Ftb 565 K1 Form 2019

What is the Ftb 565 K1 Form

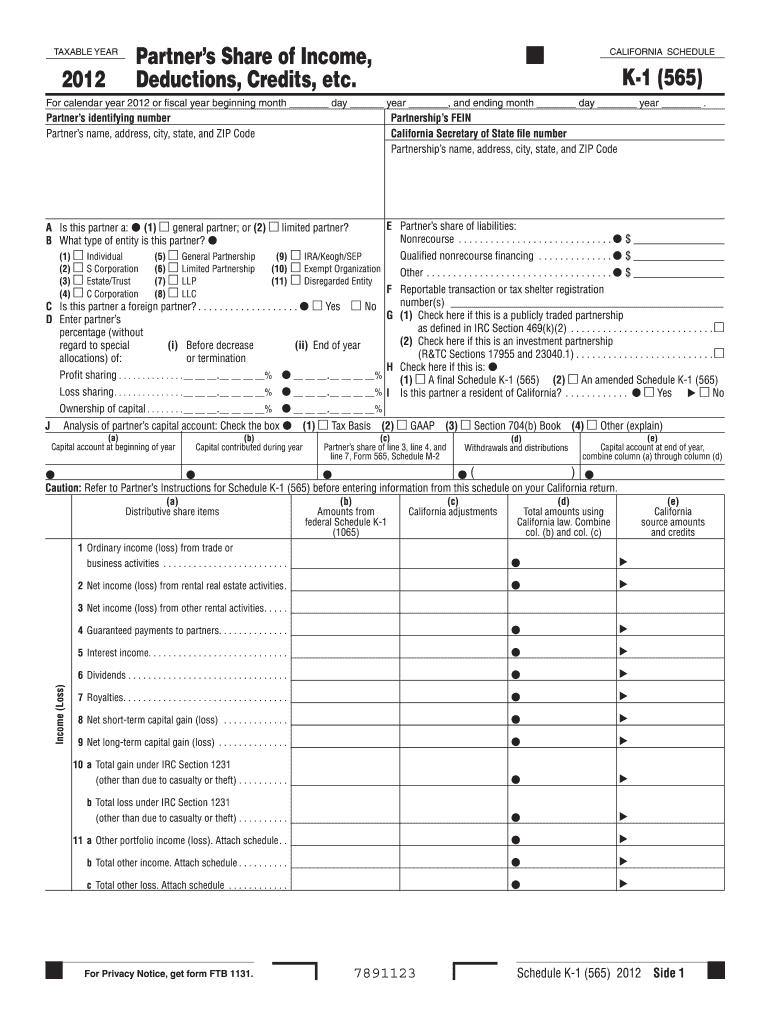

The Ftb 565 K1 Form is a tax document used in California for reporting income, deductions, and credits from partnerships and limited liability companies (LLCs). This form provides detailed information about each partner's share of the entity's income, losses, and other tax-related items. It is essential for ensuring accurate tax reporting and compliance with state tax laws.

How to use the Ftb 565 K1 Form

To use the Ftb 565 K1 Form, partners or members of an LLC must receive a copy from the entity they are involved with. Each partner should review the information provided on the form to ensure it accurately reflects their share of income and deductions. The details from the K1 form are then used to complete individual tax returns, specifically on California Form 540 or 540NR, depending on residency status.

Steps to complete the Ftb 565 K1 Form

Completing the Ftb 565 K1 Form involves several key steps:

- Gather all necessary financial information related to the partnership or LLC.

- Fill in the entity's name, address, and tax identification number at the top of the form.

- Provide the partner's name, address, and tax identification number.

- Report the partner's share of income, deductions, and credits in the appropriate sections.

- Sign and date the form to certify the accuracy of the information provided.

Legal use of the Ftb 565 K1 Form

The Ftb 565 K1 Form is legally binding when completed accurately and submitted in accordance with California tax laws. It is crucial for partners to ensure that the information reported is correct, as inaccuracies can lead to penalties or audits. The form must be filed with the California Franchise Tax Board along with the partnership's tax return.

Filing Deadlines / Important Dates

Filing deadlines for the Ftb 565 K1 Form align with the partnership's tax return due date. Typically, partnerships must file their returns by the 15th day of the third month following the close of their tax year. For most partnerships operating on a calendar year, this means the deadline is March 15. Partners should ensure they receive their K1 forms in time to file their individual returns accurately and on schedule.

Who Issues the Form

The Ftb 565 K1 Form is issued by partnerships and LLCs operating in California. The entity is responsible for preparing and distributing the K1 forms to each partner or member. It is important for the issuing entity to ensure that all information is accurate and complies with the California Franchise Tax Board's requirements.

Quick guide on how to complete ftb 565 2012 k1 form

Complete Ftb 565 K1 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the tools essential to create, modify, and eSign your documents promptly without delays. Manage Ftb 565 K1 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Ftb 565 K1 Form smoothly

- Locate Ftb 565 K1 Form and click Get Form to begin.

- Utilize the tools offered to complete your document.

- Emphasize important sections or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which is quick and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form: via email, SMS, or shareable link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Alter and eSign Ftb 565 K1 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ftb 565 2012 k1 form

Create this form in 5 minutes!

How to create an eSignature for the ftb 565 2012 k1 form

The best way to generate an eSignature for your PDF document in the online mode

The best way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What is the Ftb 565 K1 Form?

The Ftb 565 K1 Form is issued to report income, deductions, and other tax-related information for partners in a partnership. It is essential for both the partnership and its partners to accurately complete this form to ensure compliance with California tax laws. Using tools like airSlate SignNow can simplify the process of preparing and signing the Ftb 565 K1 Form.

-

How can airSlate SignNow assist with the Ftb 565 K1 Form?

airSlate SignNow provides an intuitive platform to easily prepare, send, and eSign documents, including the Ftb 565 K1 Form. With its user-friendly interface, businesses can streamline their document management process, reducing the time spent on tedious paperwork and ensuring timely filing.

-

What are the pricing options for airSlate SignNow when handling the Ftb 565 K1 Form?

airSlate SignNow offers various pricing plans that cater to different business needs, starting with a free trial. Depending on your volume and additional features, you can select a plan that fits your budget while ensuring you can efficiently manage documents like the Ftb 565 K1 Form.

-

Are there any integrations available with airSlate SignNow for the Ftb 565 K1 Form?

Yes, airSlate SignNow seamlessly integrates with various applications and platforms, making it easy to aggregate data and manage the Ftb 565 K1 Form. This integration capacity enhances productivity and ensures that all necessary information is readily accessible for quick processing.

-

What are the main benefits of using airSlate SignNow for the Ftb 565 K1 Form?

Using airSlate SignNow for the Ftb 565 K1 Form streamlines the document preparation and signing process, which can save valuable time and reduce errors. The platform also provides a secure environment for document sharing and storage, ensuring that sensitive tax information is protected.

-

Can airSlate SignNow help with eSigning the Ftb 565 K1 Form?

Absolutely! airSlate SignNow facilitates eSigning, allowing you to securely and legally sign the Ftb 565 K1 Form electronically. This feature not only accelerates the signing process but also offers the convenience of accessing documents from anywhere.

-

Is the Ftb 565 K1 Form compatible with mobile devices using airSlate SignNow?

Yes, the airSlate SignNow platform is mobile-friendly, allowing users to manage and eSign the Ftb 565 K1 Form on-the-go. This flexibility ensures that you can complete your documents anytime and anywhere, enhancing overall productivity.

Get more for Ftb 565 K1 Form

Find out other Ftb 565 K1 Form

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament