Tax Form St 100 2020

What is the Tax Form St 100

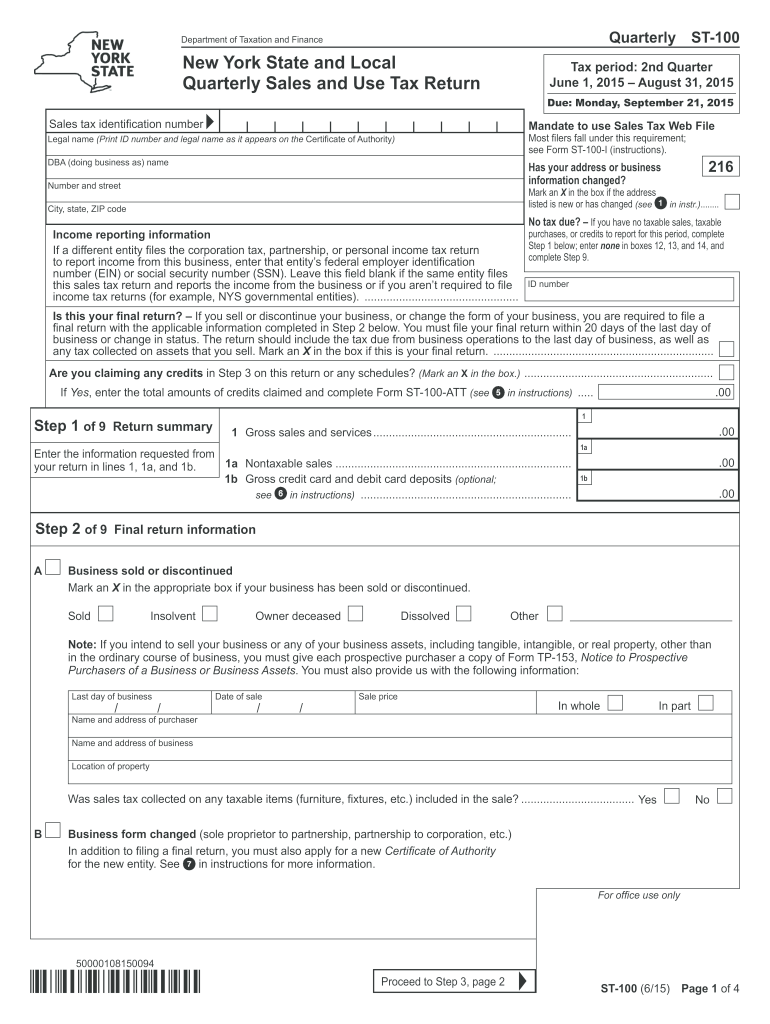

The Tax Form St 100 is a crucial document used in the United States for businesses to report their income and expenses to the appropriate tax authorities. This form is particularly relevant for entities operating within specific states that require detailed tax information. It serves as a declaration of the business's financial activities and is essential for compliance with state tax regulations.

How to use the Tax Form St 100

Using the Tax Form St 100 involves several steps to ensure accurate reporting. First, gather all necessary financial records, including income statements, receipts, and expense reports. Next, fill out the form with the required information, ensuring that all figures are accurate and reflect your business activities. Once completed, the form must be submitted to the relevant tax authority by the designated deadline to avoid penalties.

Steps to complete the Tax Form St 100

Completing the Tax Form St 100 requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, including income and expense records.

- Fill out the form, ensuring that each section is completed accurately.

- Review the form for any errors or omissions.

- Sign and date the form to certify its accuracy.

- Submit the form to the appropriate tax authority by the deadline.

Legal use of the Tax Form St 100

The Tax Form St 100 must be used in accordance with state tax laws. It is legally binding, meaning that the information provided must be truthful and accurate. Misrepresentation or failure to file the form can result in penalties, including fines and legal repercussions. Businesses should ensure compliance with all relevant regulations to maintain their good standing with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Form St 100 vary by state and business type. Generally, businesses must submit the form annually, with specific due dates often aligned with the end of the fiscal year. It is essential to check the state tax authority's website for the most accurate and updated deadlines to avoid late filing penalties.

Who Issues the Form

The Tax Form St 100 is typically issued by state tax authorities. Each state may have its own version of the form, tailored to meet local tax laws and requirements. Businesses should ensure they are using the correct version for their state to guarantee compliance and accurate reporting.

Quick guide on how to complete tax form st 100 2015

Effortlessly Prepare Tax Form St 100 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can obtain the correct template and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Tax Form St 100 seamlessly on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to Edit and eSign Tax Form St 100 with Ease

- Obtain Tax Form St 100 and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes just moments and carries the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Tax Form St 100 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax form st 100 2015

Create this form in 5 minutes!

How to create an eSignature for the tax form st 100 2015

The way to make an eSignature for a PDF document in the online mode

The way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the Tax Form St 100?

The Tax Form St 100 is a crucial tax document used for reporting sales tax in various jurisdictions. Businesses must accurately complete this form to comply with state tax regulations. Using airSlate SignNow, you can easily eSign and submit your Tax Form St 100, streamlining the filing process.

-

How can airSlate SignNow help with Tax Form St 100?

airSlate SignNow offers an intuitive platform that allows users to quickly prepare, eSign, and send the Tax Form St 100. With its user-friendly interface, you can eliminate paperwork and ensure that your tax forms are filed on time. This helps you focus more on your business and less on administrative tasks.

-

Is there a cost associated with using airSlate SignNow for Tax Form St 100?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including the ability to manage Tax Form St 100 submissions. The cost-effectiveness of the platform ensures that you can efficiently handle your tax paperwork without breaking the bank. Explore our pricing to find a plan that suits you.

-

What features does airSlate SignNow offer for taxation documents like the Tax Form St 100?

airSlate SignNow provides numerous features, including document templates specifically tailored for the Tax Form St 100, real-time collaboration, and secure storage. These features simplify the process of preparing your tax forms, allowing you to focus on accuracy and compliance. Additionally, you can track document statuses for better management.

-

Can airSlate SignNow integrate with other tools for filling out the Tax Form St 100?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and productivity tools, enhancing your ability to manage the Tax Form St 100. This integration helps consolidate your data and simplifies the filing process. Ensure all your financial documents are in sync and easily accessible.

-

What are the benefits of using airSlate SignNow for the Tax Form St 100?

Using airSlate SignNow for the Tax Form St 100 offers several benefits, including reduced processing time and improved accuracy. The electronic signing process not only accelerates approval but also provides a secure way to handle sensitive information. By streamlining your tax documentation, you can minimize errors and enhance productivity.

-

How secure is airSlate SignNow when handling the Tax Form St 100?

Security is a top priority for airSlate SignNow. The platform utilizes advanced encryption and data protection measures to ensure your Tax Form St 100 and other documents remain safe. You can trust that your sensitive tax information is protected against unauthorized access.

Get more for Tax Form St 100

Find out other Tax Form St 100

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online