1120 Form Department of the Treasury Internal Revenue Service a Check 2022

What is the Form 1120?

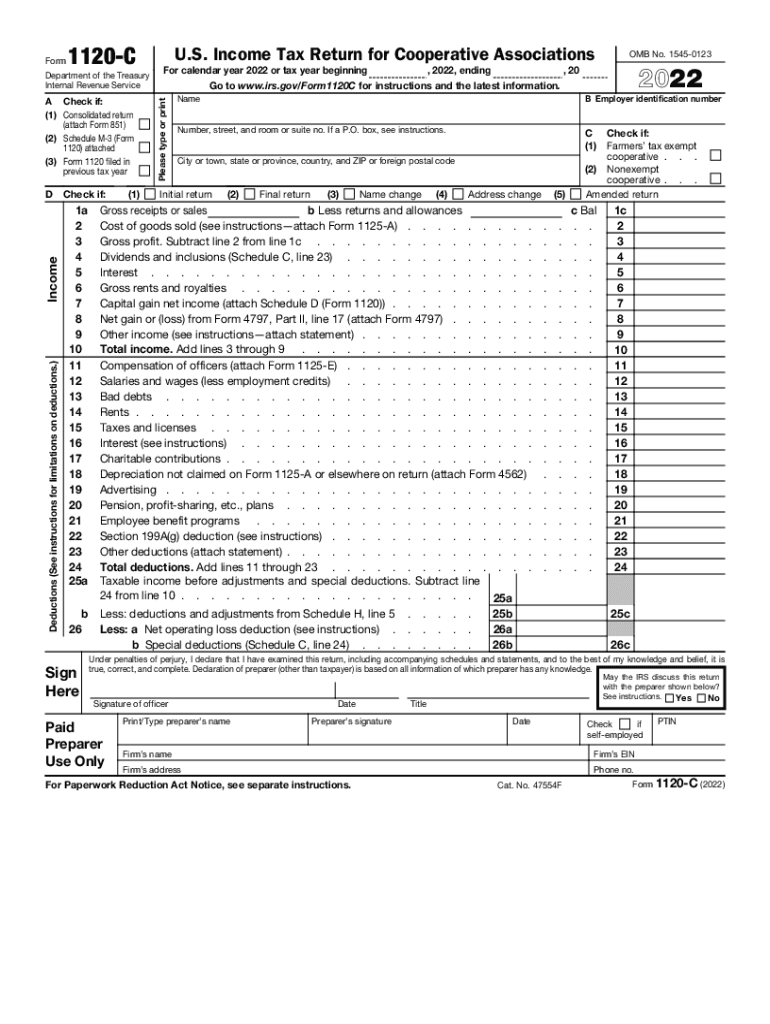

The Form 1120 is a corporate income tax return used by C corporations in the United States to report their income, gains, losses, deductions, and credits. It is filed annually with the Internal Revenue Service (IRS) and serves as a comprehensive overview of a corporation's financial activities for the tax year. C corporations are separate legal entities from their owners, which means they are taxed independently of the shareholders. This form is essential for ensuring compliance with federal tax regulations.

Key Elements of the Form 1120

The Form 1120 includes several crucial sections that require detailed information. Corporations must report their total income, including sales revenue and other earnings, as well as any deductions they are eligible for, such as business expenses. Key elements include:

- Income Section: This section details gross receipts and other income sources.

- Deductions: Corporations can deduct ordinary and necessary business expenses.

- Tax Computation: This calculates the tax liability based on the corporation's taxable income.

- Schedule C: This part is used to report dividends and special deductions.

Steps to Complete the Form 1120

Completing the Form 1120 involves several steps to ensure accuracy and compliance. Here are the key steps:

- Gather financial records, including income statements and balance sheets.

- Fill out the income section, reporting all sources of income.

- Document allowable deductions to reduce taxable income.

- Calculate the tax liability based on the net income.

- Review the form for accuracy and completeness before submission.

Filing Deadlines / Important Dates

Corporations must be aware of important deadlines for filing the Form 1120. The standard due date for filing is the fifteenth day of the fourth month after the end of the corporation's tax year. For corporations operating on a calendar year, this typically falls on April 15. If additional time is needed, corporations can file for an extension, which provides an additional six months to submit the return.

Penalties for Non-Compliance

Failure to file the Form 1120 on time or inaccuracies in reporting can result in significant penalties. The IRS imposes a penalty for late filings, which can accumulate daily until the return is filed. Additionally, inaccuracies may lead to interest charges on unpaid taxes. It is crucial for corporations to adhere to filing requirements to avoid these financial repercussions.

Digital vs. Paper Version

Corporations have the option to file the Form 1120 either digitally or via paper submission. Filing electronically can expedite processing times and reduce the likelihood of errors. The IRS encourages electronic filing for faster refunds and easier tracking. However, some corporations may prefer paper filing for record-keeping purposes. Regardless of the method chosen, ensuring that all information is accurate and complete is essential.

Quick guide on how to complete 1120 form department of the treasury internal revenue service a check

Effortlessly Prepare 1120 Form Department Of The Treasury Internal Revenue Service A Check on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the desired form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without interruptions. Manage 1120 Form Department Of The Treasury Internal Revenue Service A Check on any device using the airSlate SignNow apps for Android or iOS and simplify any document-oriented process today.

The easiest way to modify and electronically sign 1120 Form Department Of The Treasury Internal Revenue Service A Check effortlessly

- Locate 1120 Form Department Of The Treasury Internal Revenue Service A Check and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important portions of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), shareable link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your choice. Edit and electronically sign 1120 Form Department Of The Treasury Internal Revenue Service A Check and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1120 form department of the treasury internal revenue service a check

Create this form in 5 minutes!

People also ask

-

What are C corporation tax rates and how do they affect my business?

C corporation tax rates are the rates at which corporate income is taxed at the federal and state levels. Understanding these rates is crucial for businesses, as they can affect profitability and cash flow. It's important to consult a tax professional to optimize your tax strategy in relation to these rates.

-

How can airSlate SignNow help my C corporation with tax documentation?

airSlate SignNow streamlines the process of preparing and signing tax-related documents for C corporations. Our platform allows for easy eSigning and document management, ensuring that all necessary tax documents are correctly executed and filed. This efficiency can directly support compliance with C corporation tax rates.

-

What features of airSlate SignNow can assist with understanding C corporation tax rates?

With airSlate SignNow, users gain access to template management and automated workflows that simplify handling tax documents. These features help ensure that your business stays updated with current C corporation tax rates. Additionally, our platform allows for easy collaboration with tax advisors.

-

Are there any additional costs associated with managing C corporation tax documents on airSlate SignNow?

While airSlate SignNow offers competitive pricing, any additional costs will depend on your specific usage and features. We provide a cost-effective solution for managing C corporation tax-related documents. Always check our pricing page or contact sales for more detailed information.

-

How does airSlate SignNow ensure the security of my tax documents?

Security is a top priority for airSlate SignNow, especially when managing sensitive tax documents. We utilize advanced encryption and security measures to protect your documents, ensuring compliance with C corporation tax rates and regulations. This gives businesses the confidence that their data is safe.

-

Can airSlate SignNow integrate with accounting software for managing C corporation tax rates?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions. This integration assists businesses in efficiently managing records related to C corporation tax rates, enabling more accurate financial tracking and reporting. By connecting these tools, you can simplify your tax preparation process signNowly.

-

What are the benefits of using airSlate SignNow for C corporations?

Using airSlate SignNow offers C corporations numerous benefits, including streamlined documentation, enhanced collaboration, and improved compliance with tax regulations. Our user-friendly platform helps save time and reduce errors, which is crucial for navigating C corporation tax rates. It's an essential tool for modern business operations.

Get more for 1120 Form Department Of The Treasury Internal Revenue Service A Check

- Legal last will and testament form for married person with adult children from prior marriage new mexico

- Legal last will and testament form for divorced person not remarried with adult children new mexico

- Nm last will testament form

- Legal last will and testament form for divorced person not remarried with minor children new mexico

- Legal last will and testament form for divorced person not remarried with adult and minor children new mexico

- Mutual wills package with last wills and testaments for married couple with adult children new mexico form

- Mutual wills package with last wills and testaments for married couple with no children new mexico form

- Mutual wills package with last wills and testaments for married couple with minor children new mexico form

Find out other 1120 Form Department Of The Treasury Internal Revenue Service A Check

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation