Form W RA Wisconsin Department of Revenue Revenue Wi 2019

What is the Form W RA Wisconsin Department Of Revenue Revenue Wi

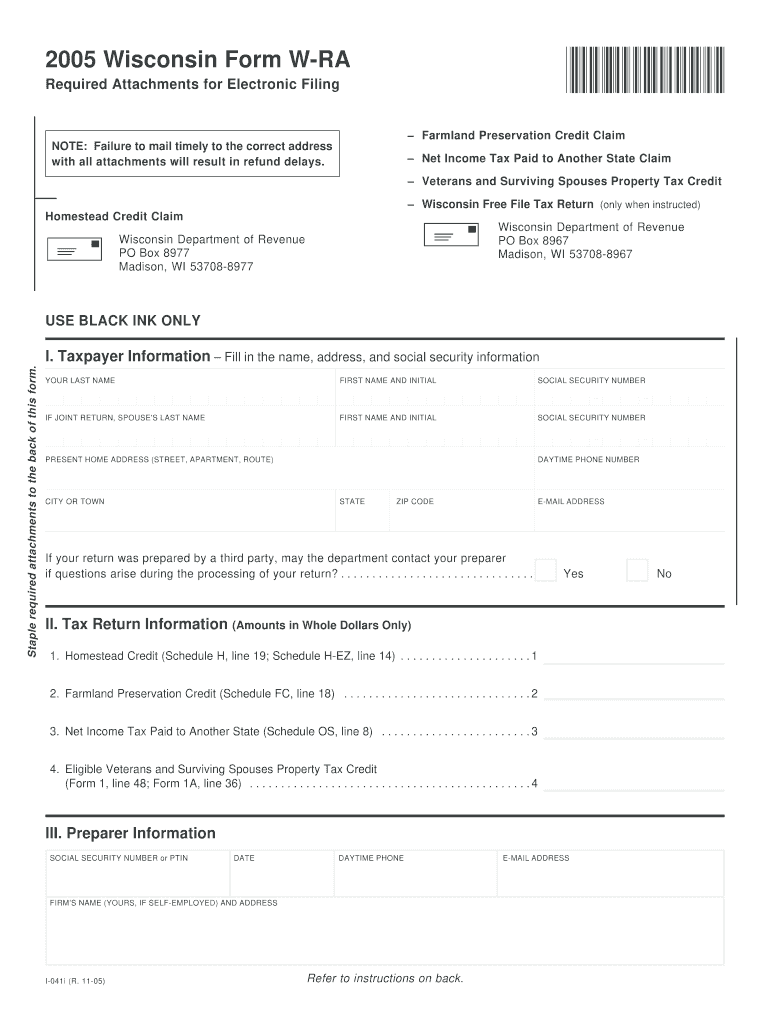

The Form W RA is a document issued by the Wisconsin Department of Revenue, primarily used for reporting and withholding taxes. This form is essential for individuals and businesses in Wisconsin to accurately report income and ensure compliance with state tax regulations. It serves as a declaration of income earned, allowing the state to assess the appropriate tax obligations based on the reported figures.

How to use the Form W RA Wisconsin Department Of Revenue Revenue Wi

Using the Form W RA involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form with your personal information, including your name, address, and Social Security number. Be sure to report all sources of income and calculate the total taxable income. Once completed, the form must be submitted to the Wisconsin Department of Revenue according to the specified guidelines.

Steps to complete the Form W RA Wisconsin Department Of Revenue Revenue Wi

Completing the Form W RA requires attention to detail. Here are the steps to follow:

- Begin by entering your personal information, including your full name and address.

- Input your Social Security number or taxpayer identification number.

- List all sources of income, ensuring that each amount is accurate and corresponds with your financial records.

- Calculate your total income and any applicable deductions.

- Review the completed form for accuracy before submission.

Legal use of the Form W RA Wisconsin Department Of Revenue Revenue Wi

The legal use of the Form W RA is governed by state tax laws. It is crucial to ensure that the information provided is truthful and accurate, as discrepancies can lead to penalties or legal consequences. The form must be submitted within the designated timeframes to maintain compliance with Wisconsin tax regulations. Additionally, utilizing secure methods, such as e-signatures, can enhance the legal validity of the document.

Key elements of the Form W RA Wisconsin Department Of Revenue Revenue Wi

Key elements of the Form W RA include:

- Personal identification information, such as name and Social Security number.

- Details of all income sources, including wages and self-employment earnings.

- Calculations for total taxable income and any deductions.

- Signature and date, affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Form W RA are crucial to avoid penalties. Typically, the form must be submitted by the state’s tax deadline, which aligns with federal tax deadlines. It is advisable to check the Wisconsin Department of Revenue's official calendar for any specific dates or changes that may apply to your situation.

Quick guide on how to complete form w ra wisconsin department of revenue revenue wi

Complete Form W RA Wisconsin Department Of Revenue Revenue Wi effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, amend, and eSign your documents quickly without delays. Manage Form W RA Wisconsin Department Of Revenue Revenue Wi on any platform with airSlate SignNow Android or iOS applications and simplify any document-centered process today.

The simplest way to edit and eSign Form W RA Wisconsin Department Of Revenue Revenue Wi effortlessly

- Obtain Form W RA Wisconsin Department Of Revenue Revenue Wi and then click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize important sections of your documents or conceal sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the details and then click the Done button to save your changes.

- Choose how you wish to share your form—via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form W RA Wisconsin Department Of Revenue Revenue Wi while ensuring seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form w ra wisconsin department of revenue revenue wi

Create this form in 5 minutes!

How to create an eSignature for the form w ra wisconsin department of revenue revenue wi

The best way to create an electronic signature for a PDF file in the online mode

The best way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

The way to generate an eSignature for a PDF file on Android

People also ask

-

What is Form W RA from the Wisconsin Department of Revenue?

Form W RA is a document provided by the Wisconsin Department of Revenue that is used to report tax information for certain entities. This form is essential for ensuring proper compliance with state tax regulations and allows businesses and individuals to submit required information efficiently.

-

How can airSlate SignNow help with Form W RA submissions?

airSlate SignNow streamlines the process of electronically signing and sending Form W RA to the Wisconsin Department of Revenue. With our easy-to-use platform, users can complete and eSign the document swiftly, ensuring timely submission and compliance with all requirements.

-

Is airSlate SignNow cost-effective for handling Form W RA?

Yes, airSlate SignNow offers a variety of pricing plans that cater to businesses of all sizes, making it a cost-effective solution for handling Form W RA submissions. By utilizing our platform, you can save time and resources while ensuring compliance with the Wisconsin Department of Revenue.

-

What features does airSlate SignNow provide for Form W RA?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, specifically for managing Form W RA from the Wisconsin Department of Revenue. Each feature is designed to enhance efficiency and ensure smooth processing of your documents.

-

Can airSlate SignNow integrate with other tools for Form W RA processing?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and platforms, allowing for efficient processing of Form W RA. This flexibility enables users to incorporate eSigning into their existing workflows easily, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for Form W RA?

Using airSlate SignNow for Form W RA brings multiple benefits, including increased efficiency in document handling, enhanced security for sensitive information, and the convenience of eSigning from any device. Our platform simplifies the submission process to the Wisconsin Department of Revenue.

-

Is there a mobile app for airSlate SignNow that supports Form W RA?

Yes, airSlate SignNow offers a mobile app that allows users to manage form submissions including Form W RA from the Wisconsin Department of Revenue on-the-go. This app provides flexibility and ensures users can send, eSign, and track documents anytime, anywhere.

Get more for Form W RA Wisconsin Department Of Revenue Revenue Wi

- Ministrio das relaes exteriores mre recibo de entrega de requerimento rer form

- How to fill up rural bank form

- Northeast arc payroll login form

- B10 form pdf

- Gradual dose reduction worksheet form

- Account opening purchase of certificate application form for individuals

- Loyola plans list of claims form

- Bfa actingmusical theatre and mfa acting production audition jury evaluation form

Find out other Form W RA Wisconsin Department Of Revenue Revenue Wi

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure

- Electronic signature California Sublease Agreement Template Myself