IRS 8801 2020

What is the IRS 8801

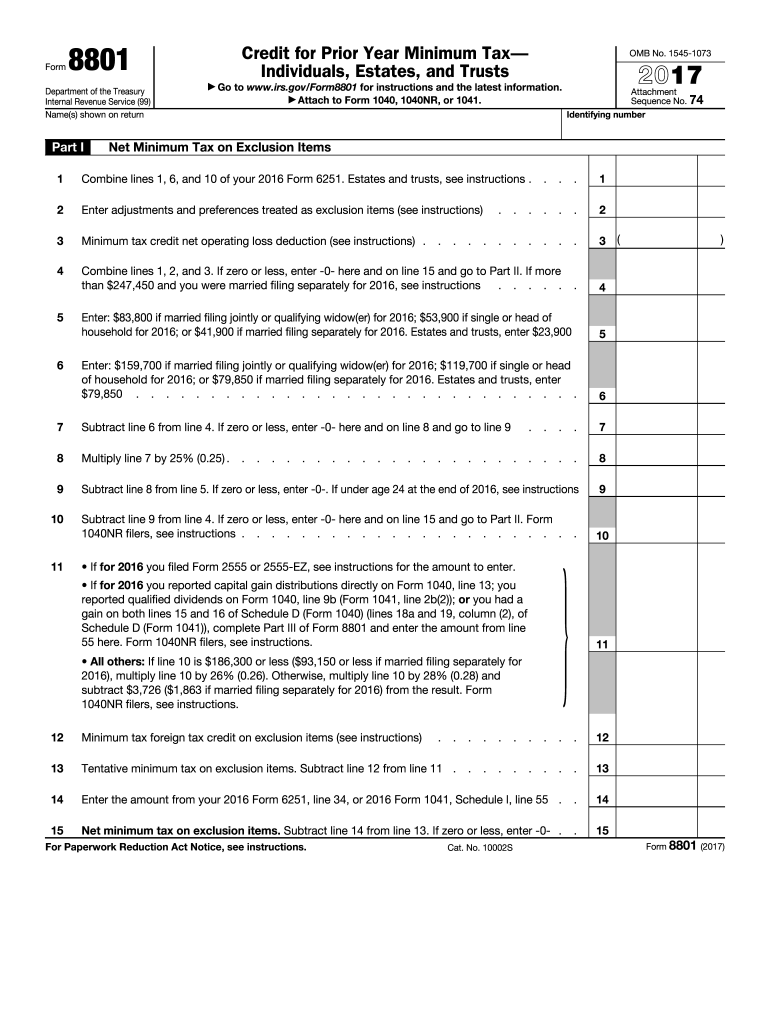

The IRS 8801 form, also known as the "Credit for Prior Year Minimum Tax—Individuals, Estates, and Trusts," is used by taxpayers to claim a credit for prior year minimum tax. This form is essential for individuals and entities that have paid alternative minimum tax (AMT) in previous years and are now eligible to recover some of that tax through a credit. The IRS 8801 helps ensure that taxpayers are not penalized for income that was taxed at a higher rate in earlier years, thereby promoting fairness in the tax system.

How to use the IRS 8801

Using the IRS 8801 involves several steps. First, you must determine your eligibility for the credit by reviewing your tax history to see if you paid AMT in prior years. Next, gather necessary documentation, including your previous tax returns and any relevant financial records. Once you have this information, complete the form, ensuring that all calculations are accurate. After filling out the IRS 8801, you will submit it along with your current year tax return to the IRS, which will process your claim for the credit.

Steps to complete the IRS 8801

Completing the IRS 8801 requires a systematic approach:

- Review your past tax returns to identify any AMT payments.

- Gather supporting documents, such as W-2s, 1099s, and previous IRS 8801 forms.

- Fill out the form accurately, ensuring all calculations reflect your financial situation.

- Double-check the form for errors or omissions before submission.

- Submit the completed IRS 8801 with your current tax return to the IRS.

Legal use of the IRS 8801

The IRS 8801 form is legally binding when filled out correctly and submitted according to IRS guidelines. It is crucial to comply with all requirements, including providing accurate information and supporting documents. Failure to do so may result in delays in processing or denial of the credit. Additionally, maintaining records of your submissions and any correspondence with the IRS is essential for legal purposes and future reference.

Filing Deadlines / Important Dates

Filing deadlines for the IRS 8801 align with the general tax return deadlines. Typically, individual tax returns are due on April 15 of each year. If you require an extension, you may file for an extension, but the IRS 8801 must still be submitted by the extended deadline. It is important to stay informed about any changes to deadlines, as the IRS may adjust dates based on various factors, including legislative changes or unforeseen circumstances.

Required Documents

To complete the IRS 8801 accurately, you will need several documents:

- Previous tax returns that show AMT payments.

- W-2 forms and 1099s for the current tax year.

- Any supporting documentation for deductions or credits claimed.

- Records of any prior year IRS 8801 forms submitted.

Examples of using the IRS 8801

Examples of scenarios where the IRS 8801 may be utilized include:

- An individual who paid AMT in a previous year and is now filing their taxes for the current year.

- A trust that has previously incurred AMT and is looking to recover some of that tax through the credit.

- A taxpayer who had significant income fluctuations, resulting in AMT in prior years, seeking to utilize the credit in a year with lower income.

Quick guide on how to complete 2015 irs 8801

Complete IRS 8801 effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to access the necessary form and securely maintain it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without interruptions. Handle IRS 8801 on any device using airSlate SignNow's Android or iOS applications and simplify any document-based task today.

How to modify and eSign IRS 8801 with ease

- Locate IRS 8801 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to deliver your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or missing files, tedious form navigation, or errors that require generating new copies of documents. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign IRS 8801 to ensure effective communication at every stage of the form filling process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 irs 8801

Create this form in 5 minutes!

How to create an eSignature for the 2015 irs 8801

The way to make an electronic signature for your PDF online

The way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

How to make an eSignature for a PDF on Android

People also ask

-

What is IRS 8801 and why is it important for businesses?

IRS 8801 is a tax form used to calculate and claim credits for prior year minimum tax liabilities. Understanding IRS 8801 is crucial for businesses that want to efficiently manage their tax obligations and ensure compliance. Properly utilizing this form can result in signNow tax savings and enhanced financial planning.

-

How can airSlate SignNow assist with filling out IRS 8801?

AirSlate SignNow simplifies the process of completing IRS 8801 by providing user-friendly document management tools. With our platform, businesses can easily upload, edit, and eSign necessary tax documents, ensuring accuracy and efficiency in their submissions. This minimizes errors and helps streamline your tax preparation process.

-

What are the pricing options for using airSlate SignNow for IRS 8801 forms?

AirSlate SignNow offers flexible pricing plans that cater to various business needs, including features tailored for handling IRS 8801 forms. Our competitive pricing ensures that you get a cost-effective solution without sacrificing document management capabilities. Explore our plans to find the one that fits your budget and requirements.

-

Can airSlate SignNow integrate with accounting software to manage IRS 8801?

Yes, airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage IRS 8801 forms and related documents. This integration allows for a streamlined workflow, enabling businesses to send, sign, and store their tax documents directly within their accounting systems. This enhances productivity and ensures better organization.

-

What security features does airSlate SignNow offer for IRS 8801 documents?

AirSlate SignNow prioritizes security with advanced features like end-to-end encryption and secure cloud storage for your IRS 8801 documents. Our platform ensures that sensitive tax information is kept private and protected from unauthorized access. These security measures provide peace of mind for businesses handling critical tax documents.

-

How does airSlate SignNow improve the efficiency of processing IRS 8801 forms?

By leveraging airSlate SignNow, businesses can reduce the time spent on processing IRS 8801 forms through automated workflows and easy eSigning capabilities. Our platform streamlines document preparation and approval processes, allowing for faster turnaround times. This increased efficiency enhances overall productivity and reduces stress during tax season.

-

Are there any features specifically designed for managing IRS 8801 forms?

AirSlate SignNow includes features specifically catered to tax documentation, including templates that can be customized for IRS 8801 forms. Users can easily access and edit form fields, ensuring compliance with IRS regulations. This tailored approach simplifies tax form management and ensures your submissions are complete and accurate.

Get more for IRS 8801

Find out other IRS 8801

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online