760 Form 2019

What is the 760 Form

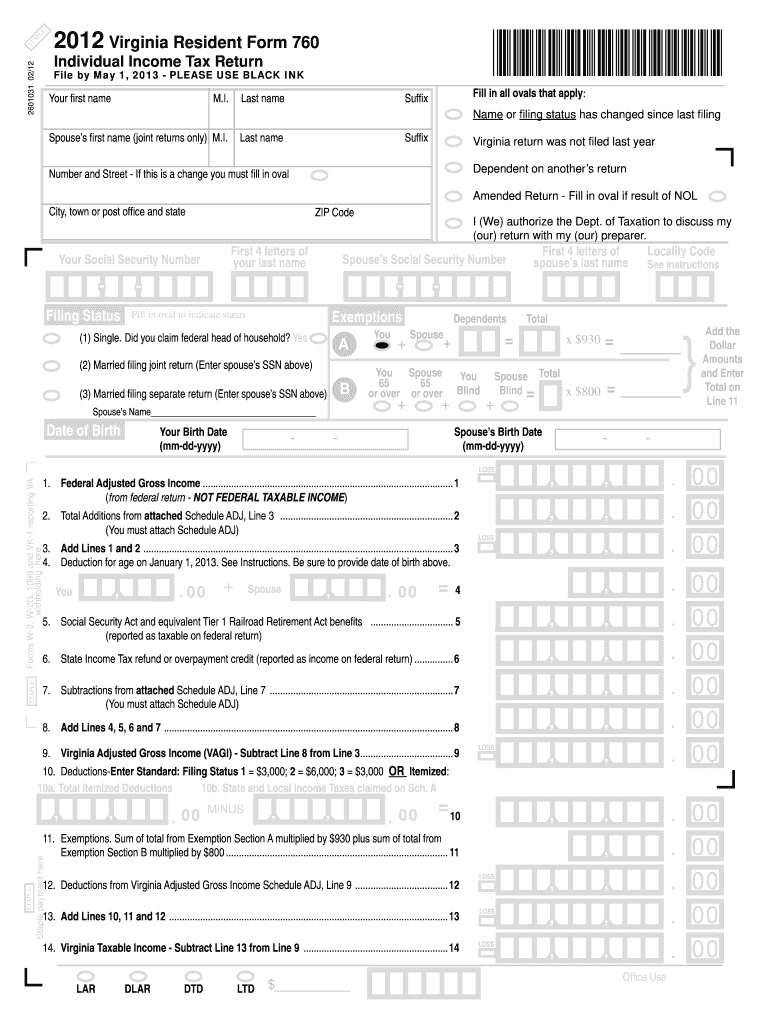

The 760 Form is a tax document used by residents of Virginia to report their income and calculate their state tax liability. This form is essential for individuals and businesses alike, as it helps ensure compliance with state tax laws. The 760 Form is specifically designed for residents and includes various sections for reporting income, deductions, and credits applicable to Virginia taxpayers. Understanding the purpose and requirements of the 760 Form is crucial for accurate tax filing.

How to use the 760 Form

Using the 760 Form involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, carefully fill out the form, ensuring that all income sources are accurately reported. Be mindful of the deductions and credits you may qualify for, as these can significantly affect your tax liability. After completing the form, review it for accuracy and completeness before submission. Utilizing electronic tools can simplify this process and enhance accuracy.

Steps to complete the 760 Form

Completing the 760 Form requires a systematic approach. Follow these steps:

- Gather all required documents, including income statements and previous tax returns.

- Begin by entering your personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring to include wages, interest, and dividends.

- Claim any applicable deductions, such as those for mortgage interest or charitable contributions.

- Calculate your total tax liability using the provided tax tables or software tools.

- Double-check all entries for accuracy before signing and dating the form.

Legal use of the 760 Form

The 760 Form is legally binding when filled out correctly and submitted in accordance with Virginia state tax laws. It is essential to ensure that all information provided is accurate and truthful, as providing false information can lead to penalties or legal repercussions. The form must be submitted by the designated deadline to avoid late fees. Understanding the legal implications of the 760 Form helps taxpayers remain compliant and avoid unnecessary complications.

Filing Deadlines / Important Dates

Filing deadlines for the 760 Form are critical for compliance. Typically, the form must be submitted by May 1 of the tax year, but extensions may be available. It is important to stay informed about any changes to these deadlines, as they can vary year to year. Marking these dates on your calendar can help ensure timely submission and avoid penalties.

Form Submission Methods

The 760 Form can be submitted through various methods, including online filing, mail, or in-person submission at designated locations. Online filing is often the most efficient and secure method, allowing for immediate confirmation of receipt. If mailing the form, ensure it is sent to the correct address and consider using certified mail for tracking purposes. In-person submissions may be available at local tax offices, providing an opportunity for direct assistance if needed.

Quick guide on how to complete 2012 760 form

Access 760 Form effortlessly on any device

Digital document management has gained considerable traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and eSign your documents quickly without delays. Manage 760 Form on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to edit and eSign 760 Form effortlessly

- Find 760 Form and then click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools explicitly provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Review all the information thoroughly and then click the Done button to save your modifications.

- Select your preferred method of delivery for your form: by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign 760 Form to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 760 form

Create this form in 5 minutes!

How to create an eSignature for the 2012 760 form

How to generate an eSignature for a PDF document online

How to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

The way to make an eSignature for a PDF file on Android OS

People also ask

-

What is a 760 Form and how is it used?

The 760 Form is a tax form used for reporting state income taxes in Virginia. It helps individuals and businesses accurately calculate their tax liability and ensure compliance with state tax laws. By using the 760 Form, taxpayers can efficiently report their income and claim deductions or credits applicable to them.

-

How can airSlate SignNow assist with the 760 Form?

airSlate SignNow provides a seamless way to manage, sign, and send the 760 Form electronically. Our platform ensures that your tax documents are securely eSigned and shared, making the process more efficient. With features such as templates and workflow management, preparing and submitting your 760 Form has never been easier.

-

Is there a cost associated with using airSlate SignNow for the 760 Form?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, including options for processing the 760 Form. Our cost-effective solutions ensure that you only pay for the features you require. By optimizing your document workflows, you can save time and money while managing your eSigning needs.

-

What features does airSlate SignNow offer for managing the 760 Form?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage for managing the 760 Form. Additionally, users can utilize advanced authentication methods for added security during the eSigning process. These features help streamline the workflow for preparing and submitting tax documents.

-

Can I integrate airSlate SignNow with other software for handling the 760 Form?

Absolutely! airSlate SignNow supports integrations with various third-party applications to enhance your document management process, including popular accounting and tax software. This makes it easier to import data directly into your 760 Form and ensures that all necessary information is accurately reflected.

-

What are the benefits of using airSlate SignNow for the 760 Form?

Using airSlate SignNow for the 760 Form provides numerous benefits, including increased efficiency and reduced errors in document handling. The ability to eSign documents remotely saves time and simplifies the submission process. Moreover, our platform enhances collaboration among team members when preparing tax forms.

-

How does airSlate SignNow ensure the security of my 760 Form?

airSlate SignNow prioritizes security by employing encryption and compliance with industry standards to protect your 760 Form and other documents. Our platform includes features like secure user access and detailed audit trails, ensuring that your sensitive information is safe and only accessible by authorized individuals.

Get more for 760 Form

Find out other 760 Form

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online