it 203 C 2019

What is the IT-203-C?

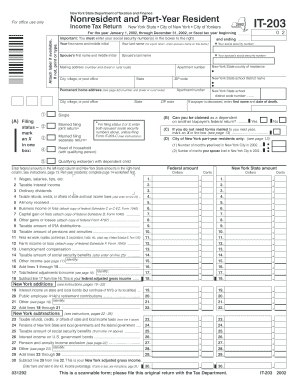

The IT-203-C form is a New York State tax form used by non-residents to report income earned within the state. This form allows individuals who do not reside in New York but have sourced income from the state to accurately report their earnings and calculate their tax obligations. It is essential for ensuring compliance with state tax laws while providing a clear record of income earned and taxes owed.

How to Use the IT-203-C

Using the IT-203-C form involves several steps to ensure accurate reporting of income. First, gather all necessary documentation, including W-2 forms, 1099 forms, and any other income statements. Next, complete the form by entering your personal information, including your name, address, and Social Security number. Then, report your income from New York sources and calculate any applicable deductions or credits. Finally, review your entries for accuracy before submitting the form to the New York State Department of Taxation and Finance.

Steps to Complete the IT-203-C

Completing the IT-203-C form requires careful attention to detail. Follow these steps:

- Collect all relevant income documents, such as W-2s and 1099s.

- Fill in your personal information at the top of the form.

- Report your New York source income in the designated sections.

- Calculate your deductions and credits, if applicable.

- Review the form for any errors or omissions.

- Sign and date the form before submission.

Legal Use of the IT-203-C

The IT-203-C form is legally recognized as a valid document for reporting non-resident income in New York. To ensure its legal standing, it must be completed accurately and submitted by the required deadline. Adhering to the instructions provided by the New York State Department of Taxation and Finance is crucial for compliance. Additionally, retaining copies of submitted forms and supporting documents is recommended for personal records and future reference.

Filing Deadlines / Important Dates

Filing deadlines for the IT-203-C form are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of the year following the tax year in question. If April fifteenth falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to deadlines annually, as these can vary based on state regulations.

Required Documents

To complete the IT-203-C form, several documents are necessary. These include:

- W-2 forms from employers for income earned in New York.

- 1099 forms for any freelance or contract work completed in the state.

- Records of any deductions or credits being claimed.

- Proof of residency in another state, if applicable.

Form Submission Methods

The IT-203-C form can be submitted through various methods. Taxpayers may choose to file online using the New York State Department of Taxation and Finance's e-filing system, which is secure and efficient. Alternatively, the form can be mailed to the appropriate address provided in the filing instructions or submitted in person at designated tax offices. Each method has its own processing times and requirements, so it is important to choose the one that best fits your needs.

Quick guide on how to complete it 203 c

Complete It 203 C effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage It 203 C on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign It 203 C with ease

- Locate It 203 C and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow makes available specifically for that purpose.

- Generate your eSignature using the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Put aside the worries of lost or misplaced documents, tedious form searching, or mistakes requiring the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign It 203 C and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it 203 c

Create this form in 5 minutes!

How to create an eSignature for the it 203 c

The way to make an electronic signature for a PDF online

The way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is airSlate SignNow and how does it relate to it 203 c?

airSlate SignNow is a comprehensive eSignature solution that streamlines the process of sending and signing documents electronically. It 203 c is a key focus in our offerings, as it emphasizes compliance and security, making our platform ideal for businesses needing reliable documentation.

-

How much does airSlate SignNow cost for businesses using it 203 c?

Pricing for airSlate SignNow is competitive and varies based on your specific needs and the volume of usage. For companies focusing on it 203 c compliance, we offer tailored plans that provide cost-effective solutions to enhance your document workflows.

-

What features does airSlate SignNow provide to support it 203 c compliance?

airSlate SignNow includes features such as secure cloud storage, advanced authentication options, and audit trails that ensure full compliance with it 203 c standards. These tools help businesses safeguard their documents while maintaining legal validity.

-

Can airSlate SignNow integrate with other tools to enhance it 203 c functionality?

Absolutely! airSlate SignNow integrates seamlessly with various applications like CRM systems and productivity tools, enhancing the functionality of it 203 c. This integration ensures a streamlined workflow that boosts efficiency and compliance.

-

How can airSlate SignNow benefit my business in relation to it 203 c?

By using airSlate SignNow, businesses can signNowly reduce the time spent on document management while enhancing security and compliance with it 203 c. Our platform provides an easy-to-use interface that allows for quick eSignatures, improving overall productivity.

-

Is airSlate SignNow suitable for small businesses concerned with it 203 c?

Yes, airSlate SignNow is designed to be cost-effective and easy to use, making it an excellent choice for small businesses focused on it 203 c. Our plans are scalable, enabling businesses to grow while ensuring they meet compliance requirements.

-

What type of support does airSlate SignNow offer for it 203 c users?

airSlate SignNow provides robust customer support for users concerned with it 203 c compliance. Our support team is available to assist with implementation, troubleshooting, and any questions about maximizing our platform for your compliance needs.

Get more for It 203 C

- Subway rewards card replacement form

- Behavior point sheet template 536243462 form

- Kokstad junior school form

- Jv 295 de facto parent request form

- First aid checklist template form

- Scanjet sc30t manual pdf form

- Rental application for represented landlords parealtor form

- Stewart scholarship applications due june 30 form

Find out other It 203 C

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile