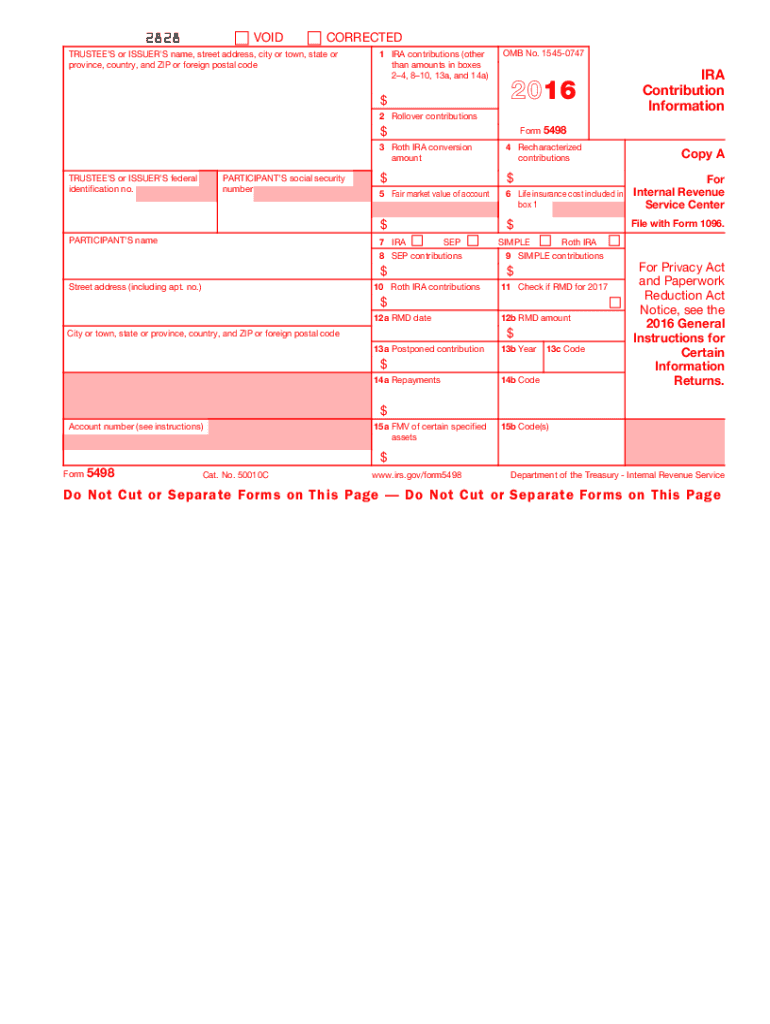

Form 5498 2016

What is the Form 5498

The Form 5498 is an informational tax form used in the United States to report contributions to individual retirement accounts (IRAs), including traditional IRAs, Roth IRAs, and SEP IRAs. It is also used to report the fair market value of these accounts at the end of the year. The form is essential for both the IRS and taxpayers, as it helps ensure that contributions are accurately reported and that taxpayers comply with contribution limits and other regulations.

How to use the Form 5498

To use the Form 5498 effectively, taxpayers should first understand its purpose and the information it contains. The form is typically issued by financial institutions that manage IRAs. Taxpayers should review the form to verify the accuracy of the reported contributions and account values. This information is crucial for completing tax returns, as it helps individuals determine their eligibility for tax deductions or credits related to their retirement accounts.

Steps to complete the Form 5498

Completing the Form 5498 involves several key steps:

- Gather necessary information, including account details and contribution amounts.

- Fill out the form with accurate data, ensuring all required fields are completed.

- Double-check the entries for accuracy, particularly the Social Security number and account numbers.

- Submit the form to the IRS by the designated deadline, usually by May 31 of the year following the tax year.

Legal use of the Form 5498

The legal use of the Form 5498 is governed by IRS regulations. It is important for taxpayers to ensure that the information reported on the form is complete and accurate to avoid penalties. The form serves as a record of contributions and account values, which can be crucial in case of an audit. Additionally, using the form correctly helps maintain compliance with retirement account rules and regulations.

Filing Deadlines / Important Dates

Taxpayers should be aware of the key deadlines associated with the Form 5498. The form must be filed with the IRS by May 31 of the year following the tax year. This deadline allows taxpayers to report contributions made during the previous year. Additionally, it is important to keep track of any changes in IRS regulations that may affect filing dates or requirements.

Who Issues the Form

The Form 5498 is typically issued by financial institutions that manage individual retirement accounts. This includes banks, brokerage firms, and other entities that handle IRA accounts. Taxpayers should expect to receive their Form 5498 from their financial institution by the end of May each year, reflecting contributions made during the previous tax year.

Quick guide on how to complete 2016 form 5498

Complete Form 5498 effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, amend, and electronically sign your files quickly and without interruptions. Manage Form 5498 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

How to revise and eSign Form 5498 with ease

- Find Form 5498 and then select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive details with tools specifically offered by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choosing. Alter and eSign Form 5498 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 5498

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 5498

How to make an electronic signature for the 2016 Form 5498 in the online mode

How to create an electronic signature for the 2016 Form 5498 in Chrome

How to make an electronic signature for signing the 2016 Form 5498 in Gmail

How to create an eSignature for the 2016 Form 5498 from your smartphone

How to generate an electronic signature for the 2016 Form 5498 on iOS

How to create an electronic signature for the 2016 Form 5498 on Android devices

People also ask

-

What is Form 5498 and why is it important?

Form 5498 is an IRS tax form that reports contributions to Individual Retirement Accounts (IRAs). It is important because it helps taxpayers, financial institutions, and the IRS track contributions, rollovers, and required minimum distributions. Ensuring accurate filing of Form 5498 is crucial for tax compliance and can impact your retirement savings.

-

How can airSlate SignNow help with completing Form 5498?

airSlate SignNow simplifies the process of completing Form 5498 by providing a user-friendly platform for eSigning and sharing documents securely. With its intuitive interface, you can easily fill out the necessary fields and send the form to relevant parties, ensuring that your Form 5498 is completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for Form 5498?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Depending on the features you require, you can choose a plan that fits your budget. The platform provides an affordable solution for managing documents, including Form 5498, without compromising on quality or security.

-

What features does airSlate SignNow offer for managing Form 5498?

airSlate SignNow includes features such as customizable templates, real-time collaboration, and secure cloud storage, which are beneficial for managing Form 5498. You can create and save templates for the form, ensuring that you have quick access to the necessary fields each tax season, enhancing your productivity.

-

Can I integrate airSlate SignNow with other software for filing Form 5498?

Absolutely! airSlate SignNow offers seamless integrations with various software solutions such as CRM systems and accounting software. This allows you to streamline your workflow for filing Form 5498, ensuring that all your financial data is cohesive and easily accessible.

-

How does airSlate SignNow ensure the security of Form 5498 documents?

airSlate SignNow prioritizes document security by employing advanced encryption protocols and secure cloud storage. All documents, including Form 5498, are protected against unauthorized access, ensuring that sensitive information remains confidential and compliant with regulatory standards.

-

What benefits can I expect from using airSlate SignNow for Form 5498 management?

Using airSlate SignNow for managing Form 5498 offers numerous benefits, including increased efficiency, reduced errors, and enhanced compliance. The platform enables you to quickly prepare, sign, and submit the form, minimizing the time spent on paperwork and allowing you to focus on your financial goals.

Get more for Form 5498

Find out other Form 5498

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure