Form 1065

What is the Form 1065

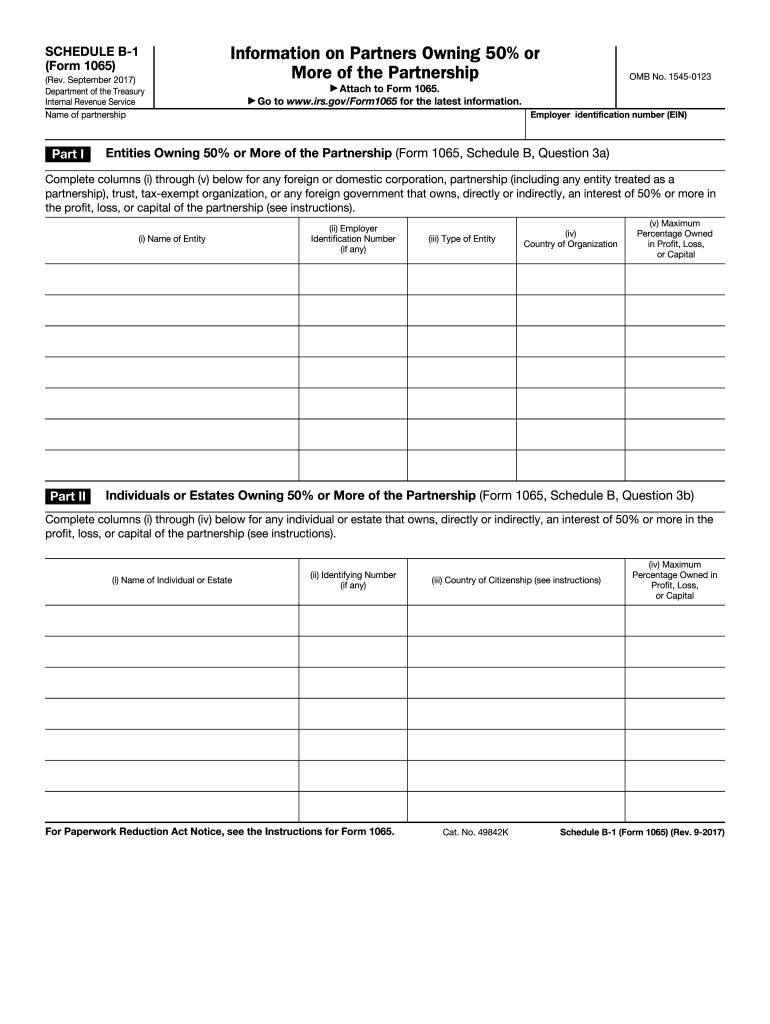

The Form 1065 is an annual tax return filed by partnerships in the United States. This form is used to report income, deductions, gains, and losses from the partnership's operations. Unlike individual tax returns, Form 1065 does not calculate tax owed; instead, it provides the IRS with information about the partnership's financial activities. Each partner in the partnership receives a Schedule K-1, which details their share of the partnership's income, deductions, and credits, allowing them to report this information on their individual tax returns.

How to use the Form 1065

Using Form 1065 involves several steps. First, gather all relevant financial information for the partnership, including income, expenses, and distributions. Next, complete the form by entering the necessary details in the appropriate sections, such as income, deductions, and partner information. After filling out the form, review it for accuracy and ensure that all partners' information is correctly reported. Finally, submit the completed Form 1065 to the IRS by the designated deadline, typically March 15 for calendar-year partnerships.

Steps to complete the Form 1065

Completing Form 1065 requires careful attention to detail. Follow these steps for accurate completion:

- Gather financial records, including income statements and expense reports.

- Fill out the basic information section, including the partnership's name, address, and Employer Identification Number (EIN).

- Report total income by summarizing all revenue sources.

- Detail deductions, including operating expenses and other allowable deductions.

- Calculate the partnership's taxable income by subtracting deductions from total income.

- Complete the Schedule K-1 for each partner, detailing their share of income and deductions.

- Review the entire form for accuracy before submission.

Filing Deadlines / Important Dates

Partnerships must be aware of key deadlines for filing Form 1065. The standard deadline for filing is March 15 for calendar-year partnerships. If additional time is needed, partnerships can file for an extension, which typically allows an additional six months. However, it is essential to note that an extension to file does not extend the time to pay any taxes owed. Partners should also be aware of deadlines for issuing Schedule K-1s, which must be provided to partners by the same date as the Form 1065 filing deadline.

Legal use of the Form 1065

Form 1065 is legally binding when completed and submitted according to IRS regulations. It is crucial for partnerships to ensure that the information reported is accurate and complete, as discrepancies can lead to penalties or audits. The form must be signed by a partner or an authorized representative of the partnership, affirming that the information is true and correct. Utilizing electronic signature solutions can streamline this process while ensuring compliance with legal requirements.

IRS Guidelines

The IRS provides specific guidelines for completing and filing Form 1065. These guidelines include instructions on what information is necessary, how to report income and deductions, and how to handle special situations such as changes in partnership structure. It is important for partnerships to refer to the latest IRS instructions for Form 1065 to ensure compliance with current tax laws and regulations. Regular updates may occur, so staying informed about any changes is essential for accurate reporting.

Quick guide on how to complete form 1065 2009

Complete Form 1065 effortlessly on any device

Web-based document handling has gained traction among organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents swiftly without any lag. Manage Form 1065 on any device through the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 1065 without any effort

- Find Form 1065 and click on Get Form to commence.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature using the Sign tool, which requires seconds and holds the same legal standing as a conventional handwritten signature.

- Review all the details and then click on the Done button to preserve your modifications.

- Choose how you wish to deliver your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form 1065 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1065 2009

The best way to create an eSignature for your PDF online

The best way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The way to make an eSignature for a PDF on Android

People also ask

-

What is Form 1065 and why is it important?

Form 1065 is a crucial document for partnerships, used to report income, deductions, and other important financial information to the IRS. Completing Form 1065 accurately is essential for compliance and can impact the tax obligations of each partner in the business. Understanding Form 1065 can help your business avoid penalties and ensure proper tax reporting.

-

How does airSlate SignNow streamline the Form 1065 signing process?

AirSlate SignNow simplifies the signing process for Form 1065 by allowing users to send, sign, and manage documents electronically. The platform offers a user-friendly interface that enables easy collaboration among partners, ensuring that everyone can review and sign the Form 1065 promptly. This efficiency saves time and reduces potential errors in tax filing.

-

What features does airSlate SignNow offer for handling Form 1065?

AirSlate SignNow offers several features tailored for handling Form 1065, such as customizable templates, secure eSignature options, and real-time document tracking. These features enhance the overall experience of completing Form 1065, making it easier for businesses to stay organized. Moreover, users can automate reminders for signatures, ensuring timely submissions.

-

Is airSlate SignNow cost-effective for filing Form 1065?

Yes, airSlate SignNow is a cost-effective solution for managing Form 1065, as it minimizes paper usage and associated costs. The platform offers various pricing plans to accommodate different business needs, providing excellent value for the efficiency it brings to the document signing process. Investing in airSlate SignNow can lead to long-term savings in both time and resources.

-

Can I integrate airSlate SignNow with other accounting tools to manage Form 1065?

Absolutely! AirSlate SignNow offers seamless integrations with various accounting tools, enabling easy management of Form 1065 alongside your other financial documents. By integrating with platforms like QuickBooks and Xero, businesses can streamline their workflows and ensure accurate data processing. This connectivity makes handling Form 1065 simpler and more efficient.

-

What are the benefits of using airSlate SignNow for Form 1065 compared to traditional methods?

Using airSlate SignNow for Form 1065 provides several benefits over traditional paper methods, including heightened security, faster turnaround times, and reduced environmental impact. The electronic signing process eliminates the need for printing, mailing, and physical storage of documents. Additionally, airSlate SignNow retains a digital audit trail, enhancing transparency and accountability.

-

How does airSlate SignNow ensure the security of Form 1065 documents?

AirSlate SignNow prioritizes the security of Form 1065 documents by employing industry-standard encryption and secure storage practices. The platform is compliant with major regulations, ensuring that sensitive financial data remains protected. Users can also set permissions and access controls, further safeguarding their Form 1065 documents against unauthorized access.

Get more for Form 1065

Find out other Form 1065

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile