Form Ct 1120 2019

What is the Form Ct 1120

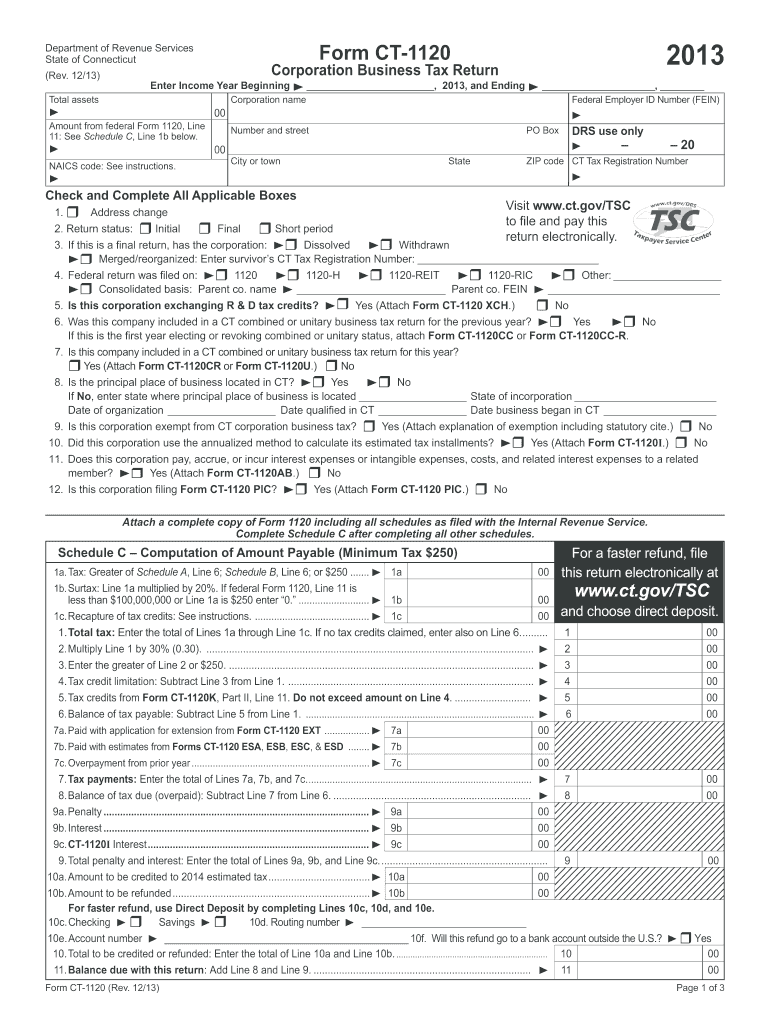

The Form Ct 1120 is a corporate income tax return used by corporations operating in Connecticut. This form is essential for reporting the income, gains, losses, deductions, and credits of a corporation. It is specifically designed for C corporations, which are taxed separately from their owners. The form requires detailed financial information to ensure compliance with state tax laws, allowing the Connecticut Department of Revenue Services to assess the corporation's tax liability accurately.

How to use the Form Ct 1120

Using the Form Ct 1120 involves several steps. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, accurately fill out the form, ensuring that all sections are completed, including income, deductions, and credits. After completing the form, review it for accuracy and compliance with Connecticut tax regulations. Finally, submit the form to the Connecticut Department of Revenue Services by the specified deadline, either electronically or by mail.

Steps to complete the Form Ct 1120

Completing the Form Ct 1120 requires careful attention to detail. Follow these steps:

- Gather financial records, including income statements and balance sheets.

- Fill out the identification section with your corporation's name, address, and federal employer identification number (EIN).

- Report total income, including gross receipts and other income sources.

- Detail allowable deductions, such as operating expenses and tax credits.

- Calculate the taxable income by subtracting total deductions from total income.

- Determine the tax liability based on the applicable Connecticut corporate tax rate.

- Review the completed form for accuracy and compliance.

- Submit the form by the due date.

Legal use of the Form Ct 1120

The Form Ct 1120 is legally binding when filled out and submitted according to Connecticut tax laws. It must be signed by an authorized officer of the corporation, affirming that the information provided is true and complete. Failure to comply with the legal requirements can result in penalties, including fines and interest on unpaid taxes. Therefore, it is crucial to understand the legal implications of submitting this form and ensure that all information is accurate and complete.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with the Form Ct 1120 to avoid penalties. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due on April 15. Extensions may be available, but they must be requested before the original due date. It is essential to stay informed about any changes to deadlines to ensure timely filing.

Form Submission Methods (Online / Mail / In-Person)

The Form Ct 1120 can be submitted through multiple methods, providing flexibility for corporations. Options include:

- Online submission: Corporations can file electronically through the Connecticut Department of Revenue Services website, which offers a secure and efficient filing process.

- Mail: The completed form can be mailed to the appropriate address provided by the Connecticut Department of Revenue Services. Ensure that sufficient postage is applied.

- In-person: Corporations may also choose to submit their forms in person at designated state offices, allowing for immediate confirmation of receipt.

Quick guide on how to complete 2013 form ct 1120

Prepare Form Ct 1120 effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary format and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents rapidly without delays. Handle Form Ct 1120 on any device using airSlate SignNow’s Android or iOS applications and streamline your document-related processes today.

How to edit and eSign Form Ct 1120 with ease

- Find Form Ct 1120 and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Choose your delivery method for the form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form Ct 1120 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form ct 1120

Create this form in 5 minutes!

How to create an eSignature for the 2013 form ct 1120

The way to generate an electronic signature for your PDF file online

The way to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is Form Ct 1120?

Form Ct 1120 is the corporate income tax return form required by the state of Connecticut. It is used by corporations to report their income, gains, losses, and other tax-related information. Understanding how to correctly fill out and submit Form Ct 1120 is essential for compliance with Connecticut tax laws.

-

How can airSlate SignNow help with Form Ct 1120?

airSlate SignNow simplifies the process of signing and managing documents like Form Ct 1120. With its user-friendly interface, businesses can easily eSign and send Form Ct 1120, ensuring timely submission to tax authorities. This helps avoid penalties for late filing and provides peace of mind during tax season.

-

What features does airSlate SignNow offer for managing documents such as Form Ct 1120?

airSlate SignNow offers features like customizable templates, advanced security measures, and real-time tracking for documents, including Form Ct 1120. Users can efficiently collaborate with multiple parties, ensuring everyone has access to necessary forms. This enhances productivity and streamlines the document signing process.

-

Is there a cost associated with using airSlate SignNow for Form Ct 1120?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. While there are associated costs for using the platform to manage documents like Form Ct 1120, the investment can lead to time savings and increased efficiency in document handling. It’s advisable to check their pricing page for detailed information.

-

Can I integrate airSlate SignNow with other platforms for processing Form Ct 1120?

Absolutely! airSlate SignNow supports a range of integrations with popular software, enhancing its functionality. This means you can effectively sync your workflow for Form Ct 1120 with accounting software, CRMs, and more, providing a seamless experience across your business processes.

-

What are the benefits of using airSlate SignNow for Form Ct 1120 versus traditional paper filing?

Using airSlate SignNow for Form Ct 1120 offers numerous benefits over traditional paper filing, including speed, convenience, and tracking capabilities. Electronic signatures are legally binding, and you can easily manage versions and updates of the form. This signNowly reduces the risk of errors and delays related to postal services.

-

How secure is the document signing process for Form Ct 1120 with airSlate SignNow?

airSlate SignNow prioritizes security, offering features such as encryption, audit trails, and secure cloud storage. This ensures that your Form Ct 1120 and all related documents are protected from unauthorized access. These security measures help maintain compliance and safeguard sensitive information throughout the signing process.

Get more for Form Ct 1120

- Georgia state form

- Massage therapy client health intake form spinal health

- Chauffeur license cost form

- Tax exempt motor vehicle sales or leases to first nations purchasers form

- Formulario dgc 005

- Child stress disorders checklist screening form pdf

- Copyright transfer agreement word format

- Form ct 3 abcmembers detail report tax ny gov

Find out other Form Ct 1120

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free