 990 instructions tax form?

Our platform includes features like eSignature, document tracking, and secure storage, all of which are essential when handling the 990 instructions tax form. These tools ensure that your documents are signed and stored safely, making compliance hassle-free.

-

Can I integrate airSlate SignNow with other software to manage the 990 instructions tax form?

Absolutely! airSlate SignNow easily integrates with various accounting and management software to help streamline the process of preparing the 990 instructions tax form. This integration improves efficiency and reduces the risk of errors during submission.

-

How does airSlate SignNow ensure the security of my 990 instructions tax form?

Security is a top priority at airSlate SignNow. We use advanced encryption protocols and secure cloud storage to protect your 990 instructions tax form and other sensitive documents, ensuring that your data remains confidential and secure.

-

What should I do if I have questions about the 990 instructions tax form while using airSlate SignNow?

If you have questions regarding the 990 instructions tax form while using airSlate SignNow, our dedicated customer support team is here to help. You can signNow out via chat, email, or phone for assistance, ensuring that you can complete your forms correctly and timely.

Get more for The 990 Irs Form

Find out other The 990 Irs Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation