Ct 990 T Form 2019

What is the Ct 990 T Form

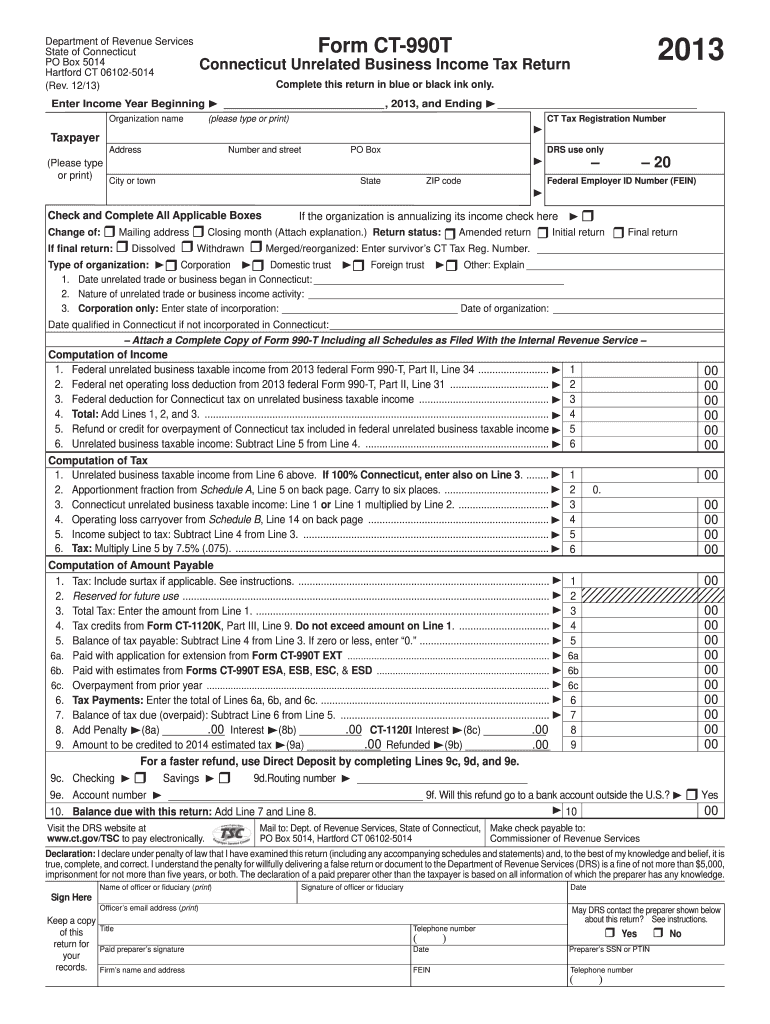

The Ct 990 T Form is a tax form used by certain organizations in the United States to report unrelated business income. This form is primarily utilized by non-profit organizations, including charities and educational institutions, to disclose income generated from activities that are not substantially related to their exempt purposes. By filing the Ct 990 T Form, organizations ensure compliance with Internal Revenue Service (IRS) regulations, thereby maintaining their tax-exempt status while accurately reporting any taxable income earned.

How to use the Ct 990 T Form

Using the Ct 990 T Form involves several key steps. Organizations must first gather all necessary financial information related to their unrelated business activities. This includes revenue generated, expenses incurred, and any applicable deductions. Once the information is compiled, organizations can fill out the form, ensuring that all sections are completed accurately. After completing the form, organizations must submit it to the IRS by the designated deadline, which is typically the fifteenth day of the fifth month following the end of their tax year.

Steps to complete the Ct 990 T Form

Completing the Ct 990 T Form requires careful attention to detail. Follow these steps for successful completion:

- Gather financial records related to unrelated business income.

- Fill in the organization’s identifying information, including name and Employer Identification Number (EIN).

- Report gross income from unrelated business activities in the appropriate section.

- Deduct allowable expenses directly related to generating that income.

- Calculate the taxable income and determine the tax owed.

- Review the form for accuracy before submission.

Legal use of the Ct 990 T Form

The Ct 990 T Form serves a legal purpose in the context of tax compliance for non-profit organizations. Filing this form is essential for organizations that earn income from activities not related to their exempt purposes. Failure to file can result in penalties and jeopardize the organization’s tax-exempt status. By adhering to IRS guidelines and submitting the Ct 990 T Form, organizations fulfill their legal obligations while ensuring transparency in their financial operations.

Filing Deadlines / Important Dates

Organizations must be aware of critical deadlines when filing the Ct 990 T Form. The standard deadline is the fifteenth day of the fifth month following the end of the organization’s tax year. For organizations operating on a calendar year, this means the form is due on May 15. If an organization requires additional time, they may file for an extension, which typically grants an additional six months to complete and submit the form. However, any tax owed must still be paid by the original deadline to avoid penalties.

Who Issues the Form

The Ct 990 T Form is issued by the Internal Revenue Service (IRS). As the federal agency responsible for tax collection and enforcement, the IRS provides this form to ensure that organizations accurately report unrelated business income. It is essential for organizations to use the most current version of the form, as updates may occur to reflect changes in tax laws or regulations.

Quick guide on how to complete ct 990 t 2013 form

Easily prepare Ct 990 T Form on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Ct 990 T Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Ct 990 T Form effortlessly

- Obtain Ct 990 T Form and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select how you want to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Ct 990 T Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 990 t 2013 form

Create this form in 5 minutes!

How to create an eSignature for the ct 990 t 2013 form

The way to create an eSignature for your PDF document online

The way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The way to create an eSignature for a PDF file on Android OS

People also ask

-

What is the Ct 990 T Form?

The Ct 990 T Form is a tax return form specifically designed for organizations that are exempt from federal income tax but have income that is reportable to the state. By filing the Ct 990 T Form, non-profit organizations can ensure compliance with state tax regulations and avoid unnecessary penalties.

-

How can airSlate SignNow help with the Ct 990 T Form?

AirSlate SignNow streamlines the signing and submission process for the Ct 990 T Form, allowing users to electronically sign documents and send them efficiently. With its user-friendly interface, businesses can focus on their compliance needs without dealing with cumbersome paperwork.

-

Is there a cost associated with using airSlate SignNow for the Ct 990 T Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost depends on the chosen plan, but rest assured that it is a cost-effective solution compared to traditional document management methods, especially for managing forms like the Ct 990 T Form.

-

What are the benefits of using airSlate SignNow for non-profit tax forms?

Using airSlate SignNow for submitting the Ct 990 T Form offers several benefits, including faster turnaround times, improved compliance through easy tracking of signed documents, and reduced printing and mailing costs. This efficiency allows non-profit organizations to focus on their core missions rather than getting bogged down in paperwork.

-

Can airSlate SignNow integrate with accounting software for the Ct 990 T Form?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting software, making it easy to manage and submit your Ct 990 T Form alongside other financial documents. This integration simplifies the overall process and enhances your workflow efficiency.

-

What features does airSlate SignNow offer for managing the Ct 990 T Form?

AirSlate SignNow offers features such as customizable templates, document tracking, and secure electronic signatures that are ideal for managing the Ct 990 T Form. These features help ensure that documents are completed accurately and submitted on time, providing peace of mind for users.

-

Are there any limitations on the number of users for the Ct 990 T Form?

AirSlate SignNow offers flexible user plans that can accommodate varying team sizes. Depending on the plan you choose, there may be limits on the number of users who can access the features for managing the Ct 990 T Form, but these can usually be adjusted to fit your organization's needs.

Get more for Ct 990 T Form

Find out other Ct 990 T Form

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template