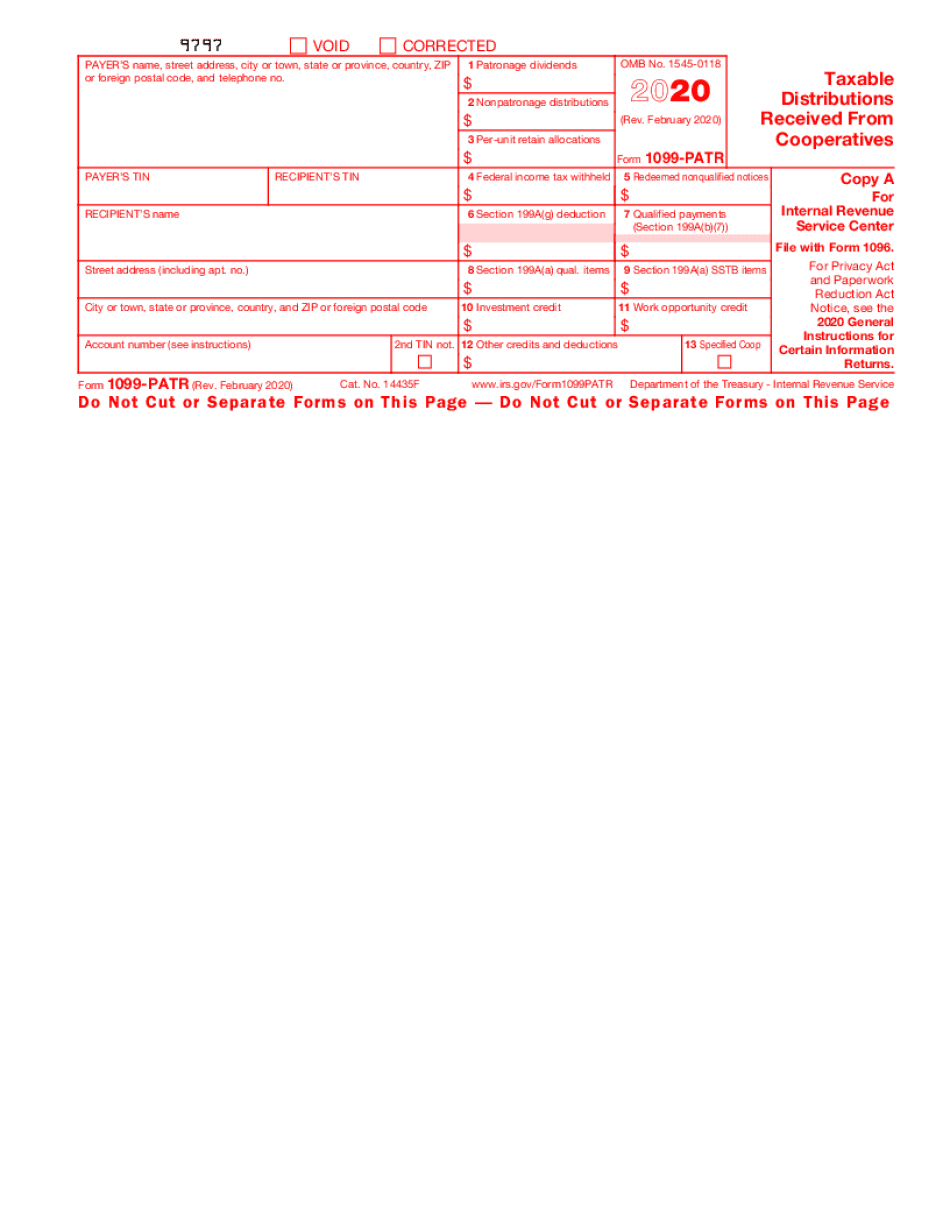

5 Redeemed Nonqualified Notices 2020

IRS Guidelines for the Fillable 1099 Form

The Internal Revenue Service (IRS) provides specific guidelines for completing the fillable 1099 form. This form is essential for reporting various types of income other than wages, salaries, and tips. The IRS requires that all information be accurate and submitted in a timely manner. Each type of 1099 form serves a unique purpose, so it is crucial to select the correct variant based on the nature of the payment. For instance, the 1099-MISC is used for miscellaneous income, while the 1099-NEC is designated for non-employee compensation.

Steps to Complete the Fillable 1099 Form

Completing the fillable 1099 form involves several key steps to ensure compliance with IRS requirements. First, gather all necessary information, including the payer's and recipient's names, addresses, and taxpayer identification numbers (TINs). Next, accurately report the income amount in the appropriate box based on the type of 1099 form being used. After filling out the form, review all entries for accuracy. Finally, submit the completed form to the IRS by the specified deadline, ensuring that copies are also provided to the recipients.

Filing Deadlines for the Fillable 1099 Form

Filing deadlines for the fillable 1099 form vary depending on the specific type being submitted. Generally, the deadline for providing copies to recipients is January thirty-first. If filing electronically, the deadline is typically March thirty-first. It is essential to adhere to these deadlines to avoid penalties. Late submissions can result in fines, so keeping track of these dates is crucial for compliance.

Required Documents for Completing the Fillable 1099 Form

To accurately complete the fillable 1099 form, certain documents are required. These include the payer's and recipient's TINs, which can be found on previous tax returns or W-9 forms. Additionally, any documentation supporting the income reported should be gathered, such as invoices or payment records. Having these documents ready ensures a smoother completion process and helps maintain accuracy.

Penalties for Non-Compliance with the Fillable 1099 Form

Non-compliance with the requirements for the fillable 1099 form can lead to significant penalties. The IRS imposes fines for failing to file on time, providing incorrect information, or not providing copies to recipients. The penalties can vary based on how late the form is filed and whether the errors are corrected. Understanding these potential consequences emphasizes the importance of timely and accurate filing.

Digital vs. Paper Version of the Fillable 1099 Form

Choosing between the digital and paper versions of the fillable 1099 form depends on convenience and compliance preferences. The digital version allows for easier completion and submission, often including features like automatic calculations and error checks. Conversely, the paper version may be preferred by those who are more comfortable with traditional filing methods. Regardless of the format chosen, it is essential to ensure that all IRS guidelines are followed.

Quick guide on how to complete 5 redeemed nonqualified notices

Effortlessly Prepare 5 Redeemed Nonqualified Notices on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, as users can easily access the right form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage 5 Redeemed Nonqualified Notices on any device with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

Easily Modify and eSign 5 Redeemed Nonqualified Notices Without Any Hassle

- Find 5 Redeemed Nonqualified Notices and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or conceal sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any chosen device. Modify and eSign 5 Redeemed Nonqualified Notices and guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 5 redeemed nonqualified notices

Create this form in 5 minutes!

How to create an eSignature for the 5 redeemed nonqualified notices

The best way to create an eSignature for your PDF online

The best way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

How to make an eSignature for a PDF on Android

People also ask

-

What is a fillable 1099 form?

A fillable 1099 form is a tax document that allows businesses to report various types of income to the IRS. With airSlate SignNow, you can easily create, customize, and send fillable 1099 forms to ensure compliance and streamline your reporting process. This digital solution also simplifies signatures, making the entire process efficient.

-

How can airSlate SignNow help me with fillable 1099 forms?

airSlate SignNow provides a user-friendly platform for creating and managing fillable 1099 forms. You can quickly generate these forms, fill them out electronically, and send them for eSignature, all within the platform. This ensures that your forms are completed correctly and submitted on time.

-

Is there a cost associated with using airSlate SignNow for fillable 1099 forms?

Yes, airSlate SignNow offers various pricing plans, starting from a budget-friendly option that allows you to create and send fillable 1099 forms. The plans are designed to cater to different business sizes and needs, ensuring you only pay for what you use. This cost-effective solution helps businesses save time and reduce operational costs.

-

Can I customize my fillable 1099 forms with airSlate SignNow?

Absolutely! airSlate SignNow allows you to fully customize your fillable 1099 forms to align with your business branding and requirements. You can add your logo, adjust the layout, and include any specific fields needed, ensuring that the forms meet your exact specifications.

-

What are the benefits of using a fillable 1099 form?

Using a fillable 1099 form helps streamline your tax reporting process, reduces the chances of errors, and enhances productivity within your business. With airSlate SignNow, you benefit from the easy eSignature process, making it quick for recipients to sign and return the forms. This efficiency can save you valuable time and resources during tax season.

-

Are fillable 1099 forms secure with airSlate SignNow?

Yes, security is a top priority for airSlate SignNow when managing fillable 1099 forms. The platform employs advanced encryption technologies to protect your data and ensure privacy. You can send and receive documents confidently, knowing that your clients' sensitive information is safeguarded.

-

Does airSlate SignNow integrate with other software for managing fillable 1099 forms?

Yes, airSlate SignNow offers seamless integrations with various accounting and business management software. This means you can easily sync your data and automate workflows when dealing with fillable 1099 forms. Such integrations enhance your overall efficiency and reduce administrative tasks.

Get more for 5 Redeemed Nonqualified Notices

- Individual credit application wyoming form

- Interrogatories to plaintiff for motor vehicle occurrence wyoming form

- Interrogatories to defendant for motor vehicle accident wyoming form

- Llc notices resolutions and other operations forms package wyoming

- Residential real estate sales disclosure statement wyoming form

- Notice of dishonored check civil keywords bad check bounced check wyoming form

- Mutual wills containing last will and testaments for man and woman living together not married with no children wyoming form

- Mutual wills package of last wills and testaments for man and woman living together not married with adult children wyoming form

Find out other 5 Redeemed Nonqualified Notices

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online