Form 6251 Alternative Minimum Tax Individuals Overview 2023

What is the Form 6251 Alternative Minimum Tax

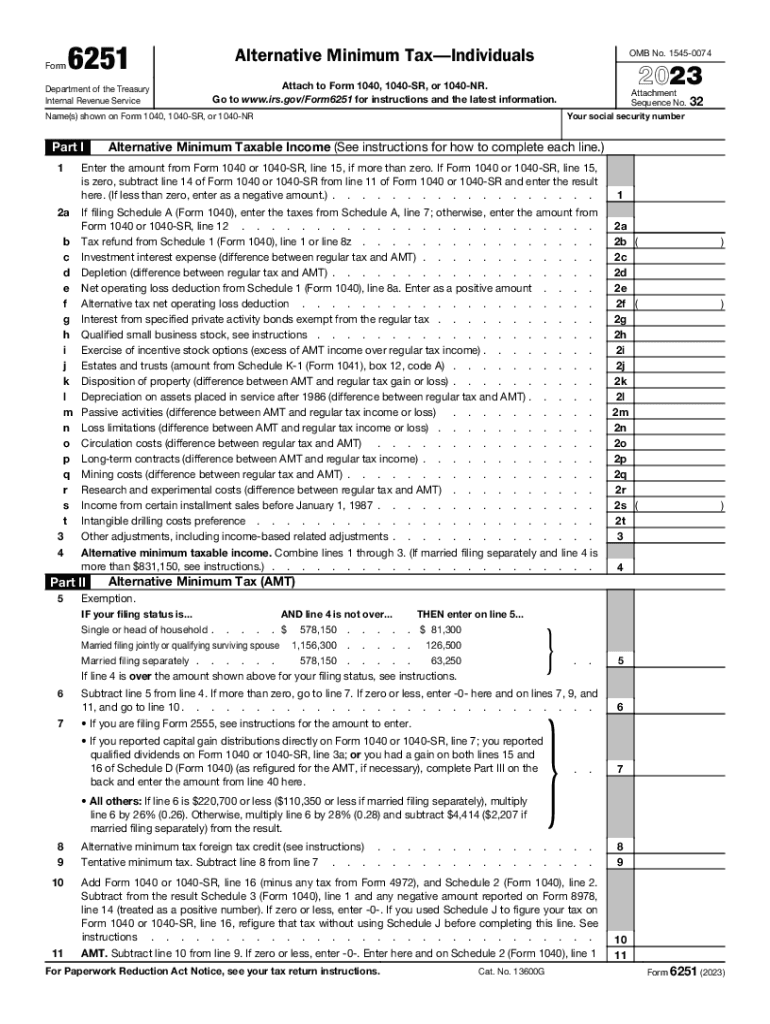

The Form 6251 is used by individuals to calculate the Alternative Minimum Tax (AMT), which ensures that taxpayers with higher incomes pay a minimum amount of tax. The AMT is designed to prevent high-income earners from using deductions and credits to significantly reduce their tax liability. The form requires taxpayers to report income, deductions, and credits that may be subject to AMT rules. Understanding this form is essential for those who may be affected by AMT, as it can impact overall tax obligations.

Steps to Complete the Form 6251

Completing the Form 6251 involves several key steps:

- Gather necessary documents: Collect your income statements, previous tax returns, and any relevant documentation for deductions and credits.

- Calculate your regular tax: Determine your total tax liability without considering AMT.

- Complete the form: Follow the instructions on Form 6251 to report your income, adjustments, and preferences that may trigger AMT.

- Compare taxes: After completing the form, compare your regular tax with the AMT calculated on Form 6251 to determine if you owe additional tax.

- File your return: Include Form 6251 with your tax return, ensuring all calculations are accurate.

IRS Guidelines for Form 6251

The IRS provides specific guidelines for completing and filing Form 6251. Taxpayers should refer to the latest IRS instructions to ensure compliance with current tax laws. Key guidelines include:

- Reviewing income thresholds that may trigger AMT.

- Understanding which deductions and credits are subject to AMT adjustments.

- Filing deadlines for submitting Form 6251 along with your tax return.

Eligibility Criteria for Form 6251

Not all taxpayers are required to file Form 6251. Eligibility typically includes individuals who:

- Have a high income that exceeds certain thresholds.

- Claim specific deductions, such as state and local tax deductions.

- Receive tax-exempt interest from private activity bonds.

It is important to assess your financial situation to determine if you need to file this form.

Form Submission Methods for Form 6251

Taxpayers can submit Form 6251 through various methods:

- Online: Use tax software that supports electronic filing of Form 6251.

- Mail: Print the completed form and send it to the appropriate IRS address based on your filing status.

- In-Person: Some taxpayers may choose to file in person at designated IRS offices or through a tax professional.

Penalties for Non-Compliance with Form 6251

Failure to file Form 6251 when required can result in penalties. Taxpayers may face:

- Additional tax liabilities if AMT is owed but not reported.

- Interest on unpaid taxes for late filings.

- Potential audits by the IRS if discrepancies are found.

Staying compliant with AMT requirements is crucial to avoid these penalties.

Quick guide on how to complete form 6251 alternative minimum tax individuals overview

Effortlessly Prepare Form 6251 Alternative Minimum Tax Individuals Overview on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without delay. Handle Form 6251 Alternative Minimum Tax Individuals Overview on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Modify and eSign Form 6251 Alternative Minimum Tax Individuals Overview Seamlessly

- Obtain Form 6251 Alternative Minimum Tax Individuals Overview and click on Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about missing or lost files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign Form 6251 Alternative Minimum Tax Individuals Overview and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 6251 alternative minimum tax individuals overview

Create this form in 5 minutes!

How to create an eSignature for the form 6251 alternative minimum tax individuals overview

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the tax 6251 form and why do I need it?

The tax 6251 form, also known as the Alternative Minimum Tax (AMT) form, is essential for determining your tax liability if you have specific tax benefits. If you're eligible, you might need to file this form to ensure you're paying the correct amount of tax. Using airSlate SignNow can help streamline the eSigning process for your tax 6251 form.

-

How can airSlate SignNow help me with my tax 6251 form?

With airSlate SignNow, you can easily send, sign, and store your tax 6251 form digitally. Our user-friendly platform ensures that your documents are handled securely and efficiently, making the eSigning process quick and convenient for you and your tax preparer.

-

Is there a cost associated with using airSlate SignNow for the tax 6251 form?

Yes, airSlate SignNow offers various pricing plans to suit your needs, ranging from individual to business subscriptions. Each plan provides you with essential features to manage your tax 6251 form effortlessly, ensuring a cost-effective solution for document management.

-

What features does airSlate SignNow provide for managing tax 6251 forms?

airSlate SignNow includes features such as templates, document tracking, and secure storage, which are perfect for handling your tax 6251 form. You can also take advantage of our mobile app to sign documents on the go, ensuring you never miss a deadline.

-

Can I integrate airSlate SignNow with other applications for my tax 6251 form?

Absolutely! airSlate SignNow offers integrations with popular applications such as Google Drive, Dropbox, and many others. This means you can easily import, share, and manage your tax 6251 form alongside your other important documents.

-

What are the benefits of using airSlate SignNow for my tax 6251 form?

By using airSlate SignNow for your tax 6251 form, you gain a reliable, secure, and efficient way to handle your tax paperwork. Our platform minimizes errors, speeds up the signing process, and provides a streamlined experience that allows you to focus on other important financial matters.

-

Is my data secure when using airSlate SignNow for tax 6251 forms?

Yes, data security is a top priority at airSlate SignNow. We utilize advanced encryption and security measures to ensure that your tax 6251 form and other documents are kept safe from unauthorized access, giving you peace of mind.

Get more for Form 6251 Alternative Minimum Tax Individuals Overview

Find out other Form 6251 Alternative Minimum Tax Individuals Overview

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe