Online Ftb State of Ca Schedule K 1 for S Corp Form 2019

What is the Online Ftb State Of Ca Schedule K 1 For S Corp Form

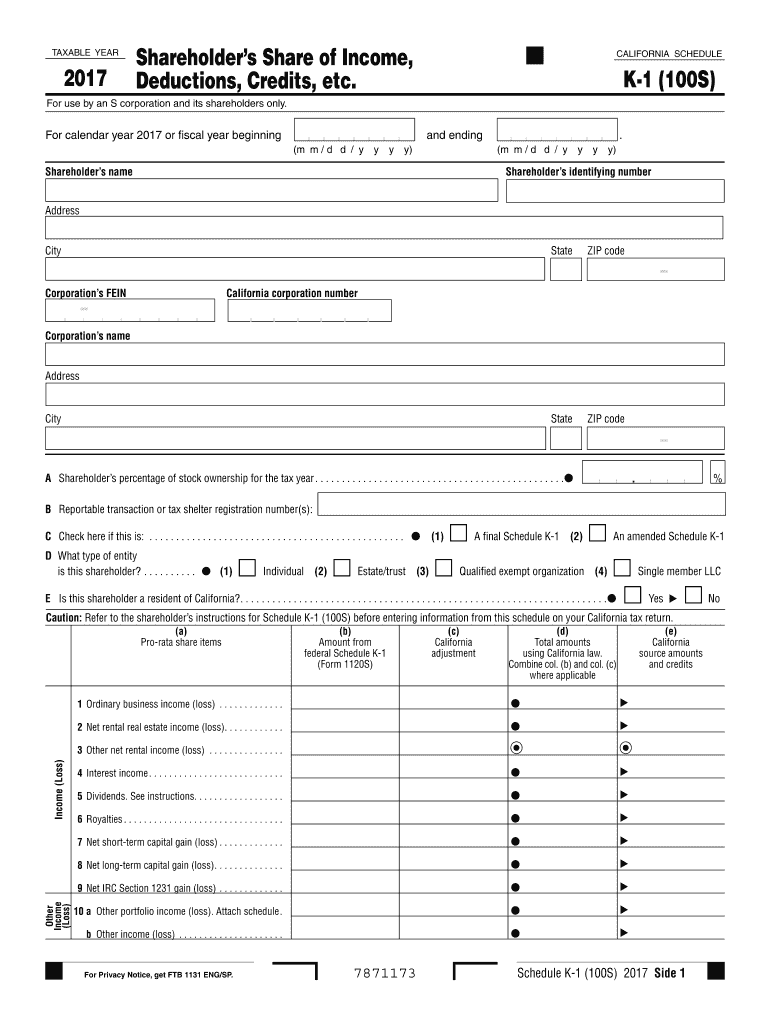

The Online Ftb State Of Ca Schedule K-1 for S Corp form is a tax document used by S corporations in California to report income, deductions, and credits to shareholders. This form provides essential information that shareholders need to complete their individual tax returns. Each shareholder receives a copy of the K-1, which details their share of the corporation's income, losses, and other tax-related items. Understanding this form is crucial for accurate tax reporting and compliance with state regulations.

How to use the Online Ftb State Of Ca Schedule K 1 For S Corp Form

Using the Online Ftb State Of Ca Schedule K-1 for S Corp form involves several steps to ensure accurate completion. First, access the form through the California Franchise Tax Board's online portal. Once you have the form, input the required information, including the corporation's details and the specific amounts allocated to each shareholder. After filling in the necessary fields, review the information for accuracy. Finally, submit the form electronically or print it for distribution to shareholders. Utilizing digital tools can streamline this process and enhance accuracy.

Steps to complete the Online Ftb State Of Ca Schedule K 1 For S Corp Form

Completing the Online Ftb State Of Ca Schedule K-1 for S Corp form requires careful attention to detail. Follow these steps:

- Access the form through the California Franchise Tax Board's online platform.

- Enter the S corporation's name, address, and identification number.

- Provide the shareholder's information, including their name and tax identification number.

- Report the shareholder's share of income, deductions, and credits in the designated sections.

- Double-check all entries for accuracy and completeness.

- Submit the form electronically or print it for distribution to shareholders.

Legal use of the Online Ftb State Of Ca Schedule K 1 For S Corp Form

The Online Ftb State Of Ca Schedule K-1 for S Corp form is legally recognized as a valid document for tax reporting purposes when completed correctly. To ensure its legal standing, it must be filled out accurately and submitted in accordance with California tax laws. Additionally, all parties involved should retain copies of the form for their records. Compliance with the relevant regulations, such as the Internal Revenue Code and California tax laws, is essential for the form to be legally binding.

Key elements of the Online Ftb State Of Ca Schedule K 1 For S Corp Form

Several key elements are essential for the Online Ftb State Of Ca Schedule K-1 for S Corp form. These include:

- Shareholder Information: Name, address, and tax identification number of each shareholder.

- Corporation Details: Name, address, and identification number of the S corporation.

- Income Reporting: Breakdown of the shareholder's share of income, losses, and deductions.

- Signature: The form may require signatures from authorized representatives of the corporation.

Filing Deadlines / Important Dates

Filing deadlines for the Online Ftb State Of Ca Schedule K-1 for S Corp form are crucial for compliance. Typically, the form must be filed by the due date of the S corporation's tax return, which is usually March 15 for calendar year filers. If the corporation requests an extension, the deadline may be extended to September 15. Shareholders should receive their K-1 forms in a timely manner to ensure they can accurately report their income on their individual tax returns.

Quick guide on how to complete online ftb state of ca schedule k 1 for s corp 2017 form

Effortlessly Prepare Online Ftb State Of Ca Schedule K 1 For S Corp Form on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Online Ftb State Of Ca Schedule K 1 For S Corp Form across any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Alter and Electronically Sign Online Ftb State Of Ca Schedule K 1 For S Corp Form Effortlessly

- Locate Online Ftb State Of Ca Schedule K 1 For S Corp Form and click on Get Form to begin the process.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that function.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and select the Done button to save your modifications.

- Decide how you'd like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, exhausting searches for forms, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Online Ftb State Of Ca Schedule K 1 For S Corp Form and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct online ftb state of ca schedule k 1 for s corp 2017 form

Create this form in 5 minutes!

How to create an eSignature for the online ftb state of ca schedule k 1 for s corp 2017 form

The way to generate an electronic signature for a PDF document online

The way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the Online Ftb State Of Ca Schedule K 1 For S Corp Form?

The Online Ftb State Of Ca Schedule K 1 For S Corp Form is a tax document used by S corporations in California to report income, deductions, and credits to shareholders. This form allows businesses to efficiently manage and share the necessary tax information directly from a digital platform, streamlining the filing process.

-

How can airSlate SignNow help with the Online Ftb State Of Ca Schedule K 1 For S Corp Form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the Online Ftb State Of Ca Schedule K 1 For S Corp Form. This simplifies the completion and distribution of the form, ensuring that business owners and shareholders can manage their tax documents promptly and securely.

-

Is there a cost associated with using the Online Ftb State Of Ca Schedule K 1 For S Corp Form through airSlate SignNow?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs. You can choose a plan that best fits your requirements for sending and eSigning the Online Ftb State Of Ca Schedule K 1 For S Corp Form, ensuring you only pay for the features you need.

-

What features does airSlate SignNow offer for the Online Ftb State Of Ca Schedule K 1 For S Corp Form?

airSlate SignNow includes several features specifically for the Online Ftb State Of Ca Schedule K 1 For S Corp Form, such as customizable templates, automated workflows, and advanced document tracking. These features help businesses save time, increase efficiency, and maintain compliance with tax regulations.

-

Can I integrate airSlate SignNow with my existing accounting software for the Online Ftb State Of Ca Schedule K 1 For S Corp Form?

Absolutely! airSlate SignNow supports integrations with various accounting and financial software solutions. This allows you to seamlessly manage your documents and data related to the Online Ftb State Of Ca Schedule K 1 For S Corp Form without leaving your preferred applications.

-

How secure is the Online Ftb State Of Ca Schedule K 1 For S Corp Form when using airSlate SignNow?

Security is a priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to ensure that your Online Ftb State Of Ca Schedule K 1 For S Corp Form and related documents are protected from unauthorized access or data bsignNowes.

-

What benefits can I expect from using airSlate SignNow for the Online Ftb State Of Ca Schedule K 1 For S Corp Form?

Using airSlate SignNow for your Online Ftb State Of Ca Schedule K 1 For S Corp Form provides numerous benefits, including reduced paperwork, faster turnaround times, and the convenience of electronic signatures. This enhances overall productivity for your business and reduces the stress associated with tax season.

Get more for Online Ftb State Of Ca Schedule K 1 For S Corp Form

- Contact usva houston health care veterans affairs form

- Line list form

- Self service respite timesheet form

- This form broward health browardhealth

- My stewardship guideline thrivent financial form

- One time withdrawal formnonretirementfidelity investments use this form to make a one time withdrawal from your nonretirement

- Tenant in common form

- Adult day services office of the assistant secretary for form

Find out other Online Ftb State Of Ca Schedule K 1 For S Corp Form

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now