Form 100s 2019

What is the Form 100s

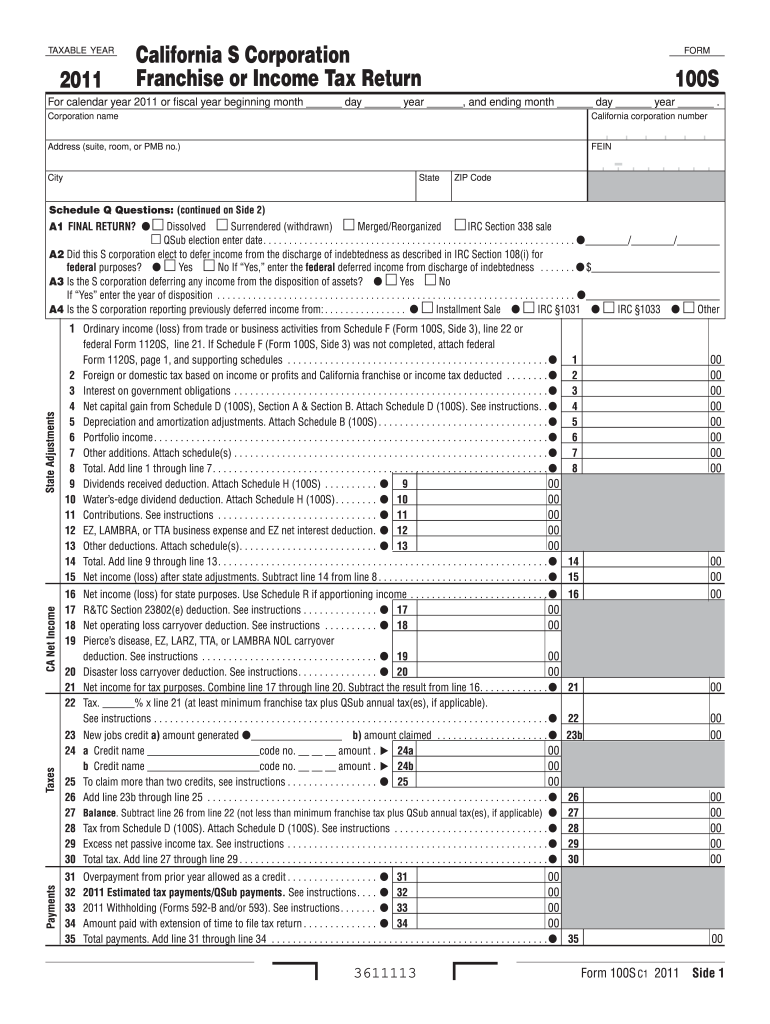

The Form 100s is a tax document used primarily by corporations in the United States to report income, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for corporations operating within California, as it serves as the state’s corporate income tax return. The Form 100s provides a comprehensive overview of a corporation's financial activities, ensuring compliance with both federal and state tax regulations.

How to use the Form 100s

Using the Form 100s involves several steps to ensure accurate reporting of financial data. First, gather all necessary financial records, including income statements, balance sheets, and any applicable deductions. Next, complete each section of the form, providing detailed information about your corporation's income, expenses, and tax credits. It is crucial to review the completed form for any errors before submission. Finally, submit the form to the appropriate tax authority, either electronically or by mail, depending on your preference and the requirements of the state.

Steps to complete the Form 100s

Completing the Form 100s requires careful attention to detail. Follow these steps:

- Gather necessary financial documents, such as profit and loss statements.

- Fill out the corporate information section, including the corporation's name, address, and tax identification number.

- Report total income, including sales and other revenue sources.

- Detail allowable deductions, such as operating expenses and depreciation.

- Calculate the taxable income by subtracting total deductions from total income.

- Apply any applicable tax credits to reduce the overall tax liability.

- Review the form for accuracy and completeness before submission.

Legal use of the Form 100s

The legal use of the Form 100s is governed by federal and state tax laws. Corporations must ensure that the information reported is accurate and complete to avoid penalties. The form must be submitted by the designated filing deadline, typically the 15th day of the fourth month after the end of the corporation's fiscal year. Failure to comply with these regulations can result in fines or additional scrutiny from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form 100s are crucial for compliance. Corporations must submit the form by the 15th day of the fourth month following the end of their fiscal year. For corporations with a calendar year-end, this means the deadline is April 15. Extensions may be available, but they must be requested in advance to avoid penalties.

Required Documents

To complete the Form 100s, several documents are required:

- Financial statements, including income statements and balance sheets.

- Records of all income sources and expenses.

- Documentation for any tax credits or deductions claimed.

- Prior year tax returns for reference.

Form Submission Methods (Online / Mail / In-Person)

The Form 100s can be submitted through various methods, providing flexibility for corporations. Options include:

- Online submission through the California Franchise Tax Board's website, which offers a streamlined process.

- Mailing a paper copy of the completed form to the appropriate tax authority.

- In-person submission at designated tax offices, if required.

Quick guide on how to complete 2011 form 100s

Effortlessly Prepare Form 100s on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any delays. Handle Form 100s on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest method to edit and eSign Form 100s effortlessly

- Locate Form 100s and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and then click on the Done button to finalize your changes.

- Select how you want to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 100s and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 form 100s

Create this form in 5 minutes!

How to create an eSignature for the 2011 form 100s

The best way to create an eSignature for your PDF in the online mode

The best way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What are Form 100s and how can airSlate SignNow help?

Form 100s are essential documents used in various industries for transactions and agreements. airSlate SignNow offers a secure eSigning solution for Form 100s, streamlining the process of sending, signing, and managing these documents electronically.

-

What features does airSlate SignNow offer for Form 100s?

airSlate SignNow provides features such as customizable templates, real-time tracking of document status, and reminders for signatories to ensure that your Form 100s are signed promptly. These capabilities help increase efficiency and reduce the time spent on paperwork.

-

Is airSlate SignNow cost-effective for managing Form 100s?

Yes, airSlate SignNow is designed to be a budget-friendly solution for businesses looking to manage Form 100s. With various pricing plans tailored for different business sizes, users can find a plan that fits their needs without sacrificing essential functionality.

-

Can airSlate SignNow integrate with other software for handling Form 100s?

Absolutely! airSlate SignNow seamlessly integrates with popular software applications, enhancing your workflow for Form 100s. This includes CRM systems, cloud storage services, and productivity tools, allowing you to manage documents efficiently across platforms.

-

How secure is the electronic signing of Form 100s with airSlate SignNow?

Security is a top priority when using airSlate SignNow for Form 100s. The platform utilizes advanced encryption methods and complies with industry regulations to ensure that your documents are protected from unauthorized access throughout the signing process.

-

What benefits do businesses gain by using airSlate SignNow for Form 100s?

Using airSlate SignNow for Form 100s helps businesses save time and reduce errors associated with manual signing processes. Additionally, the platform enhances document management efficiency and provides a better experience for both senders and signers.

-

Can I send multiple Form 100s for signing at once with airSlate SignNow?

Yes, airSlate SignNow allows you to send multiple Form 100s in bulk, making it easier to manage large-scale signing processes. This feature helps businesses streamline their operations and ensures that all documents signNow the intended recipients quickly.

Get more for Form 100s

Find out other Form 100s

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament