INDIVIDUAL INCOME TAX RETURN 2019

What is the INDIVIDUAL INCOME TAX RETURN

The INDIVIDUAL INCOME TAX RETURN is a form used by U.S. taxpayers to report their annual income, calculate their tax liability, and determine whether they owe additional taxes or are entitled to a refund. This form is essential for individuals, including employees, freelancers, and self-employed persons, as it provides the IRS with a comprehensive overview of their financial situation for the tax year. The information reported on this form includes wages, dividends, capital gains, and other income sources, as well as deductions and credits that may reduce taxable income.

Steps to complete the INDIVIDUAL INCOME TAX RETURN

Completing the INDIVIDUAL INCOME TAX RETURN involves several key steps to ensure accuracy and compliance with IRS regulations. Follow these steps:

- Gather all necessary documents, including W-2s, 1099s, and receipts for deductible expenses.

- Choose the appropriate form version, such as Form 1040, 1040-SR, or 1040-NR, based on your filing status and situation.

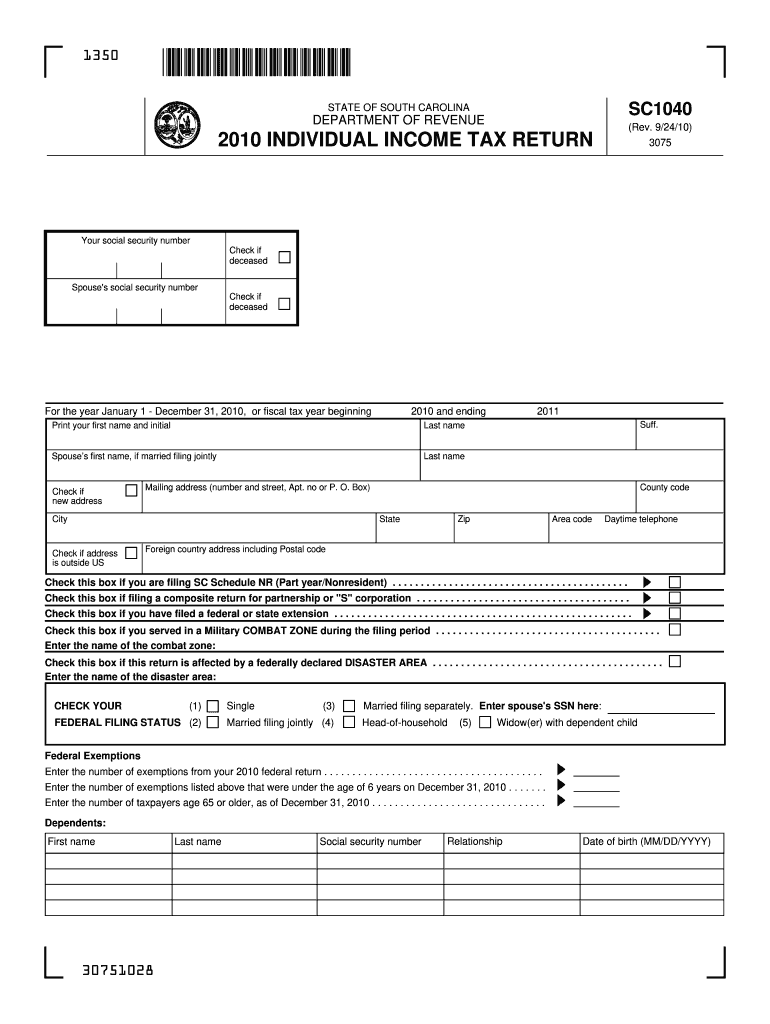

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, including wages, interest, and dividends.

- Claim deductions and credits that apply to your situation, such as the standard deduction or itemized deductions.

- Calculate your total tax liability using the IRS tax tables or tax software.

- Review the completed form for accuracy before signing and dating it.

How to obtain the INDIVIDUAL INCOME TAX RETURN

The INDIVIDUAL INCOME TAX RETURN can be obtained through various methods. Taxpayers can access the form directly from the IRS website, where it is available for download in PDF format. Additionally, many tax preparation software programs offer the form as part of their services, allowing users to complete it electronically. Taxpayers may also request a physical copy from local IRS offices or order it by phone. It is important to ensure that you are using the correct version of the form for the tax year you are filing.

Filing Deadlines / Important Dates

Filing deadlines for the INDIVIDUAL INCOME TAX RETURN are crucial for compliance. Typically, the deadline for submitting your tax return is April 15 of the following year. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers may also request an extension, allowing them to file by October 15, but any taxes owed must still be paid by the original deadline to avoid penalties and interest. Keeping track of these important dates ensures timely filing and payment.

Legal use of the INDIVIDUAL INCOME TAX RETURN

The INDIVIDUAL INCOME TAX RETURN has legal significance as it is a formal declaration of income and tax liability to the IRS. It must be completed accurately and honestly to avoid legal repercussions, such as audits, penalties, or criminal charges for tax evasion. The form serves as a legal document that may be used in various situations, including loan applications or financial assessments. Therefore, understanding the legal implications of the information provided on this form is essential for all taxpayers.

Required Documents

To complete the INDIVIDUAL INCOME TAX RETURN accurately, taxpayers need to gather several required documents. These typically include:

- W-2 forms from employers, detailing wages and withheld taxes.

- 1099 forms for other income sources, such as freelance work or interest income.

- Receipts for deductible expenses, including medical bills and charitable contributions.

- Records of any tax credits claimed, such as education credits or energy-efficient home improvements.

- Last year's tax return for reference and consistency.

Quick guide on how to complete 2010 individual income tax return

Complete INDIVIDUAL INCOME TAX RETURN effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools required to generate, modify, and eSign your documents swiftly without delays. Handle INDIVIDUAL INCOME TAX RETURN on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign INDIVIDUAL INCOME TAX RETURN seamlessly

- Locate INDIVIDUAL INCOME TAX RETURN and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign INDIVIDUAL INCOME TAX RETURN and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 individual income tax return

Create this form in 5 minutes!

How to create an eSignature for the 2010 individual income tax return

How to create an electronic signature for a PDF in the online mode

How to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

How to create an eSignature for a PDF on Android OS

People also ask

-

What is an INDIVIDUAL INCOME TAX RETURN?

An INDIVIDUAL INCOME TAX RETURN is a form used by individuals to report their income and calculate taxes owed to the federal government. It includes details on income, deductions, and credits, which determine the tax liability. Accurate filing is essential for compliance and may influence refunds or taxes owed.

-

How can airSlate SignNow assist with filing my INDIVIDUAL INCOME TAX RETURN?

airSlate SignNow provides users with a streamlined platform to easily eSign and send documents related to your INDIVIDUAL INCOME TAX RETURN. With its user-friendly interface, you can quickly complete necessary forms while ensuring that all signatures are securely collected. This helps facilitate a smoother filing process.

-

What features does airSlate SignNow offer for INDIVIDUAL INCOME TAX RETURN documents?

airSlate SignNow offers features such as document templates, electronic signatures, and secure cloud storage for managing your INDIVIDUAL INCOME TAX RETURN documents. Additionally, users can track the status of their documents and set reminders for important deadlines. These features enhance organization and reliability.

-

Is airSlate SignNow cost-effective for individuals handling their INDIVIDUAL INCOME TAX RETURN?

Yes, airSlate SignNow is a cost-effective solution for individuals managing their INDIVIDUAL INCOME TAX RETURN, as it saves time and reduces the hassle of traditional paperwork. The pricing plans are tailored to meet the needs of both individuals and small businesses, ensuring affordability while optimizing efficiency.

-

Can I integrate airSlate SignNow with other tax software for my INDIVIDUAL INCOME TAX RETURN?

Absolutely! airSlate SignNow integrates seamlessly with various tax software systems, enabling a more efficient workflow for submitting your INDIVIDUAL INCOME TAX RETURN. This integration allows users to transfer documents directly and keep all filing processes streamlined, reducing the chances of errors.

-

What are the benefits of using airSlate SignNow for my INDIVIDUAL INCOME TAX RETURN?

Using airSlate SignNow for your INDIVIDUAL INCOME TAX RETURN ensures that all your documents are securely signed and easily accessible. The platform enhances collaboration, speeds up the signing process, and provides audit trails for compliance purposes. These benefits ultimately simplify tax filing and improve accuracy.

-

How secure is airSlate SignNow when handling my INDIVIDUAL INCOME TAX RETURN?

Security is a top priority for airSlate SignNow when managing your INDIVIDUAL INCOME TAX RETURN. The platform employs industry-standard encryption and compliance measures to protect sensitive information. You can trust that your data is safe while using the service to manage your tax documents.

Get more for INDIVIDUAL INCOME TAX RETURN

- Memorandum and articles of association sample form

- Online marriage certificate form

- 40 mcq answer sheet pdf form

- Handicap placard application pennsylvania form

- Eic table form

- Bank muscat wps salary form

- Va form 21 526b replacement

- In the iowa district court for county upon the petition of affidavit for form

Find out other INDIVIDUAL INCOME TAX RETURN

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT