592 Form 2021

What is the 592 Form

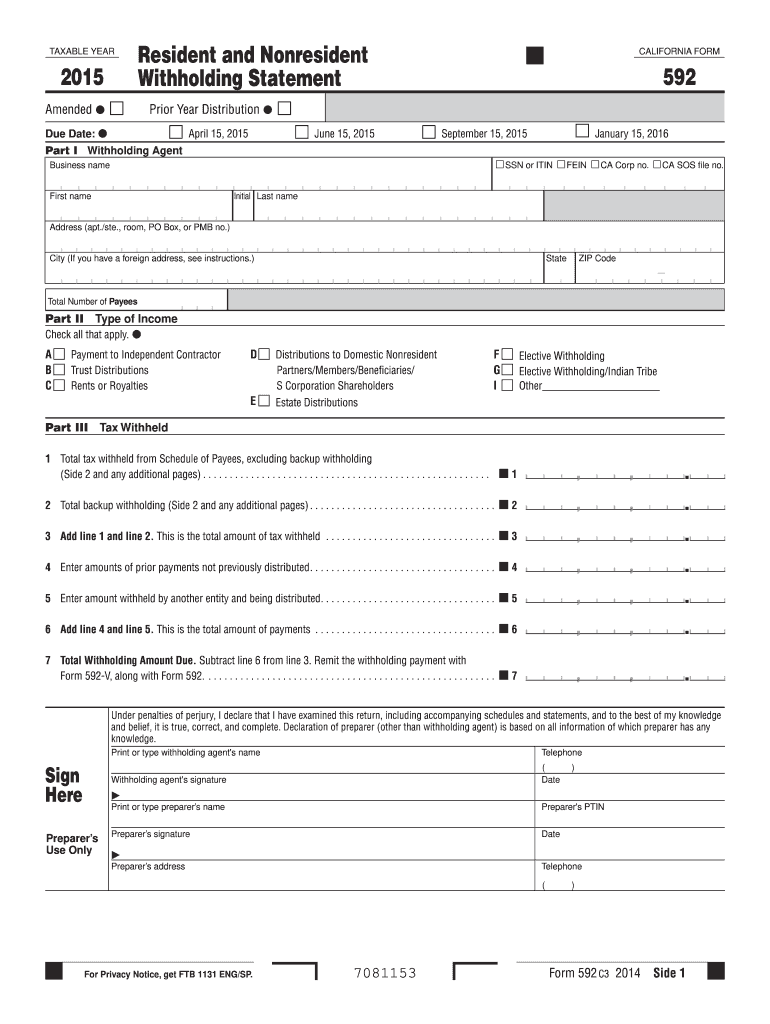

The 592 Form is a tax document used primarily in the United States for reporting California source income paid to non-residents. This form is essential for businesses and individuals who make payments to non-residents for services rendered or income earned within California. The information collected on the 592 Form helps ensure compliance with state tax laws and facilitates the proper withholding of taxes from these payments.

How to use the 592 Form

To effectively use the 592 Form, individuals and businesses must complete it accurately to report payments made to non-residents. The form captures essential details such as the payee's information, the amount paid, and the applicable withholding tax. Once completed, the form must be submitted to the California Franchise Tax Board (FTB) along with any required tax payments. Users should ensure they understand the specific instructions provided by the FTB to avoid errors and ensure compliance.

Steps to complete the 592 Form

Completing the 592 Form involves several key steps:

- Gather necessary information about the payee, including their name, address, and taxpayer identification number.

- Determine the total amount paid to the non-resident and any applicable withholding tax rate.

- Fill out the form with accurate details, ensuring all sections are completed as required.

- Review the form for accuracy and completeness before submission.

- Submit the form to the California Franchise Tax Board along with any required tax payments.

Legal use of the 592 Form

The 592 Form is legally recognized as a valid document for reporting payments to non-residents under California tax law. It serves as a means to ensure that the appropriate taxes are withheld and reported, thereby protecting both the payer and the payee from potential legal issues related to tax compliance. Proper use of this form is critical for businesses to avoid penalties and maintain good standing with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the 592 Form are crucial to ensure compliance with California tax regulations. Typically, the form must be filed by the end of the month following the quarter in which the payments were made. For example, payments made in the first quarter must be reported by April 30. It's important for businesses to keep track of these deadlines to avoid late filing penalties and interest charges.

Required Documents

To complete the 592 Form, several documents may be necessary:

- Payee's taxpayer identification number (TIN) or Social Security number (SSN).

- Records of payments made to the non-resident.

- Any prior correspondence with the California Franchise Tax Board regarding withholding tax.

Having these documents readily available can streamline the completion process and help ensure accuracy.

Quick guide on how to complete 2015 592 form

Complete 592 Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your files quickly without delays. Handle 592 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered process today.

How to modify and eSign 592 Form with ease

- Locate 592 Form and then click Get Form to begin.

- Use the tools available to finalize your document.

- Mark important sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to preserve your changes.

- Select how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from your preferred device. Modify and eSign 592 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 592 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 592 form

The best way to generate an eSignature for a PDF document online

The best way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

The way to create an eSignature for a PDF file on Android OS

People also ask

-

What is the 592 Form and why is it important?

The 592 Form is a tax form required for California residents to report the income of nonresidents. It's crucial for businesses that operate in California to ensure compliance with tax regulations. airSlate SignNow simplifies the process of completing and eSigning the 592 Form, saving time and reducing errors.

-

How does airSlate SignNow help manage the 592 Form?

airSlate SignNow provides a streamlined process for creating, sending, and eSigning the 592 Form securely. Our platform ensures that all necessary fields are easily accessible and that the form is compliant with California tax requirements. This eliminates the hassle of manual paperwork and enhances efficiency.

-

What are the benefits of using airSlate SignNow for the 592 Form?

Using airSlate SignNow for the 592 Form allows for faster processing and secure signing, helping you meet deadlines. The platform also offers automated reminders and tracking features, ensuring that all parties are in sync. Its user-friendly interface makes it easy for anyone to navigate.

-

Is airSlate SignNow cost-effective for managing the 592 Form?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing the 592 Form and other documents. Our pricing plans are flexible and cater to businesses of all sizes, ensuring you only pay for what you need. By reducing paper usage and streamlining processes, you can also save on related expenses.

-

Can I integrate airSlate SignNow with other tools for the 592 Form?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications and services that you may already be using. This means you can manage and send the 592 Form alongside your existing tools without disruption, enhancing your workflow and efficiency.

-

What security features does airSlate SignNow offer for the 592 Form?

airSlate SignNow takes security seriously, especially for sensitive documents like the 592 Form. Our platform includes advanced encryption, secure cloud storage, and user authentication to ensure that your data is protected at all times. This provides peace of mind when handling tax-related documents.

-

Can I customize the 592 Form in airSlate SignNow?

Yes, airSlate SignNow allows you to customize the 592 Form to suit your specific business needs. You can add fields, instructions, or branding elements to ensure the form aligns with your corporate identity. Customization enhances clarity and improves the overall signing experience.

Get more for 592 Form

Find out other 592 Form

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word