Form 1120 C U S Income Tax Return for Cooperative Associations 2010

What is the Form 1120 C U S Income Tax Return For Cooperative Associations

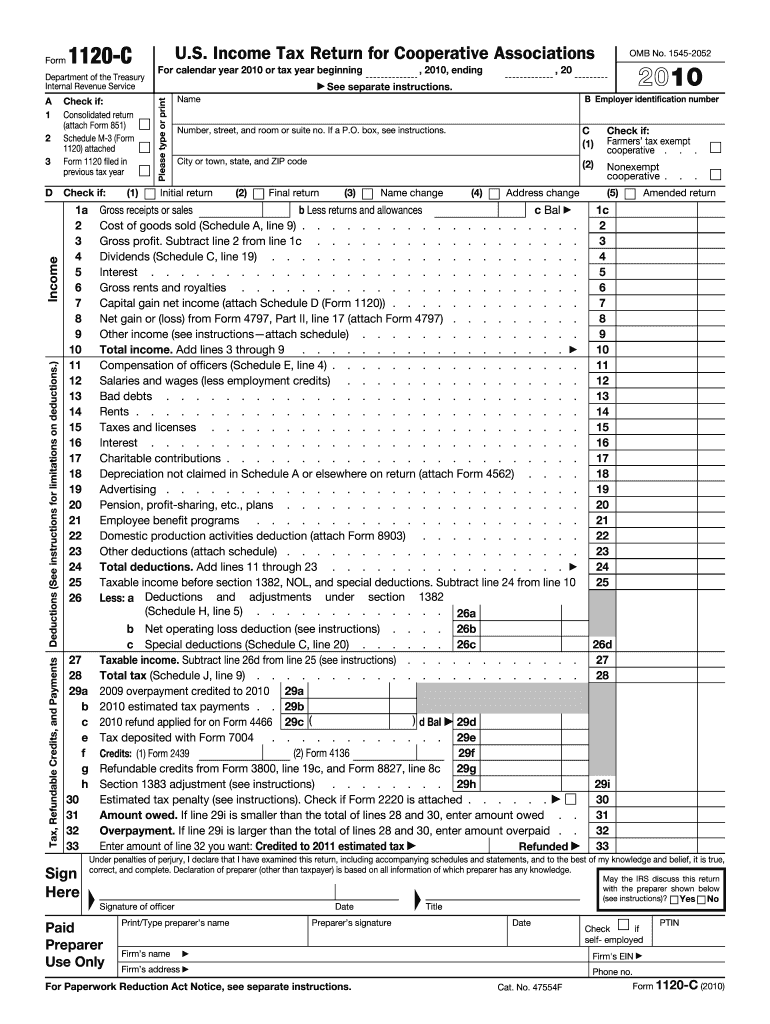

The Form 1120 C U S Income Tax Return for Cooperative Associations is a tax document specifically designed for cooperative associations operating within the United States. This form is used by cooperatives to report their income, gains, losses, deductions, and credits to the Internal Revenue Service (IRS). Cooperative associations, which are member-owned organizations that provide services or products to their members, must file this form annually to comply with federal tax regulations. The form ensures that cooperatives are taxed appropriately based on their unique financial structures and operational models.

Steps to complete the Form 1120 C U S Income Tax Return For Cooperative Associations

Completing the Form 1120 C U S Income Tax Return involves several key steps:

- Gather financial records: Collect all necessary financial documents, including income statements, balance sheets, and records of deductions and credits.

- Fill out the form: Enter your cooperative's identifying information, such as name, address, and Employer Identification Number (EIN). Provide details on income, deductions, and credits as required.

- Calculate tax liability: Use the information provided to determine your cooperative's tax liability based on the applicable tax rates.

- Review for accuracy: Ensure all information is complete and accurate to avoid potential issues with the IRS.

- Sign and date the form: The form must be signed by an authorized officer of the cooperative.

Legal use of the Form 1120 C U S Income Tax Return For Cooperative Associations

The legal use of the Form 1120 C U S Income Tax Return is essential for cooperative associations to maintain compliance with federal tax laws. Filing this form accurately and on time helps avoid penalties and ensures that the cooperative is taxed appropriately. The form must be submitted in accordance with IRS guidelines, which stipulate the required information and filing procedures. Failure to file or inaccuracies can lead to legal consequences, including fines and audits.

Filing Deadlines / Important Dates

Cooperative associations must adhere to specific filing deadlines for the Form 1120 C U S Income Tax Return. Generally, the form is due on the fifteenth day of the fourth month following the end of the cooperative's tax year. For cooperatives operating on a calendar year, this typically means the due date is April 15. It is crucial for associations to mark these deadlines on their calendars to ensure timely submission and avoid penalties.

Required Documents

To complete the Form 1120 C U S Income Tax Return, cooperative associations need to prepare several documents, including:

- Financial statements: Income statements and balance sheets that reflect the cooperative's financial position.

- Records of income: Documentation of all income earned during the tax year.

- Deduction records: Evidence of any deductions the cooperative intends to claim.

- Previous tax returns: Copies of prior year returns may be helpful for reference.

Form Submission Methods

The Form 1120 C U S Income Tax Return can be submitted through various methods to accommodate the preferences of cooperative associations. These methods include:

- Online filing: Many cooperatives choose to file electronically using IRS-approved software, which can streamline the process and reduce errors.

- Mail: Associations can also print the completed form and send it via postal service to the appropriate IRS address.

- In-person submission: Some cooperatives may opt to submit their forms in person at designated IRS offices, though this method is less common.

Quick guide on how to complete 2010 form 1120 c us income tax return for cooperative associations

Effortlessly Prepare Form 1120 C U S Income Tax Return For Cooperative Associations on Any Device

Online document management has gained traction among businesses and individuals. It offers a superb eco-friendly alternative to traditional printed and signed documents, allowing users to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Form 1120 C U S Income Tax Return For Cooperative Associations on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The Easiest Way to Modify and Electronically Sign Form 1120 C U S Income Tax Return For Cooperative Associations Without Stress

- Obtain Form 1120 C U S Income Tax Return For Cooperative Associations and then click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize pertinent portions of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for such tasks.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional handwritten signature.

- Verify the details and then click the Done button to finalize your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 1120 C U S Income Tax Return For Cooperative Associations to ensure clear communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 form 1120 c us income tax return for cooperative associations

Create this form in 5 minutes!

How to create an eSignature for the 2010 form 1120 c us income tax return for cooperative associations

The way to make an eSignature for a PDF document in the online mode

The way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What is the Form 1120 C U S Income Tax Return For Cooperative Associations?

The Form 1120 C U S Income Tax Return For Cooperative Associations is a tax form specifically designed for cooperative associations to report their income, gains, losses, and deductions to the IRS. Understanding this form is essential for cooperative entities to ensure compliance with federal tax regulations and avoid penalties.

-

How can airSlate SignNow help with the Form 1120 C U S Income Tax Return For Cooperative Associations?

airSlate SignNow offers an easy-to-use platform for sending and electronically signing your Form 1120 C U S Income Tax Return For Cooperative Associations. Our solution allows for seamless document management, ensuring that all necessary signatures are obtained quickly and securely.

-

What are the pricing options for using airSlate SignNow for my tax forms?

airSlate SignNow provides a range of pricing plans to accommodate various business needs. Whether you’re a small cooperative or a larger association, our competitive pricing allows you to effectively manage your Form 1120 C U S Income Tax Return For Cooperative Associations without breaking the bank.

-

Are there any features in airSlate SignNow that support signing tax documents like Form 1120 C U S Income Tax Return For Cooperative Associations?

Yes, airSlate SignNow includes a variety of features aimed at enhancing the signing process for tax documents. Features such as templates, in-person signing, and real-time tracking make it easier to manage your Form 1120 C U S Income Tax Return For Cooperative Associations efficiently.

-

Can I integrate airSlate SignNow with other software I use for accounting?

Absolutely! airSlate SignNow can be integrated with various accounting and financial software, making it easier to manage your documents, including the Form 1120 C U S Income Tax Return For Cooperative Associations, all in one place. Ensure a smooth workflow by integrating with platforms like QuickBooks and Xero.

-

What are the benefits of using airSlate SignNow for Form 1120 C U S Income Tax Return For Cooperative Associations?

Using airSlate SignNow for your Form 1120 C U S Income Tax Return For Cooperative Associations offers numerous benefits, including improved compliance, reduced processing time, and enhanced security. Our platform makes it simple to collect eSignatures and store your documents safely in the cloud.

-

Is airSlate SignNow compliant with e-signature laws for tax documents?

Yes, airSlate SignNow is fully compliant with all relevant e-signature laws, including the ESIGN Act and UETA. This compliance ensures that your Form 1120 C U S Income Tax Return For Cooperative Associations can be legally signed and submitted electronically, streamlining your tax filing process.

Get more for Form 1120 C U S Income Tax Return For Cooperative Associations

- Financial statements only in connection with prenuptial premarital agreement idaho form

- Revocation of premarital or prenuptial agreement idaho form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children idaho form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497305388 form

- Idaho pre incorporation agreement shareholders agreement and confidentiality agreement idaho form

- Idaho bylaws form

- Corporate records maintenance package for existing corporations idaho form

- Idaho operating form

Find out other Form 1120 C U S Income Tax Return For Cooperative Associations

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document