Form CT 1041ES 4 Form CT 1041ES 2019

What is the Form CT 1041ES 4 Form CT 1041ES

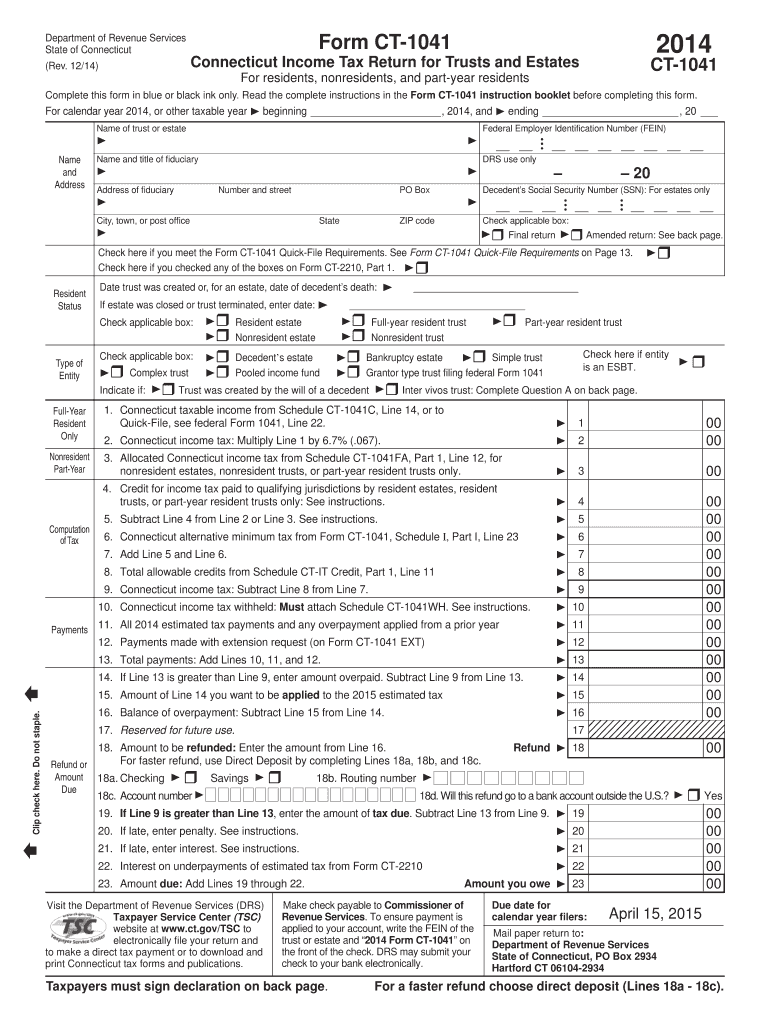

The Form CT 1041ES is a tax form used by estates and trusts in Connecticut to make estimated income tax payments. This form is essential for fiduciaries who need to ensure that the estate or trust meets its tax obligations throughout the year. By filing this form, estates and trusts can avoid underpayment penalties and interest that may accrue if taxes are not paid on time. It is important to note that this form is specifically designed for Connecticut tax purposes and is distinct from federal estimated tax payment forms.

How to use the Form CT 1041ES 4 Form CT 1041ES

To use the Form CT 1041ES, fiduciaries must first determine the estimated taxable income for the estate or trust for the current tax year. This involves projecting income, deductions, and credits. Once the estimated income is calculated, the fiduciary can complete the form, indicating the estimated tax due. Payments can be made in four installments throughout the year, aligning with the state's tax payment schedule. It is crucial to keep accurate records of these payments for future reference and to ensure compliance with state tax laws.

Steps to complete the Form CT 1041ES 4 Form CT 1041ES

Completing the Form CT 1041ES involves several key steps:

- Gather financial information for the estate or trust, including income, deductions, and credits.

- Estimate the total taxable income for the year.

- Calculate the estimated tax liability based on the projected income.

- Fill out the form with the necessary information, including the fiduciary's name, address, and the estimated tax amount.

- Submit the form along with the estimated payment by the due date.

Filing Deadlines / Important Dates

The deadlines for submitting the Form CT 1041ES are typically aligned with the state’s tax calendar. Estimated payments are generally due on the fifteenth day of the fourth, sixth, ninth, and twelfth months of the tax year. It is important for fiduciaries to mark these dates on their calendars to avoid penalties for late payments. Additionally, any changes in the estate or trust's financial situation may necessitate adjustments to the estimated payments, which should be reflected in subsequent filings.

Legal use of the Form CT 1041ES 4 Form CT 1041ES

The Form CT 1041ES is legally binding when completed and submitted according to Connecticut tax laws. It is essential for fiduciaries to ensure that all information provided is accurate and truthful, as any discrepancies may lead to penalties or audits. The form serves as a formal declaration of the estate or trust's intent to pay estimated taxes, and maintaining compliance with state regulations is crucial for avoiding legal complications.

Who Issues the Form

The Form CT 1041ES is issued by the Connecticut Department of Revenue Services (DRS). This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. Fiduciaries can obtain the form directly from the DRS website or through authorized tax professionals who assist with estate and trust tax filings. It is advisable to use the most current version of the form to ensure compliance with any recent changes in tax regulations.

Quick guide on how to complete form ct 1041es 4 form ct 1041es

Complete Form CT 1041ES 4 Form CT 1041ES smoothly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the appropriate form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Form CT 1041ES 4 Form CT 1041ES on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Form CT 1041ES 4 Form CT 1041ES effortlessly

- Find Form CT 1041ES 4 Form CT 1041ES and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, text (SMS), invitation link, or download it to your computer.

Forget about misplaced files, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Form CT 1041ES 4 Form CT 1041ES and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 1041es 4 form ct 1041es

Create this form in 5 minutes!

How to create an eSignature for the form ct 1041es 4 form ct 1041es

The way to generate an electronic signature for your PDF in the online mode

The way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is Form CT 1041ES 4 Form CT 1041ES?

Form CT 1041ES 4 Form CT 1041ES is an essential tax form for estimated income taxes for fiduciaries in Connecticut. This form helps fiduciaries to calculate and pay their estimated tax liabilities in a timely manner, ensuring compliance with state tax regulations. Using airSlate SignNow can simplify the process of preparing and signing this form.

-

How can airSlate SignNow help with Form CT 1041ES 4 Form CT 1041ES?

AirSlate SignNow provides an intuitive platform that enables users to fill, sign, and send Form CT 1041ES 4 Form CT 1041ES efficiently. The software ensures that all your data is securely handled and readily accessible. This capability streamlines the entire process, saving you valuable time and reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for Form CT 1041ES 4 Form CT 1041ES?

Yes, while airSlate SignNow offers various pricing plans, the cost is quite competitive and designed to provide value for businesses of all sizes. Users can opt for monthly or annual subscriptions, ensuring they find a plan that meets their specific needs. This cost-effective solution is particularly beneficial for those frequently handling Form CT 1041ES 4 Form CT 1041ES.

-

What features are available for managing Form CT 1041ES 4 Form CT 1041ES on airSlate SignNow?

AirSlate SignNow offers numerous features to support users with Form CT 1041ES 4 Form CT 1041ES, including customizable templates, eSignature options, and real-time document tracking. These features ensure that you can manage your tax forms seamlessly and securely. Moreover, the platform allows document collaboration, which can be particularly beneficial for fiduciaries dealing with multiple parties.

-

Can I integrate airSlate SignNow with other software for Form CT 1041ES 4 Form CT 1041ES?

Absolutely! AirSlate SignNow offers integration with numerous software applications, allowing for smooth workflows when managing Form CT 1041ES 4 Form CT 1041ES. Common integrations include CRM systems and document management tools, making it easy to enhance productivity and maintain organization. This flexibility ensures that users can work within their preferred systems without hassle.

-

What are the benefits of using airSlate SignNow for Form CT 1041ES 4 Form CT 1041ES?

Using airSlate SignNow for Form CT 1041ES 4 Form CT 1041ES offers several benefits including enhanced efficiency, security, and ease of use. The platform eliminates the need for printing and physical signatures, facilitating faster submissions. Additionally, users can enjoy peace of mind knowing their sensitive financial information is protected throughout the process.

-

How secure is my information when using airSlate SignNow for Form CT 1041ES 4 Form CT 1041ES?

AirSlate SignNow takes security very seriously, employing advanced encryption and security protocols to safeguard all information related to Form CT 1041ES 4 Form CT 1041ES. This ensures that both documents and user data are protected against unauthorized access. Users can confidently manage their tax documents, knowing that airSlate SignNow prioritizes their security.

Get more for Form CT 1041ES 4 Form CT 1041ES

Find out other Form CT 1041ES 4 Form CT 1041ES

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free