Filable Ct 3 2020

What is the Filable Ct 3

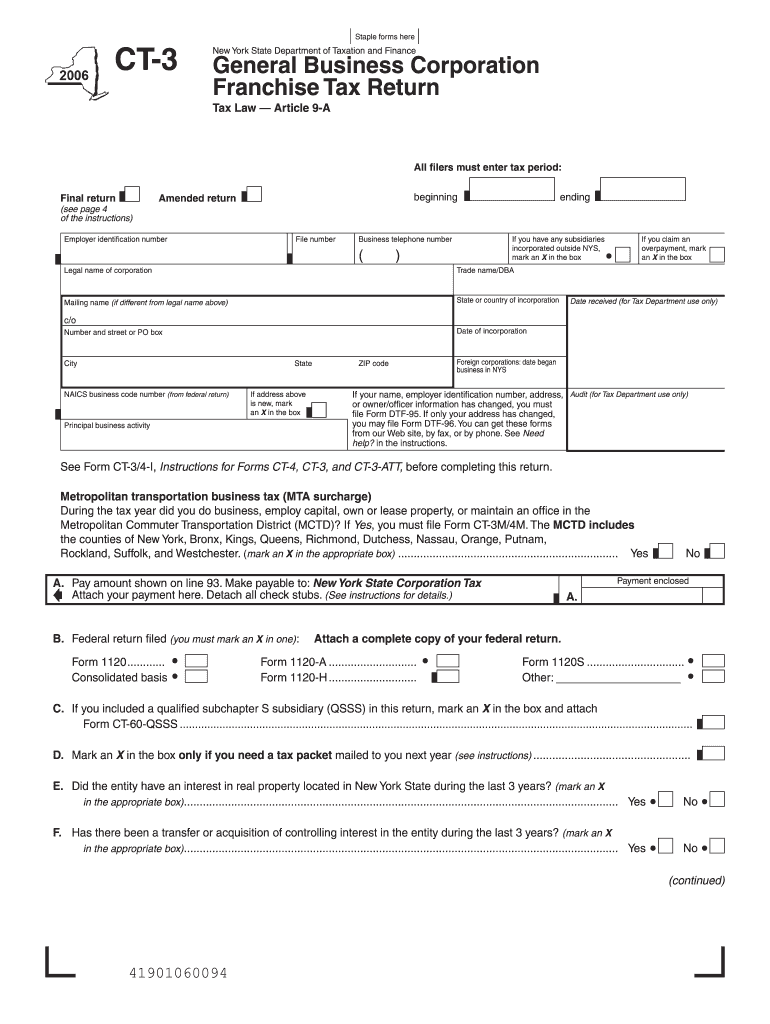

The filable ct 3 form is a crucial document used primarily for tax reporting purposes in the United States. It is designed for specific business entities, including corporations and partnerships, to report income, deductions, and credits to the Internal Revenue Service (IRS). This form helps ensure compliance with federal tax regulations and is essential for maintaining accurate financial records. Understanding its purpose and requirements is vital for any business entity looking to fulfill its tax obligations effectively.

How to Use the Filable Ct 3

Using the filable ct 3 form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements, expense records, and prior year tax returns. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is important to double-check figures and ensure that all required information is provided. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements set by the IRS.

Steps to Complete the Filable Ct 3

Completing the filable ct 3 form involves a systematic approach:

- Gather Information: Collect all relevant financial documents.

- Fill Out the Form: Enter accurate data in each section, including income, deductions, and credits.

- Review: Check for errors and ensure all information is complete.

- Submit: Choose your submission method—electronically or by mail—and send the form to the IRS.

Legal Use of the Filable Ct 3

The legal use of the filable ct 3 form is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted by the designated deadlines. Failure to comply with these regulations can result in penalties or legal repercussions. It is essential for businesses to understand the legal implications of their submissions and to maintain compliance with federal tax laws to avoid potential issues.

Filing Deadlines / Important Dates

Filing deadlines for the filable ct 3 form are critical for compliance. Generally, the form must be submitted by the due date specified by the IRS, which is typically the fifteenth day of the fourth month following the end of the tax year. For businesses with a fiscal year, the deadline may vary. It is important to stay informed about these dates to avoid late fees and penalties.

Who Issues the Form

The filable ct 3 form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that businesses understand their tax obligations and comply with federal regulations.

Quick guide on how to complete filable ct 3

Prepare Filable Ct 3 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage Filable Ct 3 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

How to modify and eSign Filable Ct 3 effortlessly

- Locate Filable Ct 3 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and eSign Filable Ct 3 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct filable ct 3

Create this form in 5 minutes!

How to create an eSignature for the filable ct 3

How to create an electronic signature for your PDF document in the online mode

How to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is a filable ct 3 and how does it work?

A filable ct 3 is a digital form that allows businesses to fill out and submit CT-3 tax documents electronically. With airSlate SignNow, you can easily create, modify, and send these documents for eSignature, streamlining the filing process and ensuring compliance with tax regulations.

-

How can airSlate SignNow help with filable ct 3?

AirSlate SignNow simplifies the management of filable ct 3 documents by allowing users to create templates, automate workflows, and electronically sign documents. This ease of use ensures that you can quickly and accurately complete your CT-3 filings without the hassle of physical paperwork.

-

What are the pricing options for using airSlate SignNow for filable ct 3?

AirSlate SignNow offers various pricing plans designed to fit your business needs, including options for individual users and teams. By choosing a plan, you can access features specifically for managing and signing filable ct 3 documents at a price point that meets your budget.

-

Are there any additional features available for managing filable ct 3 documents?

Yes, alongside eSigning, airSlate SignNow provides advanced features like automated reminders, document tracking, and integration with other applications. These tools enhance your experience with filable ct 3, making it easier to keep track of your submissions and deadlines.

-

Can airSlate SignNow integrate with other software to manage filable ct 3?

Absolutely! AirSlate SignNow integrates seamlessly with popular software like Google Workspace, Salesforce, and Microsoft Office. This integration allows users to access and manage their filable ct 3 documents directly from these platforms, improving efficiency in your workflow.

-

What are the main benefits of using airSlate SignNow for filable ct 3?

The key benefits of using airSlate SignNow for filable ct 3 include improved efficiency, reduced errors, and enhanced security. By automating the signing process and providing a user-friendly interface, businesses can save time and ensure that their CT-3 filings are submitted correctly and securely.

-

Is it safe to use airSlate SignNow for filable ct 3 electronic signatures?

Yes, airSlate SignNow employs industry-standard encryption and security measures to protect your sensitive information when signing filable ct 3 documents. With features like audit trails and secure storage, you can trust that your data is safe throughout the signing process.

Get more for Filable Ct 3

Find out other Filable Ct 3

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors