Form 540 2019

What is the Form 540

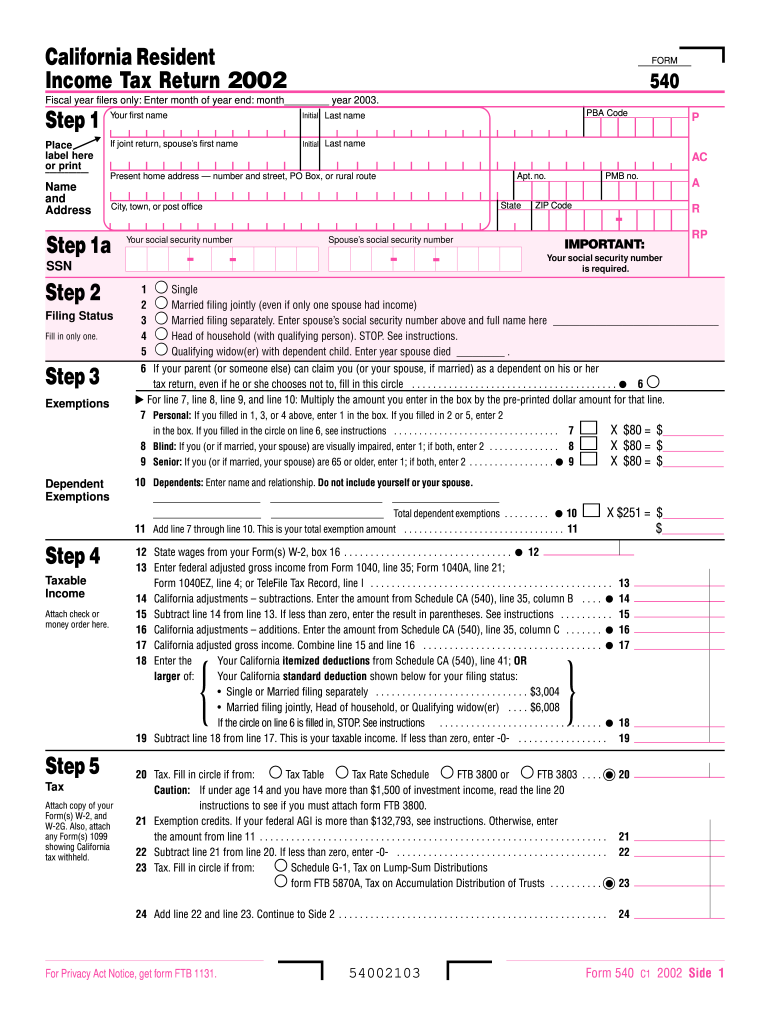

The Form 540 is a state income tax return form used by residents of California to report their income, claim deductions, and calculate their tax liability. It is essential for individuals who earn income in California and need to fulfill their tax obligations. This form is part of the California Franchise Tax Board's requirements and is typically used by those who do not qualify to use the simpler Form 540 2EZ. The Form 540 allows for a more detailed accounting of income and deductions, which can lead to potential tax benefits.

How to use the Form 540

Using the Form 540 involves several steps to ensure accurate reporting of your income and deductions. First, gather all necessary documents, such as W-2s, 1099s, and any relevant receipts for deductions. Next, carefully fill out the form, starting with your personal information and moving on to your income details. Be sure to include all sources of income, such as wages, interest, and dividends. After calculating your total income, apply any deductions and credits you qualify for. Finally, review the form for accuracy before submitting it to the California Franchise Tax Board.

Steps to complete the Form 540

Completing the Form 540 requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including income statements and deduction receipts.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring you include wages, interest, and other earnings.

- Calculate your deductions, including standard or itemized deductions, and any applicable credits.

- Determine your tax liability based on your taxable income.

- Sign and date the form before submitting it.

Legal use of the Form 540

The Form 540 is legally binding and must be filled out accurately to comply with California tax laws. It is essential to follow the guidelines set forth by the California Franchise Tax Board to ensure that your submission is valid. Any discrepancies or inaccuracies may result in penalties or audits. Additionally, eSignatures are accepted for electronically filed forms, provided that the signer meets the necessary identification and authentication requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Form 540 are crucial for compliance. Typically, the deadline for submitting your Form 540 is April 15 of each year, coinciding with the federal tax deadline. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to these deadlines, especially in light of special circumstances, such as natural disasters or legislative changes that may affect filing requirements.

Form Submission Methods (Online / Mail / In-Person)

The Form 540 can be submitted through various methods, providing flexibility for taxpayers. You can file online using the California Franchise Tax Board's e-filing system, which is often the fastest and most efficient method. Alternatively, you can mail a paper copy of the completed form to the appropriate address specified by the Franchise Tax Board. For those who prefer in-person submissions, some local tax offices may accept the form directly, although this option may be limited.

Quick guide on how to complete 2002 form 540

Complete Form 540 effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Handle Form 540 on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Form 540 without hassle

- Find Form 540 and select Get Form to begin.

- Make use of the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Form 540 to ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2002 form 540

Create this form in 5 minutes!

How to create an eSignature for the 2002 form 540

The best way to generate an electronic signature for your PDF online

The best way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is Form 540 and why is it important?

Form 540 is a California income tax return form that individuals use to report their earnings and calculate their tax obligations. Completing Form 540 is crucial for ensuring that taxpayers meet their legal requirements and avoid penalties. Using airSlate SignNow simplifies the process of e-signing and submitting Form 540 securely and efficiently.

-

How can airSlate SignNow help with Form 540 filing?

airSlate SignNow offers an intuitive platform that allows users to easily fill out, e-sign, and send Form 540 online. Our solution streamlines the entire process, reducing the time spent on paperwork and improving accuracy. By providing templates and automated workflows, SignNow makes it easier to ensure compliance with tax regulations.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including individual users and larger teams. Our plans include features for electronic signatures, document management, and integrations, ensuring you get value for your investment when handling documents like Form 540. Visit our pricing page for detailed information on available options.

-

Is airSlate SignNow secure for handling Form 540?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. We understand the importance of protecting sensitive information, especially when dealing with documents like Form 540. Our platform provides a secure environment for signing and sharing your tax documents.

-

Can I integrate airSlate SignNow with other software for Form 540?

Absolutely! airSlate SignNow seamlessly integrates with a variety of software solutions, enhancing your workflow when managing Form 540. Whether you use accounting software, CRM, or other tools, our integrations allow you to streamline your processes and improve efficiency in document handling.

-

What features does airSlate SignNow offer for managing Form 540?

airSlate SignNow includes several features designed to assist with managing Form 540, such as document templates, e-signature capabilities, and real-time tracking. These tools facilitate the easy creation, signing, and sharing of important tax documents. Our platform is designed to enhance user experience while ensuring compliance.

-

How can I get started with airSlate SignNow for Form 540?

Getting started with airSlate SignNow is simple! You can sign up for a free trial on our website, where you can explore our features and tools for managing Form 540. Once you're ready, you can choose a subscription plan that fits your needs and start streamline your document processes today.

Get more for Form 540

Find out other Form 540

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract