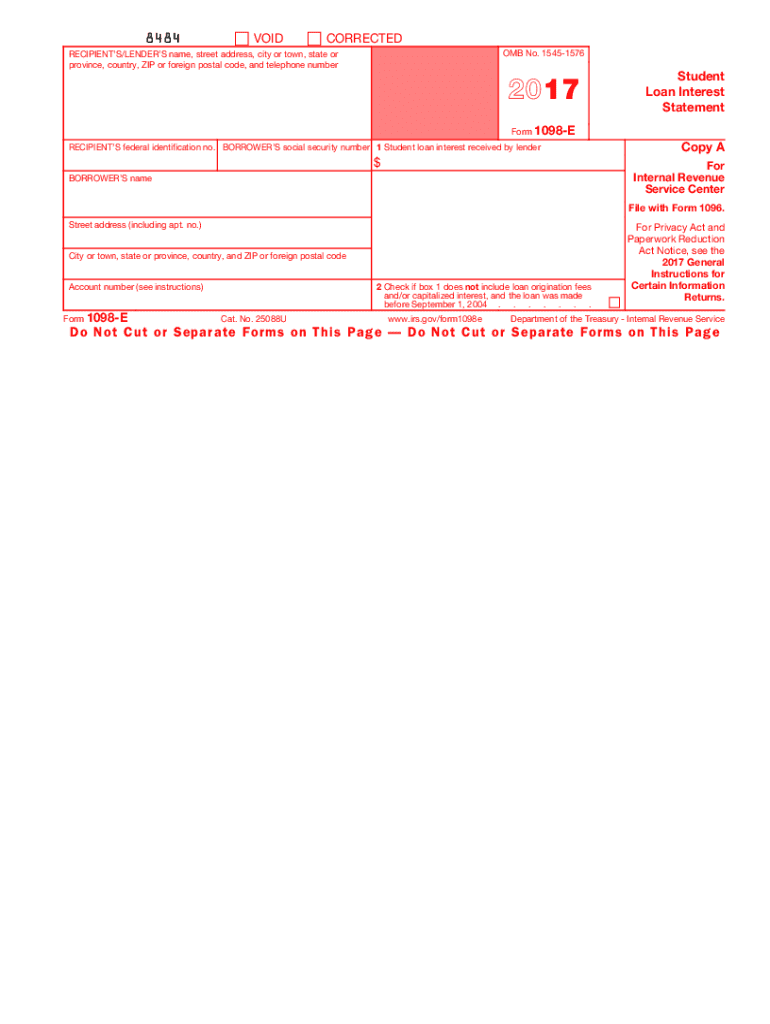

1098 E Form 2017

What is the 1098 E Form

The 1098 E Form is a tax document used in the United States to report the amount of interest paid on student loans during the tax year. This form is issued by lenders to borrowers and is crucial for individuals seeking to claim a student loan interest deduction on their federal income tax return. The information provided on the 1098 E Form helps taxpayers understand how much interest they have paid, which can potentially reduce their taxable income.

How to use the 1098 E Form

Using the 1098 E Form involves several steps. First, taxpayers should receive the form from their loan servicer, typically by January 31 of each year. Once received, individuals can review the reported interest amount. This information should be entered on the appropriate line of their federal tax return, specifically on Form 1040. It is important to keep a copy of the 1098 E Form for personal records and potential future audits.

Steps to complete the 1098 E Form

Completing the 1098 E Form is straightforward. Here are the essential steps:

- Gather your student loan information, including the lender's name and the total interest paid.

- Fill in your personal details, including your name, address, and Social Security number.

- Enter the total interest paid as reported by your lender in the designated box.

- Review the form for accuracy before submitting it with your tax return.

Legal use of the 1098 E Form

The 1098 E Form is legally recognized as a valid document for tax reporting purposes. It must be accurately completed and submitted to ensure compliance with IRS regulations. Taxpayers should be aware that failing to report the interest correctly could result in penalties or an audit. It is advisable to consult a tax professional if there are any uncertainties regarding the form's completion or submission.

Filing Deadlines / Important Dates

Filing deadlines for the 1098 E Form align with the annual tax filing schedule. Taxpayers must ensure that their tax returns, including the information from the 1098 E Form, are submitted by April 15 of the following year. If April 15 falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to tax deadlines that may occur.

Who Issues the Form

The 1098 E Form is issued by lenders or loan servicers to borrowers who have paid interest on student loans. This includes both private and federal loan servicers. Taxpayers should expect to receive their forms by the end of January each year, allowing ample time to prepare their tax returns. If a borrower does not receive the form, they should contact their lender to request a copy.

Quick guide on how to complete 1098 e form 2017

Complete 1098 E Form effortlessly on any device

Online document handling has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage 1098 E Form on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign 1098 E Form effortlessly

- Obtain 1098 E Form and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign 1098 E Form and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1098 e form 2017

Create this form in 5 minutes!

How to create an eSignature for the 1098 e form 2017

How to create an eSignature for the 1098 E Form 2017 in the online mode

How to generate an eSignature for your 1098 E Form 2017 in Google Chrome

How to generate an eSignature for putting it on the 1098 E Form 2017 in Gmail

How to create an eSignature for the 1098 E Form 2017 right from your mobile device

How to generate an electronic signature for the 1098 E Form 2017 on iOS devices

How to make an electronic signature for the 1098 E Form 2017 on Android devices

People also ask

-

What is the 1098 E Form?

The 1098 E Form is a tax document used to report interest paid on student loans. It is typically provided by lenders to students who have paid more than $600 in interest during the tax year. Having a digital solution like airSlate SignNow can streamline the process of managing and signing your 1098 E Form.

-

How can airSlate SignNow help with eSigning the 1098 E Form?

airSlate SignNow allows users to electronically sign the 1098 E Form effortlessly. Our platform offers a secure and efficient eSigning experience, enabling you to complete important documents quickly without the need for physical signatures. With easy-to-use features, you can manage your forms efficiently.

-

Is there a cost associated with using airSlate SignNow for the 1098 E Form?

Yes, airSlate SignNow offers various pricing plans to fit your needs for processing documents like the 1098 E Form. Our plans are designed to be cost-effective while providing comprehensive features such as electronic signing, document storage, and integration options. Check our pricing page for detailed information.

-

What features does airSlate SignNow offer for the 1098 E Form?

airSlate SignNow provides a variety of features tailored for managing the 1098 E Form, including eSigning, document templates, and secure cloud storage. Additionally, our platform offers tracking capabilities to monitor the status of your forms, ensuring you never miss important deadlines.

-

Are there integrations available for the 1098 E Form with airSlate SignNow?

Absolutely! airSlate SignNow integrates with numerous applications to enhance your workflow when handling the 1098 E Form. These integrations make it easier to import data, share documents seamlessly, and synchronize your eSigning tasks with your favorite tools.

-

How does airSlate SignNow ensure the security of my 1098 E Form?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and secure cloud storage to protect your documents, including sensitive information on the 1098 E Form. You can confidently eSign and store documents, knowing that they are safe and compliant with privacy regulations.

-

Can I use airSlate SignNow on mobile devices for the 1098 E Form?

Yes, airSlate SignNow is fully compatible with mobile devices, allowing you to manage your 1098 E Form on the go. Whether you're using a smartphone or tablet, our mobile-friendly platform enables you to eSign and share documents securely anytime, anywhere.

Get more for 1098 E Form

- Foothill igetc form

- Medical neessity form hewitt chrysler

- Performance assessment form unh

- Office of the professions form

- Sfn 16259 form

- Cobb county residential building permit amp demolition application comdev cobbcountyga form

- Forecast pro order form upgrade for xeampbasic

- Blg gncelleme formu gano excel marketing private t

Find out other 1098 E Form

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple