M1, Individual Income Tax Return Revenue State Mn 2020

What is the M1, Individual Income Tax Return Revenue State Mn

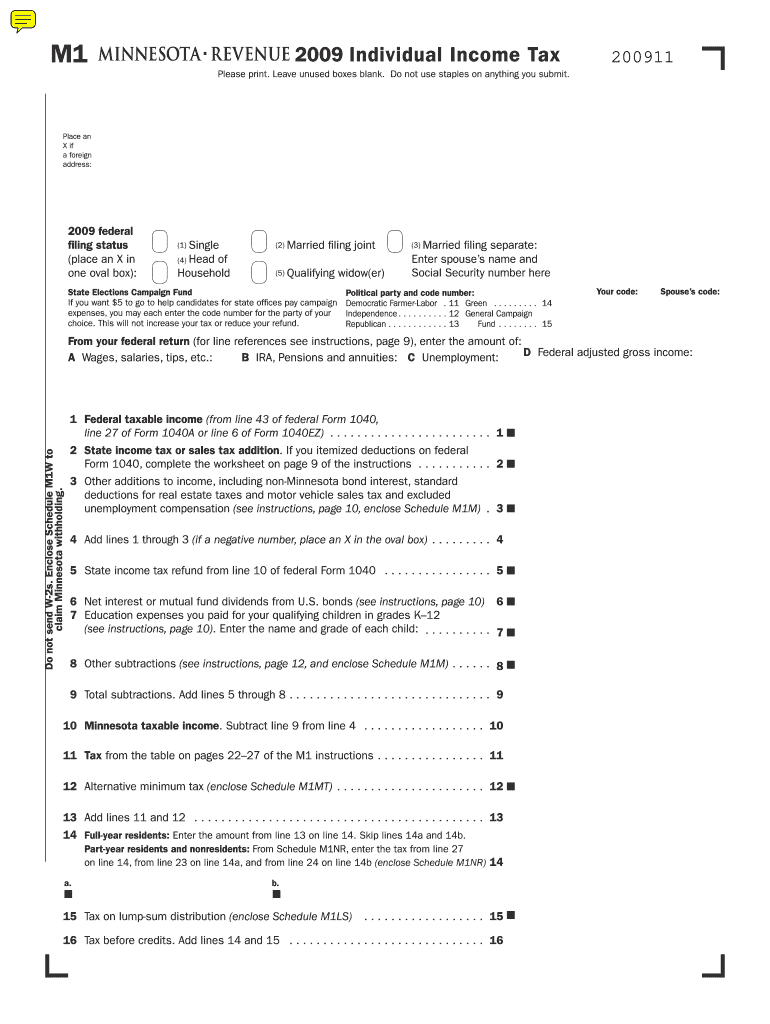

The M1, Individual Income Tax Return Revenue State Mn is a tax form used by residents of Minnesota to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state, as it helps ensure compliance with Minnesota tax laws. The M1 form captures various types of income, including wages, self-employment earnings, and investment income, allowing taxpayers to accurately report their financial situation to the state revenue department.

Steps to complete the M1, Individual Income Tax Return Revenue State Mn

Completing the M1 form involves several key steps:

- Gather necessary documents, such as W-2s, 1099s, and other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income from all sources on the appropriate lines of the form.

- Calculate your deductions and credits to determine your taxable income.

- Compute your tax liability using the state tax tables provided.

- Sign and date the form before submission.

How to obtain the M1, Individual Income Tax Return Revenue State Mn

The M1 form can be obtained through the Minnesota Department of Revenue's official website. It is available for download in PDF format, allowing taxpayers to print and complete it manually. Additionally, many tax preparation software programs include the M1 form, enabling users to fill it out electronically. It is important to ensure you are using the most current version of the form to comply with state regulations.

Legal use of the M1, Individual Income Tax Return Revenue State Mn

The M1 form is legally binding once it is completed and signed by the taxpayer. To ensure its validity, it must meet specific requirements set forth by Minnesota tax laws. This includes accurate reporting of income, proper calculation of taxes owed, and adherence to deadlines for submission. Using a reliable eSignature platform can enhance the legal standing of the completed form, ensuring it is recognized by the state revenue department.

State-specific rules for the M1, Individual Income Tax Return Revenue State Mn

When filing the M1 form, taxpayers must be aware of specific Minnesota tax rules that may affect their return. These rules include various deductions and credits unique to the state, such as the Minnesota property tax refund and the working family credit. Additionally, Minnesota has its own tax rates and brackets, which differ from federal tax rates. Understanding these state-specific regulations is crucial for accurate filing and maximizing potential refunds.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific deadlines when filing the M1 form. Typically, the deadline for submitting the M1 form is April 15 of each year, aligning with federal tax deadlines. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes or updates to these deadlines to avoid penalties.

Quick guide on how to complete 2009 m1 individual income tax return revenue state mn

Effortlessly prepare M1, Individual Income Tax Return Revenue State Mn on any device

Digital document management has gained traction among organizations and individuals. It offers a superb eco-friendly alternative to traditional printed and signed documents, as you can access the correct template and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage M1, Individual Income Tax Return Revenue State Mn on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to edit and eSign M1, Individual Income Tax Return Revenue State Mn with ease

- Find M1, Individual Income Tax Return Revenue State Mn and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your PC.

Eliminate worries about lost or mislaid documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign M1, Individual Income Tax Return Revenue State Mn and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2009 m1 individual income tax return revenue state mn

Create this form in 5 minutes!

How to create an eSignature for the 2009 m1 individual income tax return revenue state mn

How to make an eSignature for a PDF in the online mode

How to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

How to create an eSignature for a PDF document on Android OS

People also ask

-

What is the M1, Individual Income Tax Return Revenue State Mn?

The M1, Individual Income Tax Return Revenue State Mn is a tax form used by residents of Minnesota to report their income, claim deductions, and calculate their tax liability. Understanding how to properly complete the M1 form is essential for accurately fulfilling state tax obligations and avoiding penalties.

-

How can airSlate SignNow assist with the M1, Individual Income Tax Return Revenue State Mn?

airSlate SignNow simplifies the process of signing and sending your M1, Individual Income Tax Return Revenue State Mn. Our platform enables businesses to easily eSign documents and manage tax forms securely, ensuring that your submissions are timely and compliant.

-

What features does airSlate SignNow offer for tax documentation like the M1 form?

airSlate SignNow offers features such as customizable templates, eSignature capabilities, document tracking, and secure cloud storage. These tools are particularly beneficial for efficiently handling the M1, Individual Income Tax Return Revenue State Mn and ensuring that all necessary signatures are collected.

-

Is airSlate SignNow cost-effective for managing tax documents?

Yes, airSlate SignNow is a cost-effective solution for managing tax documents like the M1, Individual Income Tax Return Revenue State Mn. Our pricing plans are designed to accommodate various business needs, allowing you to choose a plan that fits your budget while still accessing powerful eSigning features.

-

Can I integrate airSlate SignNow with other software for tax filing?

Absolutely! airSlate SignNow integrates seamlessly with a range of software, making it easy to manage tax filings, including the M1, Individual Income Tax Return Revenue State Mn. This allows for a streamlined workflow that enhances your accounting and tax preparation processes.

-

What are the benefits of using airSlate SignNow for the M1, Individual Income Tax Return Revenue State Mn?

Using airSlate SignNow for your M1, Individual Income Tax Return Revenue State Mn offers numerous benefits, including improved efficiency, reduced turnaround time, and increased compliance. By utilizing electronic signatures, you can eliminate paperwork delays and ensure that your form is submitted on time.

-

How secure is airSlate SignNow when handling sensitive tax documents?

Security is a top priority at airSlate SignNow. When managing sensitive tax documents like the M1, Individual Income Tax Return Revenue State Mn, our platform employs advanced encryption and authentication protocols to protect your information and ensure confidentiality throughout the signing process.

Get more for M1, Individual Income Tax Return Revenue State Mn

Find out other M1, Individual Income Tax Return Revenue State Mn

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors