Form 1120 2018

What is the Form 1120

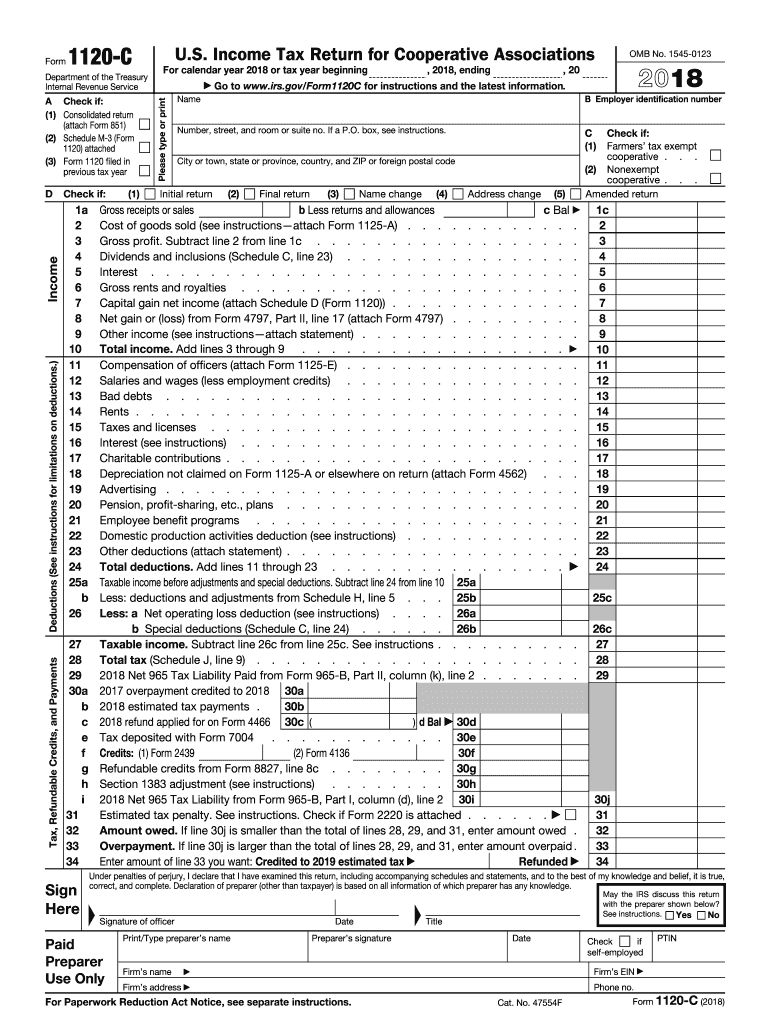

The Form 1120 is the U.S. Corporation Income Tax Return used by C corporations to report their income, gains, losses, deductions, and credits. This form is essential for corporations operating in the United States, as it provides the IRS with a comprehensive overview of the corporation's financial activities for the tax year. The information reported on the Form 1120 is used to calculate the corporation's tax liability, which is based on the taxable income derived from its operations.

Steps to complete the Form 1120

Completing the Form 1120 involves several key steps to ensure accuracy and compliance with IRS requirements. First, gather all necessary financial documents, including income statements and balance sheets. Next, fill out the form by providing details such as the corporation's name, address, and Employer Identification Number (EIN). It is crucial to accurately report all income and deductions, as this information directly impacts the tax owed. After completing the form, review it thoroughly for any errors or omissions before submission.

Filing Deadlines / Important Dates

The deadline for filing the Form 1120 is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April fifteenth. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations may also request a six-month extension to file, but this does not extend the time to pay any tax owed.

Form Submission Methods (Online / Mail / In-Person)

Corporations can submit the Form 1120 through various methods. The IRS allows electronic filing for most corporations, which is often the fastest and most efficient method. Alternatively, corporations can mail the completed form to the appropriate IRS address based on their location. In-person submissions are generally not accepted, as the IRS encourages electronic and mail submissions for efficiency. It is important to retain a copy of the submitted form for your records.

Legal use of the Form 1120

The Form 1120 must be used in accordance with IRS regulations to ensure its legal validity. Corporations are required to file this form annually, reporting their income and expenses accurately. Failure to comply with filing requirements can lead to penalties, including fines and interest on unpaid taxes. It is essential for corporations to keep detailed records and documentation to support the information reported on the form, as the IRS may request this information during audits.

Key elements of the Form 1120

Several key elements are included in the Form 1120 that are critical for accurate reporting. These include the corporation's gross income, deductions, tax credits, and the calculation of taxable income. Additionally, the form requires the disclosure of any dividends received and the corporation's total tax liability. Understanding these elements is vital for ensuring that the form is completed correctly and that the corporation meets its tax obligations.

Quick guide on how to complete form 1120 c 2018 2019

Discover the simplest method to complete and sign your Form 1120

Are you still spending time preparing your formal paperwork on paper instead of handling it online? airSlate SignNow offers a superior way to complete and sign your Form 1120 and similar forms for public services. Our intelligent electronic signature solution equips you with everything necessary to manage documents swiftly and in compliance with official standards - robust PDF editing, managing, securing, signing, and sharing tools all accessible within a user-friendly interface.

Only a few steps are needed to complete and sign your Form 1120:

- Upload the editable template to the editor using the Get Form button.

- Verify the information you need to supply in your Form 1120.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Update the content with Text boxes or Images from the top menu.

- Emphasize what is important or Blackout sections that are no longer relevant.

- Click on Sign to create a legally valid electronic signature using any method you prefer.

- Add the Date next to your signature and conclude your task with the Done button.

Store your completed Form 1120 in the Documents folder within your account, download it, or transfer it to your chosen cloud storage. Our service also offers versatile form sharing options. There’s no need to print your forms when you need to submit them to the appropriate public office - send them via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try now!

Create this form in 5 minutes or less

Find and fill out the correct form 1120 c 2018 2019

FAQs

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

How should one fill out Form 1120 for a company with no activity and no income and that has not issued shares?

You put all zeros in for revenue and expenses. Even though the corporation has not formally issued shares, someone or several individuals or entities own the common stock of the corporation and you need to report anyone who owns more than 20% of the corporation.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

How do I fill out a 1120 tax report?

If you are not sophisticated with taxes, DON'T try this form. You can get yourself in a lot of trouble. Get a good CPA or EA. The time and effort it will take you to figure this thing out is not worth it. If you value your time at more than the minimum wage, you will save time and money by hiring a professional.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the form 1120 c 2018 2019

How to make an eSignature for your Form 1120 C 2018 2019 online

How to make an eSignature for your Form 1120 C 2018 2019 in Google Chrome

How to generate an electronic signature for putting it on the Form 1120 C 2018 2019 in Gmail

How to make an eSignature for the Form 1120 C 2018 2019 straight from your smart phone

How to create an electronic signature for the Form 1120 C 2018 2019 on iOS

How to generate an eSignature for the Form 1120 C 2018 2019 on Android devices

People also ask

-

What is Form 1120 and why is it important?

Form 1120 is the U.S. Corporation Income Tax Return, used by corporations to report their income, gains, losses, deductions, and tax liability. It's crucial for compliance with federal tax regulations and ensuring accurate reporting of corporate earnings. With airSlate SignNow, you can easily eSign and manage Form 1120 digitally, simplifying the submission process.

-

How can airSlate SignNow help with completing Form 1120?

airSlate SignNow streamlines the process of completing Form 1120 by allowing users to fill out and eSign the document electronically. Our user-friendly interface makes it easy to input necessary information, ensuring you don't miss any critical details. Additionally, you can store and access your completed Form 1120 securely in one place.

-

What are the pricing options for using airSlate SignNow to manage Form 1120?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you need basic eSigning features or advanced document management for Form 1120, our plans are designed to be cost-effective. Check our website for detailed pricing information and find the perfect fit for your needs.

-

Can I integrate airSlate SignNow with other software for managing Form 1120?

Yes, airSlate SignNow seamlessly integrates with various popular software applications, enhancing your workflow for managing Form 1120. Whether you use cloud storage services or accounting software, our integrations ensure that you can easily access and send your Form 1120 without hassle.

-

Is airSlate SignNow secure for eSigning Form 1120?

Absolutely! airSlate SignNow prioritizes the security of your documents, including Form 1120. We use advanced encryption and compliance measures to ensure that your sensitive tax information is protected during the eSigning process.

-

What features does airSlate SignNow offer for Form 1120 management?

airSlate SignNow provides a range of features specifically designed for efficient management of Form 1120. You can create templates, set reminders for filing deadlines, and track the status of your documents, ensuring that you stay organized and compliant with tax regulations.

-

How does airSlate SignNow improve the efficiency of filing Form 1120?

By using airSlate SignNow, you can signNowly improve the efficiency of filing Form 1120 by reducing paperwork and streamlining the eSignature process. Our platform allows for quick collaboration between team members, ensuring that your Form 1120 is completed and filed on time.

Get more for Form 1120

- Sv 260 california courts state of california courts ca form

- Sv 710 notice of hearing to renew restraining california courts courts ca form

- Sv 250 proof of service of response by mail judicial council forms courts ca

- Massachusetts state lottery commission license application booklet supporting the 351 cities and towns of massachusetts timothy form

- Schedule ca540 california adjustments residents ftb 3885a depreciation and amortization adjustments schedule d540 california form

- California schedule k 1 568 form

- Form 5000 transaction privilege tax exemption certificate

- Form 1099 r 779271410

Find out other Form 1120

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online