Form 1120 C U S Income Tax Return for Cooperative Associations 2024

Understanding Form 1120 C for Cooperative Associations

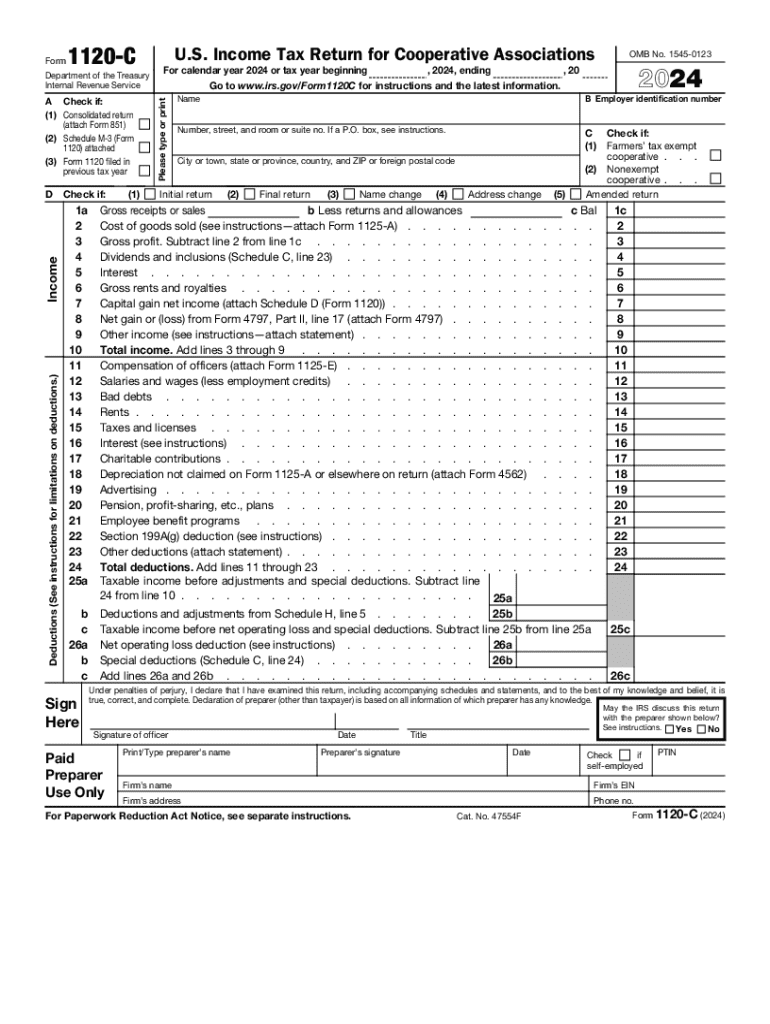

The Form 1120 C is specifically designed for cooperative associations to report their income, deductions, and tax liability to the IRS. This form is essential for cooperatives that operate as C corporations, allowing them to comply with federal tax regulations. Understanding the purpose of this form is crucial for cooperative associations to ensure accurate reporting and avoid penalties.

Steps to Complete Form 1120 C

Completing Form 1120 C involves several key steps:

- Gather necessary information: Collect all financial records, including income statements, expense reports, and previous tax returns.

- Fill out the form: Enter the cooperative's income, deductions, and credits accurately in the designated sections of the form.

- Review calculations: Ensure that all calculations are correct, especially for taxable income and tax liability.

- Attach required schedules: Include any necessary schedules, such as the Schedule C, which details income and deductions.

- Sign and date the form: Ensure that the form is signed by an authorized representative of the cooperative.

Key Elements of Form 1120 C

Form 1120 C includes several critical sections that cooperatives must complete:

- Income section: Report total income, including sales and other revenue sources.

- Deductions section: List all allowable deductions, such as operating expenses, salaries, and interest paid.

- Tax computation: Calculate the total tax owed based on the taxable income.

- Schedule C: Provide detailed information about the cooperative's income and deductions, which supports the main form.

Filing Deadlines for Form 1120 C

Cooperative associations must adhere to specific filing deadlines for Form 1120 C:

- Annual filing: The form is typically due on the fifteenth day of the fourth month following the end of the cooperative's tax year.

- Extensions: Cooperatives may file for an extension, which allows an additional six months to submit the form, but any taxes owed must still be paid by the original deadline.

IRS Guidelines for Form 1120 C

The IRS provides detailed guidelines for completing and filing Form 1120 C. These guidelines include:

- Eligibility criteria: Only cooperatives operating as C corporations can use this form.

- Filing methods: Cooperatives can file electronically or submit a paper version of the form.

- Recordkeeping: Maintain accurate records to support all entries on the form, as the IRS may request documentation during audits.

Penalties for Non-Compliance

Failure to file Form 1120 C on time or inaccuracies in the form can result in significant penalties:

- Late filing penalties: Cooperatives may incur penalties for failing to file by the deadline, which can accumulate over time.

- Accuracy-related penalties: Incorrect information may lead to additional taxes owed and further penalties.

Handy tips for filling out Form 1120 C U S Income Tax Return For Cooperative Associations online

Quick steps to complete and e-sign Form 1120 C U S Income Tax Return For Cooperative Associations online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a HIPAA and GDPR compliant platform for optimum straightforwardness. Use signNow to electronically sign and send Form 1120 C U S Income Tax Return For Cooperative Associations for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct form 1120 c u s income tax return for cooperative associations

Create this form in 5 minutes!

How to create an eSignature for the form 1120 c u s income tax return for cooperative associations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the current c corporation tax rates?

The current c corporation tax rates in the United States are set at a flat rate of 21%. This rate applies to all taxable income earned by C corporations, making it essential for businesses to understand how these rates impact their overall tax liability.

-

How do c corporation tax rates affect my business decisions?

C corporation tax rates can signNowly influence business decisions, including reinvestment strategies and dividend distributions. Understanding these rates helps businesses plan their finances effectively and optimize their tax obligations.

-

Are there any deductions available that can lower c corporation tax rates?

Yes, there are several deductions available that can help lower c corporation tax rates. Common deductions include business expenses, employee salaries, and certain types of investments, which can reduce taxable income and ultimately lower tax liabilities.

-

How does airSlate SignNow help with managing c corporation tax rates?

airSlate SignNow streamlines document management, making it easier for businesses to keep track of financial records and tax-related documents. By simplifying the eSigning process, businesses can ensure timely submissions and compliance with regulations related to c corporation tax rates.

-

What features does airSlate SignNow offer for tax documentation?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are crucial for managing tax documentation. These features help businesses maintain accurate records and ensure compliance with c corporation tax rates.

-

Can airSlate SignNow integrate with accounting software to manage c corporation tax rates?

Yes, airSlate SignNow can integrate with various accounting software solutions, allowing businesses to manage their financial data efficiently. This integration helps streamline the process of calculating and reporting c corporation tax rates.

-

What are the benefits of using airSlate SignNow for c corporations?

Using airSlate SignNow provides c corporations with a cost-effective solution for document management and eSigning. This efficiency not only saves time but also helps ensure compliance with c corporation tax rates, ultimately benefiting the bottom line.

Get more for Form 1120 C U S Income Tax Return For Cooperative Associations

Find out other Form 1120 C U S Income Tax Return For Cooperative Associations

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter