540 Form 2019

What is the 540 Form

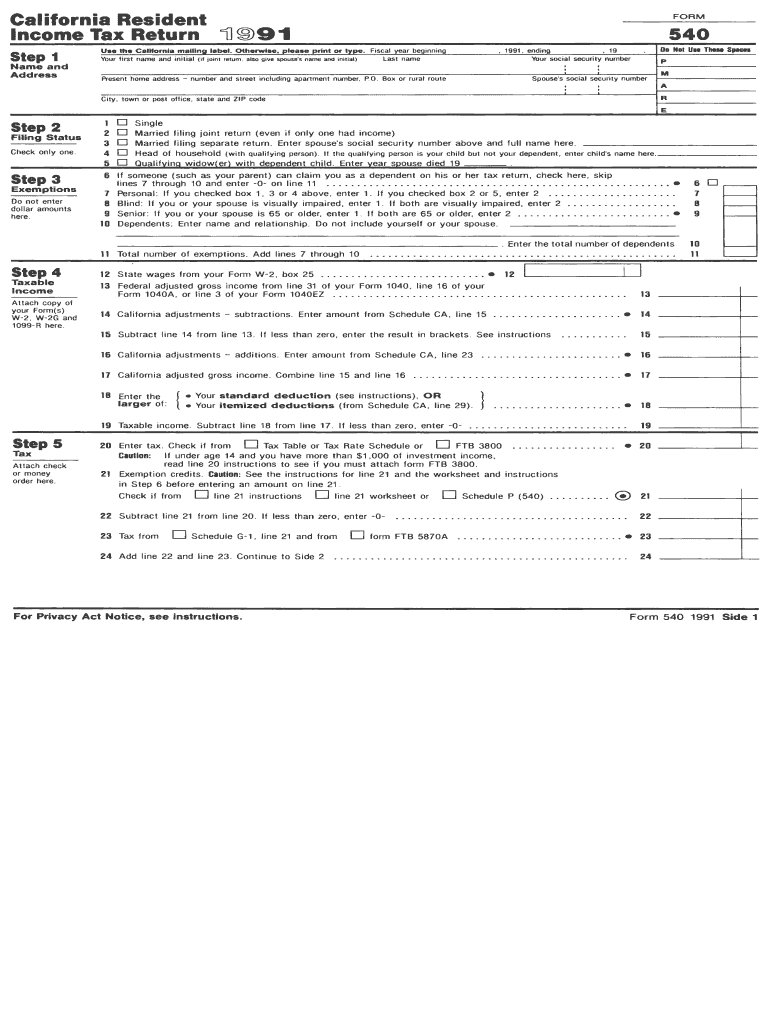

The 540 Form is a tax document used by residents of California to report their personal income to the state’s tax authority. It is essential for individuals who are required to file a state tax return, specifically for those who have earned income within California during the tax year. This form allows taxpayers to calculate their state income tax liability, claim deductions, and report any credits they may be eligible for. Understanding the purpose and requirements of the 540 Form is crucial for ensuring compliance with California tax laws.

How to use the 540 Form

Using the 540 Form involves several steps to ensure accurate reporting of income and tax obligations. First, gather all necessary financial documents, such as W-2s, 1099s, and other income statements. Next, fill out the form by entering your personal information, including your name, address, and Social Security number. Report your total income, deductions, and any applicable credits. Once completed, review the form for accuracy before submitting it to the California Franchise Tax Board (FTB) either electronically or by mail.

Steps to complete the 540 Form

Completing the 540 Form requires careful attention to detail. Follow these steps:

- Gather your financial documents, including income statements and previous tax returns.

- Enter your personal information at the top of the form.

- Report your total income from all sources, including wages, interest, and dividends.

- Claim any deductions you qualify for, such as standard or itemized deductions.

- Calculate your total tax liability using the provided tax tables.

- Include any tax credits you are eligible for to reduce your liability.

- Review the completed form for errors before signing and dating it.

Legal use of the 540 Form

The 540 Form must be used in accordance with California tax laws to ensure it is legally valid. Taxpayers are required to file this form if they meet specific income thresholds or have other tax obligations. Failure to file the 540 Form correctly can result in penalties and interest on unpaid taxes. It is important to ensure that all information provided is accurate and complete, as discrepancies can lead to audits or legal issues with the California Franchise Tax Board.

Filing Deadlines / Important Dates

Filing deadlines for the 540 Form are crucial for compliance. Typically, the form must be submitted by April 15 of the following year, aligning with federal tax deadlines. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply and ensure they file any necessary forms to avoid late penalties.

Required Documents

To complete the 540 Form accurately, certain documents are required. These typically include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of other income, such as interest or dividends

- Documentation for claimed deductions, such as mortgage interest statements

- Any relevant tax credit information

Form Submission Methods (Online / Mail / In-Person)

The 540 Form can be submitted through various methods to accommodate different preferences. Taxpayers can file online using the California Franchise Tax Board's e-file system, which is often the fastest and most efficient option. Alternatively, the form can be mailed to the appropriate address provided by the FTB. In-person submissions are also accepted at designated FTB offices, though this method may require an appointment and is less common.

Quick guide on how to complete 1991 540 form

Effortlessly Prepare 540 Form on Any Device

Managing documents online has gained traction among both businesses and individuals. It presents an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without postponements. Handle 540 Form on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign 540 Form seamlessly

- Find 540 Form and click Obtain Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize relevant sections of your documents or obscure sensitive details using tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature with the Sign feature, which takes moments and carries the same legal validity as a conventional ink signature.

- Verify all the information and then click on the Complete button to save your modifications.

- Choose how you wish to send your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require new printed copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign 540 Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1991 540 form

Create this form in 5 minutes!

How to create an eSignature for the 1991 540 form

The best way to create an eSignature for your PDF online

The best way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF on Android

People also ask

-

What is a 540 Form?

The 540 Form is a state income tax return form used primarily in California. It is designed for residents to report their income, claim deductions and credits, and calculate the amount of taxes owed or refunds due. Understanding the details of the 540 Form can simplify your tax filing process signNowly.

-

How does airSlate SignNow help with completing a 540 Form?

airSlate SignNow streamlines the process of completing a 540 Form by providing an easy-to-use platform for document management and electronic signature. You can seamlessly fill out and eSign your 540 Form, ensuring accuracy and compliance while saving time. This efficient digital solution can enhance your overall tax preparation experience.

-

Is there a cost associated with using airSlate SignNow for the 540 Form?

Yes, airSlate SignNow operates on a subscription model, which provides access to various features for managing and signing documents, including the 540 Form. Pricing is competitive and offers value for users looking for an effective eSigning solution. Check our pricing page for different plans that suit your needs.

-

Can I track the status of my 540 Form with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your 540 Form through real-time notifications and updates. You can easily see who has received, viewed, and signed your document, providing peace of mind during the tax filing process. This feature enhances accountability and organization.

-

What integrations does airSlate SignNow offer for managing the 540 Form?

airSlate SignNow integrates with various tools and platforms to facilitate the management of your 540 Form and other documents. You can connect it with popular applications like Google Drive, Dropbox, and CRM systems. These integrations enhance workflow efficiency, making it easier to access and organize your tax documents.

-

What are the key benefits of using airSlate SignNow to sign the 540 Form?

Using airSlate SignNow to sign your 540 Form provides several benefits, including enhanced security, reduced processing time, and improved accuracy. The platform ensures that all signatures are legally binding and securely stored. Additionally, users enjoy the convenience of completing tax documentation from anywhere, at any time.

-

Is airSlate SignNow suitable for businesses completing multiple 540 Forms?

Yes, airSlate SignNow is ideal for businesses that need to complete and manage multiple 540 Forms efficiently. With its bulk sending and template features, businesses can easily prepare and send out multiple forms for quicker processing. This scalability makes it an excellent choice for accounting firms and other professionals handling numerous tax returns.

Get more for 540 Form

Find out other 540 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors