Eitc Forms 2020

What is the Eitc Forms

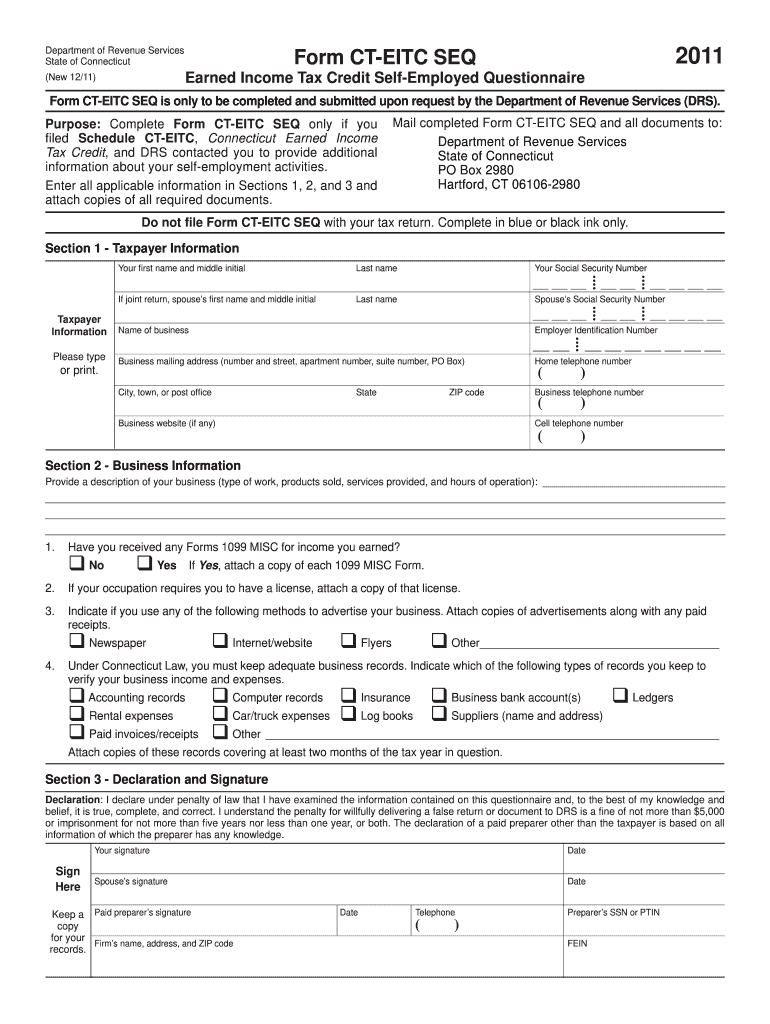

The EITC forms are essential documents used to claim the Earned Income Tax Credit (EITC), a tax benefit designed to assist low to moderate-income working individuals and families. This credit can significantly reduce the amount of tax owed and may result in a refund. The forms typically include information about income, family size, and filing status, which are critical for determining eligibility and the amount of credit available.

How to use the Eitc Forms

Using the EITC forms involves several steps to ensure accurate completion and submission. First, gather all necessary documentation, including proof of income and identification. Next, fill out the forms with precise information, ensuring that all fields are completed. After completing the forms, review them for accuracy before submitting them through the appropriate channels, which may include online filing, mailing, or in-person submission at designated locations.

Steps to complete the Eitc Forms

Completing the EITC forms requires careful attention to detail. Follow these steps:

- Gather all required documents, such as W-2s, 1099s, and Social Security numbers for all family members.

- Access the EITC forms through the IRS website or a trusted tax preparation service.

- Fill out the forms, ensuring all income and personal information is accurate.

- Calculate the EITC based on the provided guidelines, considering your filing status and number of dependents.

- Review the completed forms for any errors or omissions.

- Submit the forms electronically or via mail, ensuring you keep copies for your records.

Eligibility Criteria

To qualify for the EITC, certain eligibility criteria must be met. Generally, applicants must have earned income from employment or self-employment, meet specific income limits based on family size, and have a valid Social Security number. Additionally, applicants must be U.S. citizens or resident aliens for the entire tax year. It is important to review the latest IRS guidelines to ensure compliance with all requirements.

Filing Deadlines / Important Dates

Filing deadlines for the EITC forms are crucial to ensure timely processing and potential refunds. Typically, the deadline for submitting tax returns, including EITC claims, is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes in deadlines to avoid penalties or missed opportunities for claiming the credit.

Required Documents

When completing the EITC forms, several documents are necessary to support your claim. These include:

- W-2 forms from all employers for the tax year.

- 1099 forms for any additional income received.

- Social Security cards for all family members.

- Proof of residency, such as utility bills or lease agreements.

- Any other documentation that verifies income or eligibility.

Legal use of the Eitc Forms

The EITC forms must be used in compliance with IRS regulations to ensure their legal standing. This includes accurately reporting income and adhering to eligibility requirements. Failure to comply can result in penalties, including the denial of the credit or legal repercussions. It is vital to consult IRS guidelines or a tax professional if there are uncertainties regarding the completion and submission of these forms.

Quick guide on how to complete eitc forms 2011

Effortlessly Create Eitc Forms on Any Gadgets

Digital document management has become increasingly prevalent among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without interruptions. Manage Eitc Forms on any gadget with the airSlate SignNow Android or iOS applications and enhance any document-driven task today.

How to Modify and eSign Eitc Forms with Ease

- Obtain Eitc Forms and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form hunts, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and eSign Eitc Forms and ensure effective communication at every stage of your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct eitc forms 2011

Create this form in 5 minutes!

How to create an eSignature for the eitc forms 2011

The way to create an electronic signature for your PDF document in the online mode

The way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What are Eitc Forms and why are they important?

Eitc Forms, or Earned Income Tax Credit forms, are essential for individuals claiming this tax benefit. These forms help ensure that low to moderate-income workers receive the financial support they are entitled to. Properly completing and submitting Eitc Forms can lead to signNow tax refunds.

-

How can airSlate SignNow help with managing Eitc Forms?

airSlate SignNow allows users to digitally sign and send Eitc Forms efficiently. By utilizing our platform, users can ensure that their forms are completed accurately and submitted on time. This helps streamline the tax filing process and reduces the chances of errors.

-

Are there any costs associated with using airSlate SignNow for Eitc Forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. We provide a cost-effective solution for managing Eitc Forms without sacrificing features or support. You can select the plan that best fits your requirements and budget.

-

Can I integrate airSlate SignNow with other software for handling Eitc Forms?

Absolutely! airSlate SignNow supports integrations with numerous applications, making it easier to manage Eitc Forms alongside your existing systems. This integration capability helps you streamline workflows and enhance collaboration across your platform.

-

What features does airSlate SignNow offer for Eitc Forms?

Our platform provides features like electronic signatures, document templates, and real-time tracking, specifically designed for Eitc Forms. These tools allow you to create, send, and sign your forms quickly and securely. This enhances overall efficiency and ensures compliance.

-

Is airSlate SignNow suitable for both personal and business use of Eitc Forms?

Yes, airSlate SignNow is versatile and can be used for both personal and business-related Eitc Forms. Whether you're an individual filer or a business managing multiple clients’ forms, our platform caters to all users, ensuring a seamless experience.

-

How secure is airSlate SignNow when dealing with Eitc Forms?

airSlate SignNow prioritizes security and offers robust protection for Eitc Forms. We employ encryption and other safety measures to protect sensitive information, ensuring that your documents remain confidential and secure during the signing process.

Get more for Eitc Forms

- Night work permit for construction site form

- Plumbing inspection report pdf form

- Tsp 1 form fillable

- Patient prescriber agreement form

- Baptism certificate african methodist episcopal church baptism certificate african methodist episcopal church form

- Systematic observation form

- Business tax missouri department of revenue mo gov form

- Pa 8879 form

Find out other Eitc Forms

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself