Wis Dept Revenue Partnership Form1065 2020

What is the Wis Dept Revenue Partnership Form1065

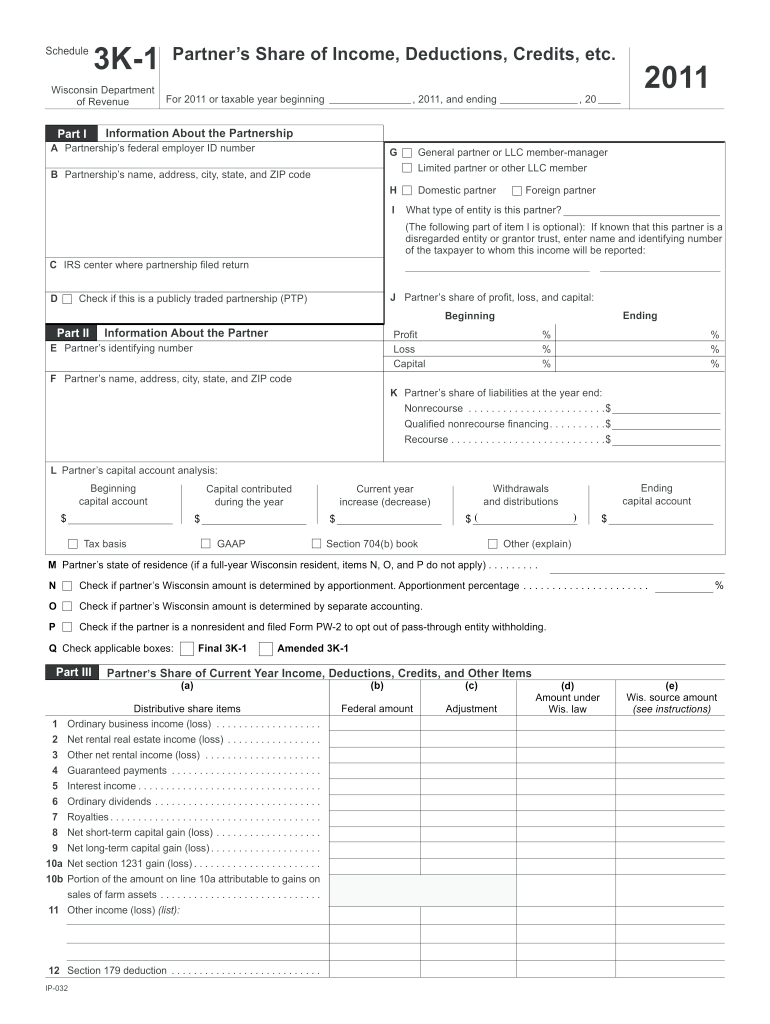

The Wis Dept Revenue Partnership Form1065 is a tax form used by partnerships operating in Wisconsin to report their income, deductions, and credits to the state revenue department. This form is essential for partnerships as it helps ensure compliance with state tax laws. It provides a comprehensive overview of the partnership's financial activities for the tax year, allowing the state to assess the tax liability accurately. The form is typically filed annually and includes detailed information about each partner's share of income and expenses.

How to use the Wis Dept Revenue Partnership Form1065

Using the Wis Dept Revenue Partnership Form1065 involves several steps that ensure accurate reporting of the partnership's financial activities. First, gather all necessary financial documents, including profit and loss statements, balance sheets, and any relevant supporting documentation. Next, complete the form by entering the required information about the partnership and its partners. It is crucial to ensure that all calculations are accurate and that the form is signed by the appropriate parties before submission. Finally, submit the completed form to the Wisconsin Department of Revenue by the specified deadline.

Steps to complete the Wis Dept Revenue Partnership Form1065

Completing the Wis Dept Revenue Partnership Form1065 requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary financial records, including income statements and expense reports.

- Fill in the partnership's basic information, including name, address, and tax identification number.

- Report total income and deductions accurately to reflect the partnership's financial performance.

- Detail each partner's share of income, deductions, and credits in the appropriate sections.

- Review the form for accuracy, ensuring all calculations are correct.

- Obtain signatures from all partners to validate the submission.

- Submit the form to the Wisconsin Department of Revenue by the due date.

Legal use of the Wis Dept Revenue Partnership Form1065

The Wis Dept Revenue Partnership Form1065 is legally binding when completed and submitted according to state regulations. To ensure its legal standing, the form must be filled out accurately and submitted on time. Additionally, electronic signatures can be used, provided they comply with the relevant eSignature laws, such as the ESIGN Act and UETA. This legal framework ensures that the form is recognized as valid and enforceable in a court of law, protecting both the partnership and its partners from potential disputes.

Filing Deadlines / Important Dates

Filing deadlines for the Wis Dept Revenue Partnership Form1065 are crucial for compliance. Typically, the form must be submitted by the 15th day of the third month following the end of the partnership's tax year. For partnerships that operate on a calendar year, this means the form is due by March 15. It is important to note any extensions that may apply and to keep track of any changes in deadlines announced by the Wisconsin Department of Revenue. Missing the deadline can result in penalties and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The Wis Dept Revenue Partnership Form1065 can be submitted through various methods, providing flexibility for partnerships. The form can be filed online through the Wisconsin Department of Revenue's e-filing system, which offers a secure and efficient way to submit documents. Alternatively, partnerships may choose to mail the completed form to the designated address provided by the department. In-person submissions are also possible, although they are less common. It is essential to check the specific submission guidelines to ensure compliance with state requirements.

Quick guide on how to complete wis dept revenue partnership form1065 2011

Effortlessly Prepare Wis Dept Revenue Partnership Form1065 on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and effortlessly. Manage Wis Dept Revenue Partnership Form1065 on any platform with airSlate SignNow’s Android or iOS applications and enhance your document-related workflow today.

The easiest way to modify and electronically sign Wis Dept Revenue Partnership Form1065 without hassle

- Locate Wis Dept Revenue Partnership Form1065 and click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method of sending your document, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing additional copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Update and electronically sign Wis Dept Revenue Partnership Form1065 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wis dept revenue partnership form1065 2011

Create this form in 5 minutes!

How to create an eSignature for the wis dept revenue partnership form1065 2011

The way to make an electronic signature for a PDF file online

The way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the Wis Dept Revenue Partnership Form1065?

The Wis Dept Revenue Partnership Form1065 is a tax return form used by partnerships to report income, deductions, and credits to the Wisconsin Department of Revenue. Understanding how to correctly fill out this form is crucial for compliance and accurate reporting.

-

How can airSlate SignNow help with the Wis Dept Revenue Partnership Form1065?

airSlate SignNow provides an efficient platform for electronically signing, sending, and managing the Wis Dept Revenue Partnership Form1065. With our solution, you can streamline your workflows and ensure timely submissions.

-

Is there a cost associated with using airSlate SignNow for the Wis Dept Revenue Partnership Form1065?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. You can choose a plan that best fits your requirements for handling the Wis Dept Revenue Partnership Form1065 and other documents.

-

What features does airSlate SignNow offer for managing the Wis Dept Revenue Partnership Form1065?

Key features include customizable templates, real-time tracking, and easy integration with other applications. These tools make completing and sharing the Wis Dept Revenue Partnership Form1065 more efficient.

-

Can I integrate airSlate SignNow with accounting software for the Wis Dept Revenue Partnership Form1065?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, enhancing your ability to manage the Wis Dept Revenue Partnership Form1065 alongside your other financial documents.

-

What benefits do I gain by using airSlate SignNow for the Wis Dept Revenue Partnership Form1065?

Using airSlate SignNow for the Wis Dept Revenue Partnership Form1065 allows for faster processing, improved accuracy, and reduced paper usage. Additionally, it helps in maintaining a clear digital audit trail for compliance purposes.

-

Is it legally binding to sign the Wis Dept Revenue Partnership Form1065 using airSlate SignNow?

Yes, signatures obtained through airSlate SignNow are legally binding and comply with electronic signature laws. This means you can confidently sign and submit the Wis Dept Revenue Partnership Form1065 without any legal concerns.

Get more for Wis Dept Revenue Partnership Form1065

Find out other Wis Dept Revenue Partnership Form1065

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy