760 Form 2019

What is the 760 Form

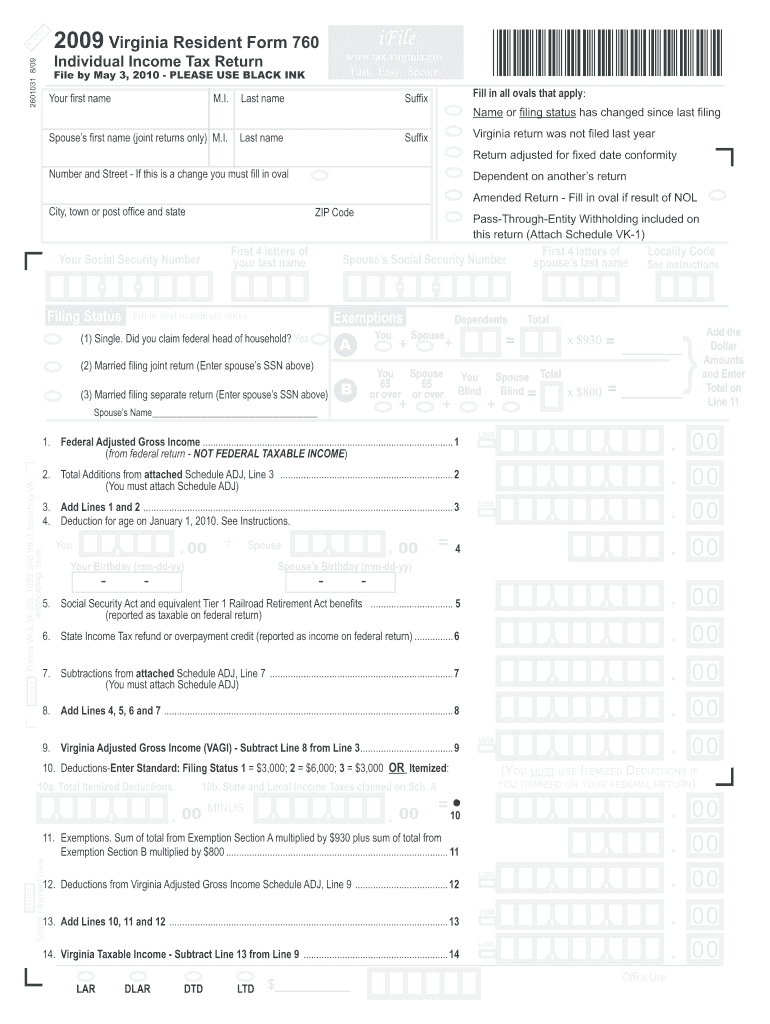

The 760 Form is a state tax form used by residents of Virginia to report their income and calculate their tax liability. This form is essential for individuals and businesses to ensure compliance with state tax laws. It captures various income sources, deductions, and credits that can affect the overall tax obligation. Understanding the purpose and structure of the 760 Form is crucial for accurate filing and avoiding potential penalties.

How to use the 760 Form

Using the 760 Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including W-2s, 1099s, and any relevant receipts for deductions. Next, carefully fill out the form, ensuring that all income sources are reported and deductions are claimed correctly. After completing the form, review it for accuracy before submitting it to the Virginia Department of Taxation, either online or by mail.

Steps to complete the 760 Form

Completing the 760 Form requires attention to detail. Follow these steps for effective completion:

- Gather all required documents, such as income statements and deduction records.

- Fill in your personal information, including your name, address, and Social Security number.

- Report all sources of income in the designated sections.

- Claim any applicable deductions and credits to reduce your taxable income.

- Calculate your total tax liability based on the provided instructions.

- Sign and date the form before submission.

Legal use of the 760 Form

The 760 Form is legally binding when completed and submitted according to Virginia tax laws. To ensure its legal validity, it is important to provide accurate information and retain copies of all submitted documents. Additionally, the form must be filed by the designated deadline to avoid penalties. Understanding the legal implications of the 760 Form helps taxpayers maintain compliance and avoid issues with the Virginia Department of Taxation.

Filing Deadlines / Important Dates

Filing deadlines for the 760 Form are crucial for compliance. Typically, the form must be submitted by May first following the end of the tax year. If May first falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to mark these dates on your calendar to ensure timely filing and avoid late fees or penalties.

Required Documents

To complete the 760 Form accurately, certain documents are required. These include:

- W-2 forms from employers for reported wages.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical costs or charitable contributions.

- Any other relevant financial records that support income and deductions.

Form Submission Methods

The 760 Form can be submitted through various methods to accommodate different preferences. Taxpayers can file online using the Virginia Department of Taxation's e-filing system, which provides a streamlined process. Alternatively, the form can be mailed to the appropriate address or submitted in person at designated tax offices. Each method has its own benefits, so choose the one that best fits your needs.

Quick guide on how to complete 2009 760 form

Complete 760 Form effortlessly on any device

Digital document management has become increasingly popular with businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct forms and securely store them online. airSlate SignNow provides you with all the resources you need to create, edit, and eSign your documents swiftly and without delays. Manage 760 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-focused process today.

How to edit and eSign 760 Form with ease

- Find 760 Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, monotonous form searches, or errors that require new document prints. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and eSign 760 Form and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2009 760 form

Create this form in 5 minutes!

How to create an eSignature for the 2009 760 form

How to create an eSignature for your PDF online

How to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The way to generate an eSignature for a PDF on Android

People also ask

-

What is the 760 Form and why is it important?

The 760 Form is a state tax return used for reporting income and calculating state taxes in California. It's important because it helps ensure compliance with state tax laws and allows filers to claim deductions and credits correctly. Understanding the 760 Form is crucial for both individuals and businesses to avoid penalties.

-

How can airSlate SignNow help with the 760 Form?

airSlate SignNow simplifies the eSigning process for the 760 Form, allowing users to quickly and securely sign documents online. With our platform, you can send the 760 Form for signatures with just a few clicks, saving you time and effort. Our user-friendly interface makes it easy for anyone to manage their tax forms efficiently.

-

What features does airSlate SignNow offer for the 760 Form?

airSlate SignNow offers features such as document templates, real-time tracking, and integration with popular storage solutions for the 760 Form. You can create reusable templates for tax forms, ensuring a polished and consistent look every time. Additionally, our platform provides automated reminders for signers to complete the 760 Form promptly.

-

Is airSlate SignNow a cost-effective solution for managing the 760 Form?

Yes, airSlate SignNow offers competitive pricing plans that are designed to be budget-friendly for businesses of all sizes. Our cost-effective solutions for managing the 760 Form help businesses streamline their document processes without breaking the bank. Investing in airSlate SignNow ensures you receive value while simplifying your tax filing procedures.

-

Can airSlate SignNow integrate with accounting software for filing the 760 Form?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting and tax software platforms, allowing you to streamline the filing process for the 760 Form. This integration means you can easily transfer data between applications, reducing manual data entry and minimizing errors. Enhanced workflows help save time and increase efficiency during tax season.

-

What are the benefits of using airSlate SignNow for the 760 Form?

Using airSlate SignNow for the 760 Form brings numerous benefits, including enhanced security, faster turnaround times, and improved compliance. Our platform uses advanced encryption to protect sensitive tax information, ensuring your data remains safe. Furthermore, the eSigning feature accelerates the completion of the 760 Form, allowing you to submit your taxes on time.

-

Is there customer support available for questions about the 760 Form?

Yes, airSlate SignNow provides comprehensive customer support to assist users with any questions regarding the 760 Form. Our knowledgeable support team can guide you through the eSigning process and address any issues that may arise. We are dedicated to helping our users navigate tax documents effectively and confidently.

Get more for 760 Form

- Efu surrender form

- Introductory phonology bruce hayes answer key pdf form

- Security guard employment status notification form

- Request letter for siphoning septic tank form

- Kyc format for company

- Nutrition crossword puzzle form

- Bed bath and beyond donation request form

- Asb kiwisaver scheme changing your fund switch f form

Find out other 760 Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document