Schedule Ct K 1 Form 2019

What is the Schedule Ct K-1 Form

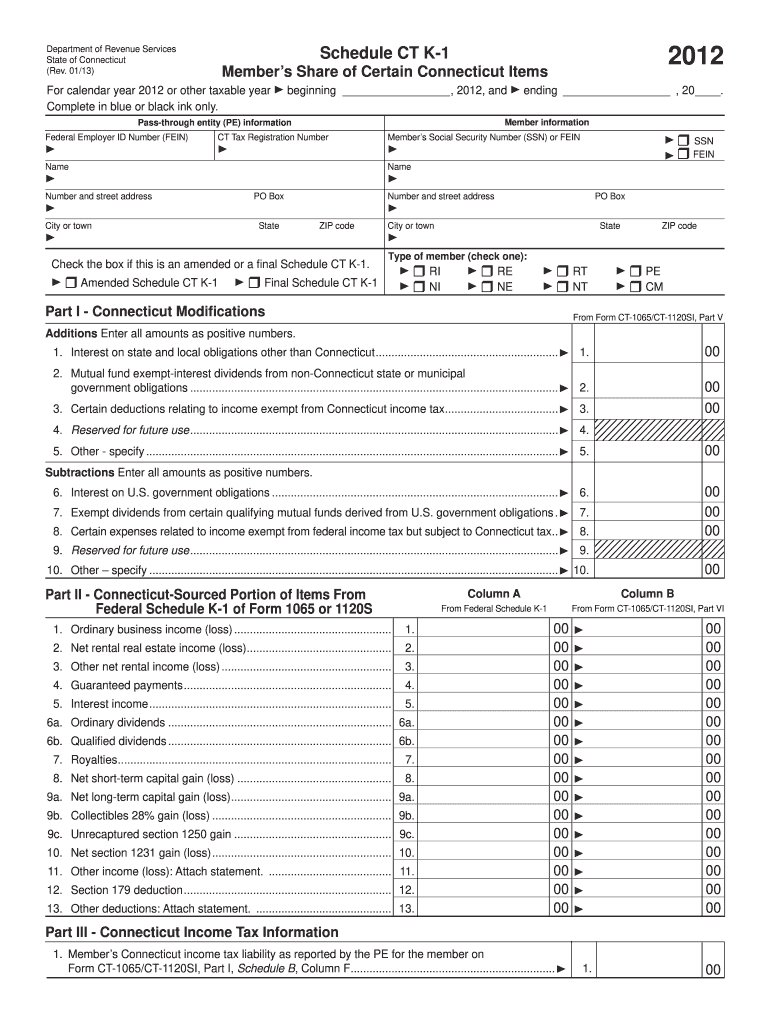

The Schedule Ct K-1 Form is a tax document used in the United States, specifically for reporting income, deductions, and credits from partnerships, S corporations, estates, and trusts. This form provides each partner or shareholder with their share of the entity's income, which they must report on their individual tax returns. The information contained in the Schedule Ct K-1 is crucial for ensuring accurate tax reporting and compliance with IRS regulations.

How to use the Schedule Ct K-1 Form

To effectively use the Schedule Ct K-1 Form, recipients must first ensure they have received the form from the entity they are involved with, such as a partnership or S corporation. Once in possession of the form, individuals should review the reported income, deductions, and credits carefully. This information should then be transferred to the appropriate sections of their personal tax returns, such as Form 1040. It is important to keep a copy of the Schedule Ct K-1 for personal records and future reference.

Steps to complete the Schedule Ct K-1 Form

Completing the Schedule Ct K-1 Form involves several key steps:

- Gather necessary information, including the entity's name, address, and Employer Identification Number (EIN).

- Fill in the partner or shareholder's details, including their name, address, and tax identification number.

- Report the income, deductions, and credits as provided by the entity, ensuring accuracy in each section.

- Review the completed form for any errors or omissions before submission.

- Provide a copy of the completed Schedule Ct K-1 to the partner or shareholder for their records.

Legal use of the Schedule Ct K-1 Form

The Schedule Ct K-1 Form is legally binding when filled out accurately and submitted in accordance with IRS guidelines. It serves as an official record of income distribution from partnerships or S corporations to their partners or shareholders. Proper completion and filing of this form are essential for compliance with federal tax laws, and failure to do so can result in penalties or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule Ct K-1 Form typically align with the tax return deadlines for partnerships and S corporations. Generally, these entities must provide the K-1 forms to their partners or shareholders by March 15 of the following tax year. Recipients should be aware of their individual tax filing deadlines, which are usually April 15, to ensure timely reporting of the income reported on their K-1 forms.

Who Issues the Form

The Schedule Ct K-1 Form is issued by partnerships, S corporations, estates, and trusts. These entities are responsible for preparing and distributing the form to their partners or shareholders, detailing each individual's share of the entity's income, deductions, and credits. It is essential for these entities to accurately complete and timely distribute the K-1 forms to ensure compliance with IRS regulations.

Quick guide on how to complete schedule ct k 1 2012 form

Easily prepare Schedule Ct K 1 Form on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage Schedule Ct K 1 Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Schedule Ct K 1 Form effortlessly

- Find Schedule Ct K 1 Form and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious document searches, or errors that require new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Modify and eSign Schedule Ct K 1 Form and ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule ct k 1 2012 form

Create this form in 5 minutes!

How to create an eSignature for the schedule ct k 1 2012 form

The way to make an electronic signature for your PDF document online

The way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The way to make an eSignature for a PDF file on Android OS

People also ask

-

What is the Schedule Ct K 1 Form?

The Schedule Ct K 1 Form is a tax document used to report income, deductions, and credits of partnerships or S corporations in Connecticut. Understanding how to fill out this form is vital for accurate tax reporting, and airSlate SignNow can streamline this process by allowing you to eSign and send your forms quickly and securely.

-

How can I eSign my Schedule Ct K 1 Form with airSlate SignNow?

To eSign your Schedule Ct K 1 Form using airSlate SignNow, simply upload the document to our platform, add the necessary signers, and use our user-friendly eSignature tools. This process makes it easy to complete your forms without the hassle of printing or scanning.

-

Is there a cost associated with using airSlate SignNow for the Schedule Ct K 1 Form?

airSlate SignNow offers various pricing plans that cater to different business needs, making it a cost-effective solution for managing documents like the Schedule Ct K 1 Form. You can choose a plan that fits your budget and get started with powerful features that simplify your eSigning needs.

-

What features does airSlate SignNow provide for handling the Schedule Ct K 1 Form?

airSlate SignNow offers features such as customizable templates, bulk sending, and in-app integrations that facilitate the completion of the Schedule Ct K 1 Form. Additionally, our secure cloud storage ensures your documents are safely stored and easily accessible at any time.

-

Can I integrate airSlate SignNow with other applications when managing the Schedule Ct K 1 Form?

Yes, airSlate SignNow provides seamless integrations with a range of applications, including Google Drive, Slack, and various CRM systems. This means you can easily manage your Schedule Ct K 1 Form alongside your other business tools for enhanced efficiency.

-

What are the benefits of using airSlate SignNow for the Schedule Ct K 1 Form?

Using airSlate SignNow for the Schedule Ct K 1 Form ensures a faster, more efficient signing process that saves time and reduces errors. The platform's intuitive interface is designed to enhance user experience, making it easy for both senders and signers to complete their forms effortlessly.

-

Is airSlate SignNow secure for submitting my Schedule Ct K 1 Form?

Absolutely! airSlate SignNow prioritizes security with advanced encryption and data protection measures, ensuring that your Schedule Ct K 1 Form is safely transmitted and stored. You can trust that your sensitive information remains confidential and secure while using our platform.

Get more for Schedule Ct K 1 Form

- Data correction form

- Scholastic bowl questions form

- Concealed carry permit valdosta ga form

- Special resolution change of company name template australia form

- Usps shipping label template form

- Uniqlo online application form

- Job application form builder

- Mc 357 patition to withdraw funds from blocked account judicial council forms

Find out other Schedule Ct K 1 Form

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online