Sc1065 Form 2019

What is the Sc1065 Form

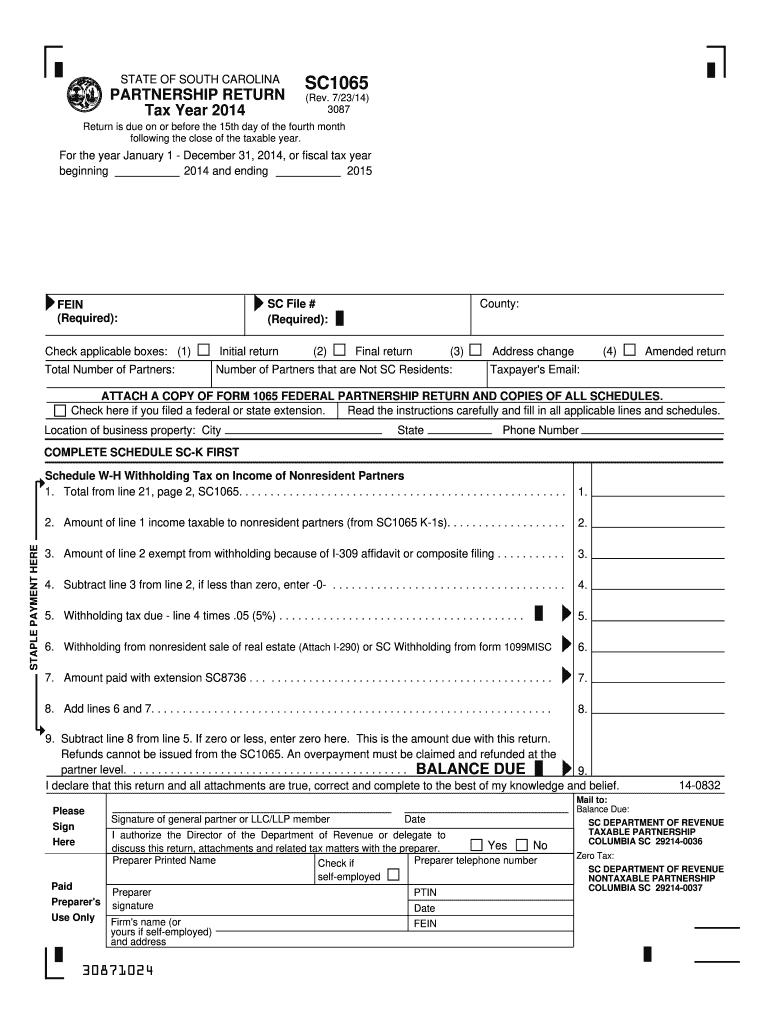

The Sc1065 Form is a tax document used by partnerships in the United States to report income, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for partnerships to accurately disclose their financial activities for a given tax year. It provides a comprehensive overview of the partnership's earnings and expenses, ensuring that each partner's share of the income is reported correctly on their individual tax returns. Understanding the Sc1065 Form is crucial for compliance with federal tax regulations.

How to use the Sc1065 Form

To effectively use the Sc1065 Form, partnerships must first gather all relevant financial information, including income, expenses, and any applicable deductions. Each partner's share of the income must be calculated based on the partnership agreement. Once the necessary data is compiled, the form can be filled out, detailing the partnership's financial activities. After completing the form, it should be reviewed for accuracy before submission to the IRS. Each partner will also need to receive a Schedule K-1, which outlines their share of the partnership's income, deductions, and credits.

Steps to complete the Sc1065 Form

Completing the Sc1065 Form involves several key steps:

- Gather all financial records, including income statements and expense reports.

- Determine the partnership's total income and allowable deductions.

- Fill out the Sc1065 Form, ensuring all sections are completed accurately.

- Calculate each partner's share of income and complete the corresponding Schedule K-1 for each partner.

- Review the completed form and schedules for accuracy.

- Submit the Sc1065 Form and all attached schedules to the IRS by the designated deadline.

Legal use of the Sc1065 Form

The Sc1065 Form must be used in compliance with IRS regulations to ensure its legal validity. Partnerships are required to file this form annually to report their income and expenses. Failure to do so can result in penalties and interest on unpaid taxes. Additionally, accurate reporting on the Sc1065 Form is essential for each partner to properly report their income on their individual tax returns. It is advisable for partnerships to maintain thorough records and consult with tax professionals to ensure compliance with all legal requirements.

Filing Deadlines / Important Dates

Partnerships must be aware of the filing deadlines associated with the Sc1065 Form. Generally, the form is due on March 15 of the year following the tax year being reported. If additional time is needed, partnerships can file for an extension, which typically grants an additional six months. However, it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

When preparing to complete the Sc1065 Form, partnerships should gather several key documents:

- Income statements detailing all sources of revenue.

- Expense reports outlining all deductible expenses incurred during the tax year.

- Partnership agreement to determine each partner's share of income and losses.

- Previous tax returns for reference and consistency.

Examples of using the Sc1065 Form

The Sc1065 Form is commonly used by various types of partnerships, such as general partnerships, limited partnerships, and limited liability companies (LLCs) that choose to be taxed as partnerships. For instance, a group of professionals forming a law firm as a partnership would use the Sc1065 Form to report their collective income and expenses. Similarly, a real estate investment partnership would utilize this form to report rental income and property-related expenses, ensuring each partner's tax obligations are met accurately.

Quick guide on how to complete sc1065 2014 form

Prepare Sc1065 Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without interruptions. Manage Sc1065 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Sc1065 Form with ease

- Obtain Sc1065 Form and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Adjust and eSign Sc1065 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc1065 2014 form

Create this form in 5 minutes!

How to create an eSignature for the sc1065 2014 form

How to create an eSignature for a PDF in the online mode

How to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the SC1065 Form?

The SC1065 Form is a tax form used by partnerships in South Carolina to report income, deductions, and credits. Understanding this form is essential for ensuring compliance with state tax laws. airSlate SignNow simplifies the process of sending and eSigning the SC1065 Form, making it easy for business partners to manage their tax forms.

-

How can airSlate SignNow help with the SC1065 Form?

airSlate SignNow offers a streamlined platform for sending and eSigning the SC1065 Form. By utilizing our solution, users enjoy features like real-time tracking, templates, and secure storage, enhancing the overall efficiency of managing tax forms. This ensures the completed SC1065 Form is easily accessible whenever needed.

-

What are the pricing options for using airSlate SignNow for SC1065 Form?

airSlate SignNow provides flexible pricing plans designed to accommodate various business needs. Whether you require a single user plan or a team package, we ensure that accessing the SC1065 Form and other document needs remains cost-effective. You can choose a plan that fits your budget while enjoying robust features for managing your forms.

-

Are there any integrations available for SC1065 Form processing?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your experience while managing the SC1065 Form. Our platform works well with CRM, accounting software, and more, allowing you to streamline your workflow. This integration capability ensures that you can easily connect your data across different platforms.

-

Is airSlate SignNow secure for eSigning the SC1065 Form?

Absolutely. Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the SC1065 Form. Our platform is equipped with advanced encryption methods and complies with industry standards to guarantee the safety and confidentiality of your documents.

-

Can the SC1065 Form be customized using airSlate SignNow?

Yes, the SC1065 Form can be customized to fit your specific partnership needs using airSlate SignNow. Our platform offers tools that allow users to add their branding and specific fields required for their individual forms. This customization ensures that the eSigned SC1065 Form accurately reflects your business identity.

-

How long does it take to eSign the SC1065 Form with airSlate SignNow?

eSigning the SC1065 Form with airSlate SignNow is a quick and efficient process. Most users can complete the eSigning in just a few minutes, thanks to our user-friendly interface and streamlined workflows. This speed helps you meet important tax deadlines effectively.

Get more for Sc1065 Form

Find out other Sc1065 Form

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe