Sched K1 541 Beneficiary Instructions Form 2019

What is the Sched K1 541 Beneficiary Instructions Form

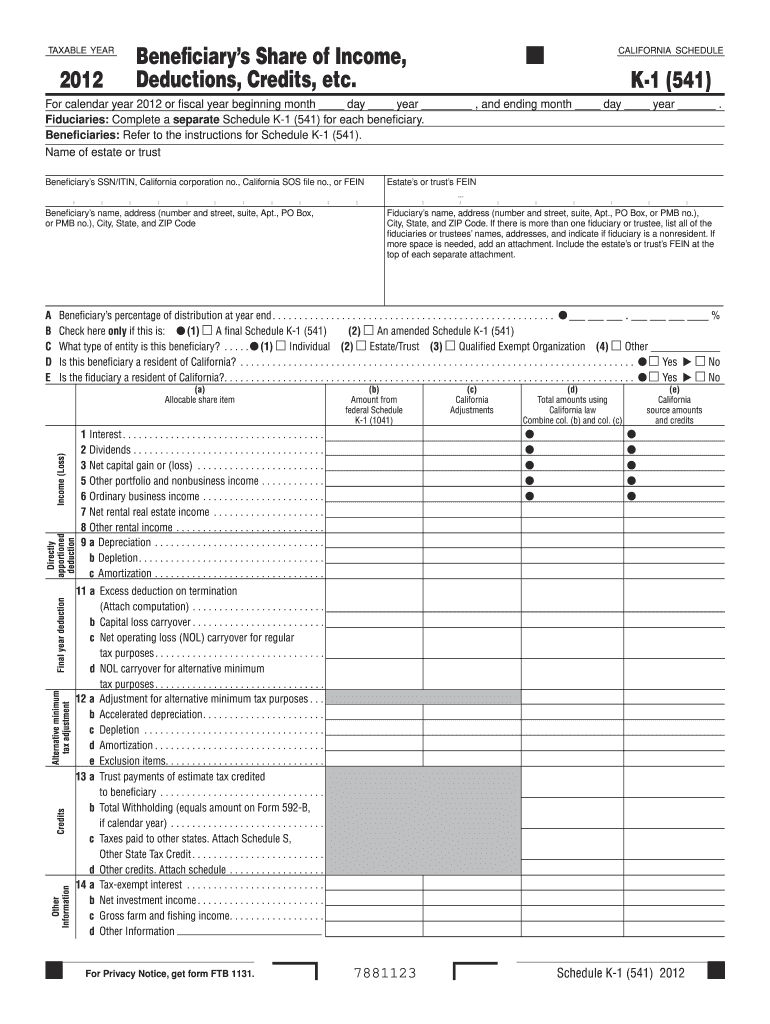

The Sched K1 541 Beneficiary Instructions Form is a tax document used in the United States for reporting income, deductions, and credits from estates, trusts, and partnerships. It is essential for beneficiaries of these entities to understand their tax obligations. This form provides detailed instructions on how beneficiaries should report income received from the estate or trust on their individual tax returns. Proper completion of this form ensures compliance with IRS regulations and accurate reporting of income.

How to use the Sched K1 541 Beneficiary Instructions Form

Using the Sched K1 541 Beneficiary Instructions Form involves several steps. First, beneficiaries must receive the form from the estate or trust administrator, which outlines the income distributed to them. Next, beneficiaries should carefully review the information provided, including the amounts and types of income. It is crucial to accurately report this information on their personal tax returns, typically using Form 1040. Beneficiaries may also need to consult a tax professional for guidance on specific reporting requirements and implications.

Steps to complete the Sched K1 541 Beneficiary Instructions Form

Completing the Sched K1 541 Beneficiary Instructions Form requires attention to detail. The following steps outline the process:

- Obtain the form from the estate or trust administrator.

- Review the income and deductions listed on the form.

- Fill in your personal information, including your name and taxpayer identification number.

- Accurately report the income on your Form 1040, following IRS guidelines.

- Keep a copy of the completed form for your records.

Legal use of the Sched K1 541 Beneficiary Instructions Form

The legal use of the Sched K1 541 Beneficiary Instructions Form is critical for ensuring compliance with tax laws. This form must be filled out accurately and submitted as part of the beneficiary's tax return. Failure to report income from estates or trusts can result in penalties or audits by the IRS. It is essential for beneficiaries to understand their legal obligations and the implications of the information reported on this form.

Key elements of the Sched K1 541 Beneficiary Instructions Form

Several key elements are included in the Sched K1 541 Beneficiary Instructions Form that beneficiaries should be aware of:

- Beneficiary Information: Personal details of the beneficiary, including name and taxpayer identification number.

- Income Distribution: Detailed amounts and types of income distributed from the estate or trust.

- Deductions: Any deductions that the beneficiary can claim related to the income received.

- Tax Credits: Information on any applicable tax credits that may reduce the beneficiary's overall tax liability.

Filing Deadlines / Important Dates

Beneficiaries must be aware of important deadlines associated with the Sched K1 541 Beneficiary Instructions Form. Typically, the form must be filed along with the beneficiary's individual tax return by April 15 of the following year. If additional time is needed, beneficiaries may file for an extension, but it is essential to ensure that all income is reported accurately and on time to avoid penalties.

Quick guide on how to complete sched k1 541 beneficiary instructions 2012 form

Effortlessly prepare Sched K1 541 Beneficiary Instructions Form on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents quickly without interruptions. Handle Sched K1 541 Beneficiary Instructions Form on any device using the airSlate SignNow applications for Android or iOS and simplify any document-centric task today.

The simplest way to modify and electronically sign Sched K1 541 Beneficiary Instructions Form with ease

- Obtain Sched K1 541 Beneficiary Instructions Form and click on Get Form to begin.

- Utilize the available tools to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Sched K1 541 Beneficiary Instructions Form to guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sched k1 541 beneficiary instructions 2012 form

Create this form in 5 minutes!

How to create an eSignature for the sched k1 541 beneficiary instructions 2012 form

How to make an eSignature for your PDF document online

How to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the Sched K1 541 Beneficiary Instructions Form?

The Sched K1 541 Beneficiary Instructions Form is a document that outlines the distribution of income, credits, and deductions from an estate or trust. This form is essential for beneficiaries to understand their tax obligations and entitlements. Using airSlate SignNow, you can efficiently manage and eSign this form, ensuring a seamless experience.

-

How can airSlate SignNow help with the Sched K1 541 Beneficiary Instructions Form?

airSlate SignNow streamlines the process of completing and signing the Sched K1 541 Beneficiary Instructions Form. Our platform offers an intuitive interface that allows for easy document uploads, annotations, and signatures. This eliminates the hassles of manual paperwork and expedites the distribution process.

-

What are the pricing options for using airSlate SignNow with the Sched K1 541 Beneficiary Instructions Form?

airSlate SignNow offers flexible pricing plans to suit various business needs. You can choose from monthly or annual subscriptions, which include features tailored for handling documents like the Sched K1 541 Beneficiary Instructions Form. Visit our pricing page for detailed options.

-

Are there any specific features for managing the Sched K1 541 Beneficiary Instructions Form?

Yes, airSlate SignNow includes specific features designed to simplify the management of the Sched K1 541 Beneficiary Instructions Form. Key features include customizable templates, automated reminders for signers, and secure storage. This ensures that all necessary parties can access and complete the form efficiently.

-

What benefits does airSlate SignNow provide for using the Sched K1 541 Beneficiary Instructions Form?

Using airSlate SignNow for the Sched K1 541 Beneficiary Instructions Form offers numerous benefits, including time savings and reduced administrative burden. The electronic signing process enhances accuracy and compliance while facilitating faster distribution of documents to beneficiaries.

-

Can I integrate airSlate SignNow with other software when working with the Sched K1 541 Beneficiary Instructions Form?

Absolutely! airSlate SignNow supports integrations with a variety of business applications, making it easy to manage the Sched K1 541 Beneficiary Instructions Form within your existing workflows. Popular integrations include CRM systems, cloud storage services, and productivity tools.

-

Is airSlate SignNow secure for handling the Sched K1 541 Beneficiary Instructions Form?

Yes, airSlate SignNow prioritizes security and compliance when handling the Sched K1 541 Beneficiary Instructions Form. We utilize bank-level encryption and adhere to strict data protection regulations to ensure that your documents and information remain safe.

Get more for Sched K1 541 Beneficiary Instructions Form

Find out other Sched K1 541 Beneficiary Instructions Form

- Sign Washington Amendment to an LLC Operating Agreement Now

- Can I Sign Wyoming Amendment to an LLC Operating Agreement

- How To Sign California Stock Certificate

- Sign Louisiana Stock Certificate Free

- Sign Maine Stock Certificate Simple

- Sign Oregon Stock Certificate Myself

- Sign Pennsylvania Stock Certificate Simple

- How Do I Sign South Carolina Stock Certificate

- Sign New Hampshire Terms of Use Agreement Easy

- Sign Wisconsin Terms of Use Agreement Secure

- Sign Alabama Affidavit of Identity Myself

- Sign Colorado Trademark Assignment Agreement Online

- Can I Sign Connecticut Affidavit of Identity

- Can I Sign Delaware Trademark Assignment Agreement

- How To Sign Missouri Affidavit of Identity

- Can I Sign Nebraska Affidavit of Identity

- Sign New York Affidavit of Identity Now

- How Can I Sign North Dakota Affidavit of Identity

- Sign Oklahoma Affidavit of Identity Myself

- Sign Texas Affidavit of Identity Online