Form 5498 IRA Contribution Information 2024-2026

What is the Form 5498 IRA Contribution Information

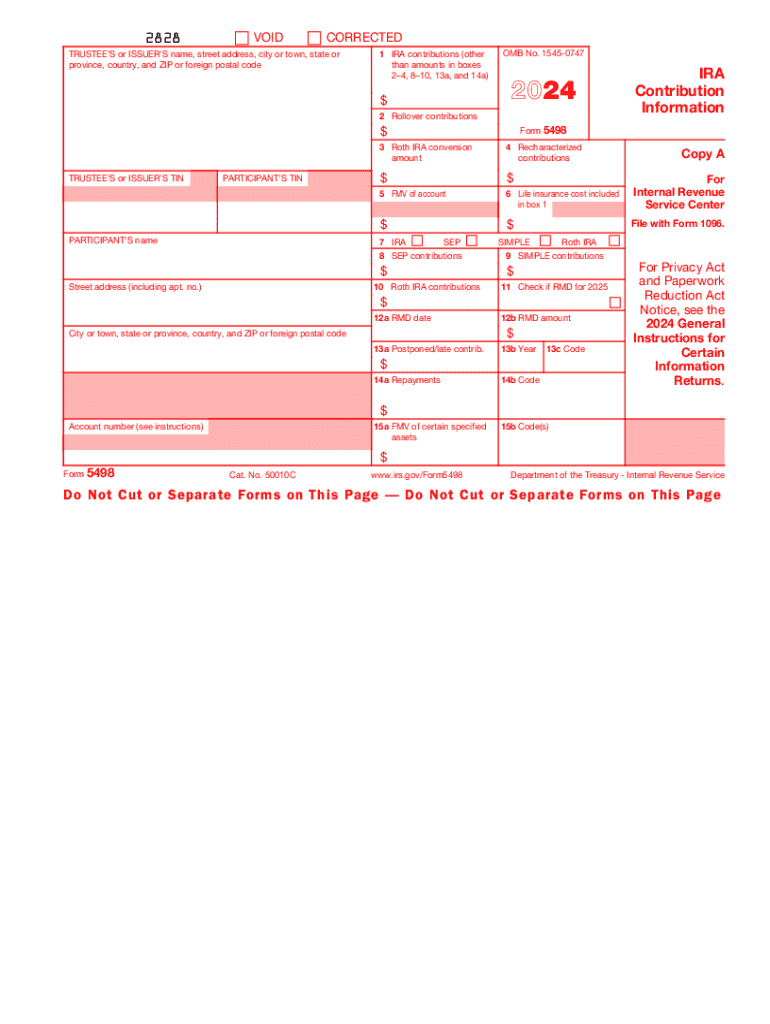

The Form 5498 is an important document used to report contributions to Individual Retirement Accounts (IRAs). It provides essential information regarding the total contributions made to an IRA for a specific tax year, as well as the fair market value of the account at year-end. This form is crucial for both the account holder and the IRS, as it helps track contributions and ensures compliance with contribution limits set by the IRS.

The form includes details such as the type of IRA (traditional, Roth, or SEP), the amounts contributed, and any rollovers or conversions that may have occurred during the year. Understanding this form is vital for accurately reporting retirement contributions on your tax return.

How to use the Form 5498 IRA Contribution Information

Using the Form 5498 involves understanding its contents and how they relate to your tax obligations. Once you receive this form from your IRA custodian or trustee, you should review it carefully to ensure all information is accurate. The amounts reported on the form will help you determine your eligibility for tax deductions or credits related to your IRA contributions.

When preparing your tax return, you will need to reference the information on Form 5498, particularly if you are claiming a deduction for traditional IRA contributions. For Roth IRAs, while contributions are not deductible, the form is still necessary for tracking contributions and ensuring compliance with income limits.

Steps to complete the Form 5498 IRA Contribution Information

Completing the Form 5498 involves several steps, though typically, the form is filled out by your IRA custodian. However, understanding the process can be beneficial:

- Gather your contribution records for the tax year, including any rollover or conversion documentation.

- Confirm the type of IRA account you have and the contributions made during the year.

- Ensure that the fair market value of your IRA is accurately reported as of December 31 of the tax year.

- Double-check that all personal information, such as your name and Social Security number, is correct.

After confirming the information, keep the form for your records, as you may need it for future tax filings or when withdrawing funds from your IRA.

IRS Guidelines

The IRS has specific guidelines regarding the use of Form 5498. According to IRS rules, custodians must file this form for each IRA account holder by May 31 of the year following the tax year in which contributions were made. It is important for account holders to receive this form to ensure that all contributions are reported accurately.

The IRS also stipulates that taxpayers should keep Form 5498 with their tax records, as it serves as proof of contributions made to their IRA accounts. This documentation is essential for verifying contributions if questions arise during an audit or review.

Filing Deadlines / Important Dates

Understanding the filing deadlines for Form 5498 is crucial for compliance. The IRS requires that custodians file this form by May 31 of the year following the tax year in which contributions were made. For example, if you made contributions in 2023, the form must be filed by May 31, 2024.

It is also important to note that while the form must be filed by the custodian, you as the account holder should ensure that you have received it by this date. If you do not receive your Form 5498, it is advisable to contact your IRA custodian to obtain a copy.

Key elements of the Form 5498 IRA Contribution Information

The Form 5498 contains several key elements that are essential for understanding your IRA contributions:

- Contributions reported: This includes all contributions made to your IRA during the tax year.

- Fair market value: The value of your IRA account as of December 31, which is critical for tracking growth and compliance.

- Type of IRA: The form specifies whether the account is a traditional IRA, Roth IRA, or other types.

- Rollover amounts: Any amounts rolled over into the IRA from other retirement accounts are also reported.

These elements help provide a comprehensive view of your retirement savings and ensure that you remain compliant with IRS regulations.

Create this form in 5 minutes or less

Find and fill out the correct form 5498 ira contribution information

Create this form in 5 minutes!

How to create an eSignature for the form 5498 ira contribution information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the maximum IRA amount I can see with airSlate SignNow?

The maximum IRA amount you can see with airSlate SignNow depends on your account type and the specific features you choose. Our platform allows you to manage and view various IRA amounts seamlessly, ensuring you have all the necessary information at your fingertips.

-

How does airSlate SignNow help me track my IRA amount?

With airSlate SignNow, you can easily track your IRA amount through our intuitive dashboard. The platform provides real-time updates and notifications, allowing you to stay informed about your IRA status and any changes that may occur.

-

Are there any costs associated with viewing my IRA amount on airSlate SignNow?

Viewing your IRA amount on airSlate SignNow is included in our subscription plans, which are designed to be cost-effective. We offer various pricing tiers to suit different business needs, ensuring you can access your IRA information without any hidden fees.

-

What features does airSlate SignNow offer for managing IRA amounts?

airSlate SignNow offers a range of features for managing IRA amounts, including document eSigning, secure storage, and easy sharing options. These features streamline the process of handling your IRA documents, making it easier to see and manage your IRA amount.

-

Can I integrate airSlate SignNow with other financial tools to see my IRA amount?

Yes, airSlate SignNow can be integrated with various financial tools and platforms, allowing you to see your IRA amount alongside other financial data. This integration enhances your ability to manage your finances effectively and keep track of your IRA.

-

What are the benefits of using airSlate SignNow for IRA management?

Using airSlate SignNow for IRA management provides numerous benefits, including enhanced security, ease of use, and cost savings. You can easily see your IRA amount and manage your documents without the hassle of traditional methods.

-

Is airSlate SignNow suitable for both individuals and businesses looking to see IRA amounts?

Absolutely! airSlate SignNow is designed to cater to both individuals and businesses, making it easy for anyone to see their IRA amount. Our platform is flexible and scalable, ensuring it meets the needs of various users.

Get more for Form 5498 IRA Contribution Information

Find out other Form 5498 IRA Contribution Information

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now