Form IL 1120 ST Illinois Department of Revenue Tax Illinois 2020

What is the Form IL 1120 ST Illinois Department Of Revenue Tax Illinois

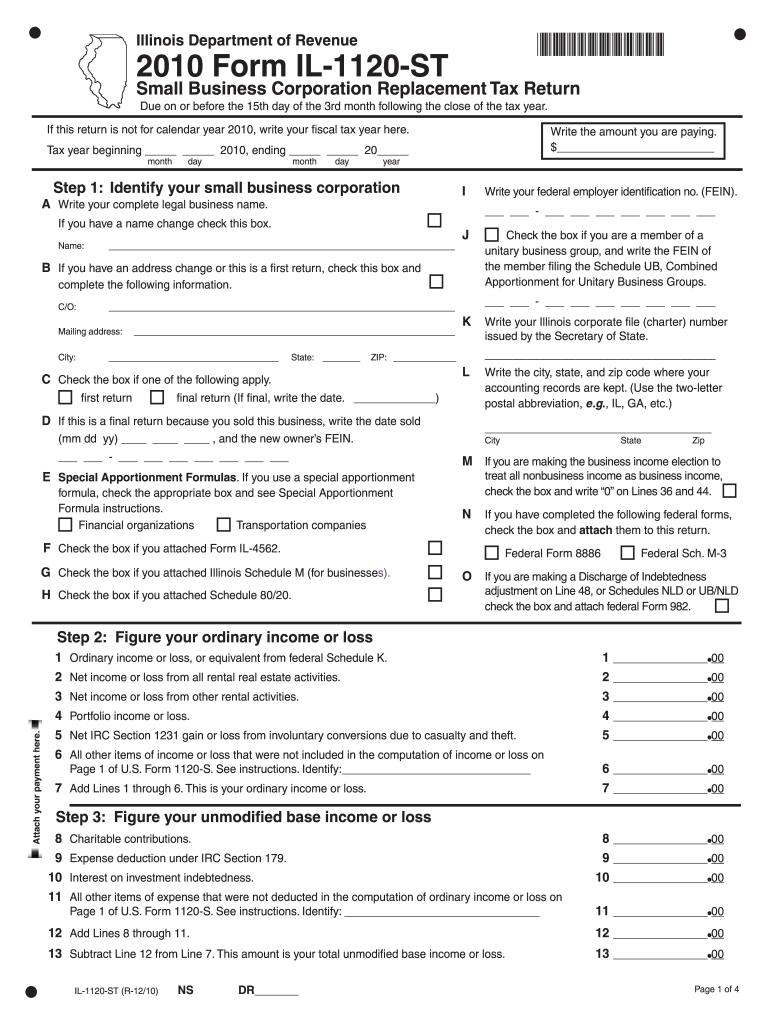

The Form IL 1120 ST is a specific tax form used by the Illinois Department of Revenue for S corporations. This form is designed to report the income, deductions, and credits of S corporations operating in Illinois. It is essential for ensuring compliance with state tax regulations and allows these entities to calculate their tax liability accurately. The form must be completed and submitted annually, reflecting the corporation's financial activity for the tax year.

How to use the Form IL 1120 ST Illinois Department Of Revenue Tax Illinois

Using the Form IL 1120 ST involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements, balance sheets, and any relevant tax documents. Next, fill out the form with accurate information regarding the corporation's income, expenses, and any applicable deductions. It is crucial to follow the instructions provided with the form carefully to avoid errors that could lead to penalties. Once completed, the form can be submitted electronically or via mail, depending on the preference of the filing entity.

Steps to complete the Form IL 1120 ST Illinois Department Of Revenue Tax Illinois

Completing the Form IL 1120 ST involves a series of methodical steps:

- Gather necessary financial records, including income and expense reports.

- Obtain the latest version of the Form IL 1120 ST from the Illinois Department of Revenue website.

- Fill in the corporation's name, address, and federal employer identification number (FEIN).

- Report total income and deductions accurately in the designated sections.

- Calculate the total tax liability based on the provided instructions.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or by mail to the appropriate address.

Legal use of the Form IL 1120 ST Illinois Department Of Revenue Tax Illinois

The legal use of the Form IL 1120 ST is governed by Illinois tax law. It is essential for S corporations to file this form to comply with state regulations. Failure to submit the form accurately and on time can result in penalties, including fines and interest on unpaid taxes. Additionally, the information provided in this form is used by the Illinois Department of Revenue to assess the corporation's tax obligations and ensure compliance with state tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form IL 1120 ST are crucial for compliance. Typically, the form must be filed by the 15th day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by March 15. It is important to be aware of any changes to deadlines or extensions that may apply, as these can vary based on specific circumstances or legislative changes.

Form Submission Methods (Online / Mail / In-Person)

The Form IL 1120 ST can be submitted through various methods, providing flexibility for filers. Corporations may choose to file electronically using the Illinois Department of Revenue's online portal, which offers a streamlined process and faster processing times. Alternatively, the form can be printed and mailed to the appropriate address listed in the filing instructions. In-person submissions are generally not common for tax forms, but it is advisable to check with local tax offices for any specific requirements.

Quick guide on how to complete 2010 form il 1120 st illinois department of revenue tax illinois

Effortlessly Prepare Form IL 1120 ST Illinois Department Of Revenue Tax Illinois on Any Device

Managing documents online has gained traction among both businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without delays. Handle Form IL 1120 ST Illinois Department Of Revenue Tax Illinois on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to Modify and eSign Form IL 1120 ST Illinois Department Of Revenue Tax Illinois with Ease

- Locate Form IL 1120 ST Illinois Department Of Revenue Tax Illinois and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight signNow sections of the documents or obscure sensitive information using the tools provided by airSlate SignNow designed specifically for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form—via email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form IL 1120 ST Illinois Department Of Revenue Tax Illinois and ensure seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 form il 1120 st illinois department of revenue tax illinois

Create this form in 5 minutes!

How to create an eSignature for the 2010 form il 1120 st illinois department of revenue tax illinois

How to make an electronic signature for a PDF document in the online mode

How to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is Form IL 1120 ST for the Illinois Department Of Revenue?

Form IL 1120 ST is a tax form used by passthrough entities such as partnerships and S corporations to report their income to the Illinois Department Of Revenue. It is essential for businesses to accurately complete this form to ensure compliance with Illinois tax regulations.

-

How can airSlate SignNow help me with Form IL 1120 ST?

Using airSlate SignNow, you can easily eSign and send Form IL 1120 ST to the Illinois Department Of Revenue. Our platform streamlines the document management process, making it simpler for you to manage tax forms efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs. Whether you are a small business or a larger enterprise, you can find a cost-effective solution to manage Form IL 1120 ST and other documents seamlessly.

-

Does airSlate SignNow integrate with accounting software for preparing Form IL 1120 ST?

Yes, airSlate SignNow integrates with various accounting software platforms, allowing you to easily import data into Form IL 1120 ST. This feature ensures that your financial information is accurate and readily available when completing your tax forms.

-

What are the benefits of using airSlate SignNow for tax forms like Form IL 1120 ST?

By using airSlate SignNow for Form IL 1120 ST, you can benefit from faster processing times, reduced paperwork, and enhanced security for sensitive tax information. The eSignature solution also helps you stay organized and compliant with Illinois tax legislation.

-

Is there a mobile app available for airSlate SignNow to handle Form IL 1120 ST?

Yes, airSlate SignNow offers a mobile app that allows you to manage Form IL 1120 ST on the go. This mobile accessibility ensures that you can eSign documents and track their status anytime, anywhere, making tax filing more convenient.

-

What types of documents can I eSign besides Form IL 1120 ST?

In addition to Form IL 1120 ST, airSlate SignNow enables you to eSign a wide variety of documents, such as contracts, agreements, and consent forms. Our platform supports diverse document types, making it versatile for all your eSignature needs.

Get more for Form IL 1120 ST Illinois Department Of Revenue Tax Illinois

- Ratio word problems worksheets pdf form

- Plumbing aptitude test practice pdf form

- Certified copy application form pdf

- Cancer paperwork form

- Franklin county area tax bureau 100032708 form

- Assam gramin vikash bank internet banking pdf form

- First 12 chords for the guitar bphilwestfallbbcomb form

- Travel expense claiming footnote this form is to

Find out other Form IL 1120 ST Illinois Department Of Revenue Tax Illinois

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form