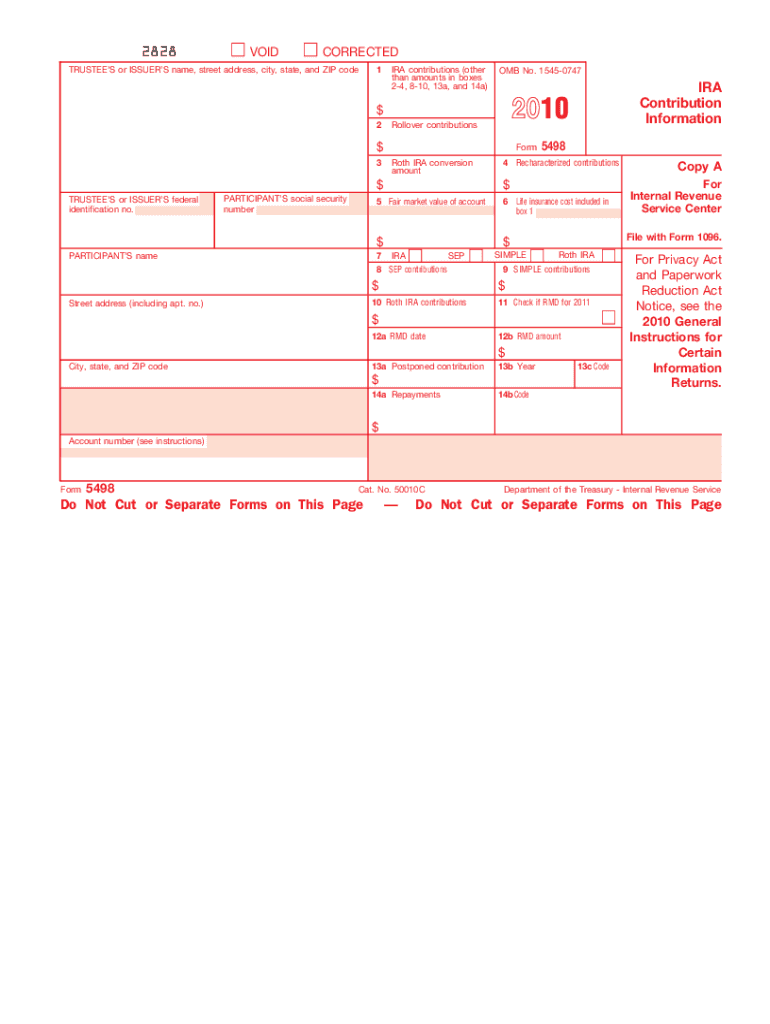

5498 Form 2010

What is the 5498 Form

The 5498 Form is an informational document used by the Internal Revenue Service (IRS) to report contributions to individual retirement accounts (IRAs). It is primarily utilized by financial institutions to report various types of contributions, including traditional IRAs, Roth IRAs, and SEP IRAs. The form provides essential details such as the total contributions made during the tax year, the fair market value of the account at year-end, and any rollovers or conversions that occurred. This form is crucial for taxpayers as it helps them track their retirement savings and ensures compliance with IRS regulations.

Steps to complete the 5498 Form

Completing the 5498 Form involves several straightforward steps. First, gather all necessary information regarding your IRA contributions for the tax year. This includes documentation of any contributions made, rollovers, and conversions. Next, accurately fill out the form, ensuring that all sections are completed, including the contributor's name, address, and taxpayer identification number. It is important to report the correct amounts in the designated fields to avoid discrepancies. Once the form is completed, it should be submitted to the IRS by the appropriate deadline, typically by May 31 of the following year, although the financial institution usually files it on behalf of the account holder.

How to obtain the 5498 Form

The 5498 Form can be obtained through various means. Financial institutions that manage your IRA accounts typically provide this form directly to you. They may send it via mail or make it available through their online platforms. If you need a copy for your records or if you have not received it, you can also download a blank version of the form from the IRS website. Ensure that you are using the correct version of the form for the specific tax year you are reporting.

Legal use of the 5498 Form

The 5498 Form serves a legal purpose by documenting contributions to IRAs, which is essential for tax reporting and compliance. It helps ensure that taxpayers adhere to contribution limits set by the IRS and provides a record that can be referenced in case of audits. Properly completing and submitting the form is vital for maintaining the tax-advantaged status of retirement accounts. Failure to comply with IRS regulations regarding the 5498 Form can lead to penalties or issues with tax filings.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 5498 Form is crucial for compliance. The form must be filed by the financial institution by May 31 of the year following the tax year in which contributions were made. However, taxpayers should be aware that they are not required to file this form with their tax returns. Instead, it is provided for informational purposes and should be kept with tax records. It is advisable to review the form for accuracy upon receipt to ensure all reported information aligns with personal records.

Key elements of the 5498 Form

The 5498 Form includes several key elements that are essential for accurate reporting. These elements typically consist of the contributor's name, address, and taxpayer identification number, as well as the type of IRA involved. Additionally, the form reports the total contributions made during the year, the fair market value of the account at year-end, and any rollovers or conversions. Understanding these elements helps taxpayers ensure that their retirement contributions are accurately documented and reported to the IRS.

Quick guide on how to complete 2010 5498 form

Complete 5498 Form effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage 5498 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign 5498 Form easily

- Obtain 5498 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Identify pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign 5498 Form and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 5498 form

Create this form in 5 minutes!

How to create an eSignature for the 2010 5498 form

The best way to create an eSignature for a PDF online

The best way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

How to generate an electronic signature for a PDF file on Android

People also ask

-

What is the 5498 Form and why is it important?

The 5498 Form is an IRS form used to report contributions to individual retirement arrangements (IRAs). It is crucial for taxpayers and financial institutions as it helps ensure accurate reporting of retirement contributions and the maintenance of tax compliance. By using airSlate SignNow, you can easily eSign and send your 5498 Form securely.

-

How can airSlate SignNow help me manage my 5498 Form?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your 5498 Form efficiently. With its intuitive interface, you can quickly upload your form, fill it out, and obtain signatures, all while ensuring compliance and security. This streamlines the process of managing your 5498 Form.

-

Is there a cost associated with using airSlate SignNow for the 5498 Form?

airSlate SignNow offers flexible pricing plans tailored to fit various business needs. You can choose a plan that suits your budget while benefiting from features that simplify the completion of your 5498 Form. Explore our pricing page to find the best option for managing your documents.

-

Can I integrate airSlate SignNow with other software for handling the 5498 Form?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow for managing the 5498 Form. You can connect it with popular tools like Google Drive, Salesforce, and more, ensuring that your document management process is streamlined and efficient.

-

What features does airSlate SignNow offer for eSigning the 5498 Form?

airSlate SignNow includes powerful features for eSigning the 5498 Form, such as customizable templates, advanced security measures, and real-time tracking. These features ensure that your document is signed quickly and securely, making the process hassle-free and compliant with IRS regulations.

-

How does airSlate SignNow ensure the security of my 5498 Form?

Security is a top priority at airSlate SignNow. We use industry-standard encryption and secure data storage to protect your sensitive information, including your 5498 Form. You can confidently send and eSign your documents, knowing that your data is safe and compliant with regulations.

-

Can I access my 5498 Form from multiple devices using airSlate SignNow?

Absolutely! airSlate SignNow is designed to be accessible from any device with internet access. Whether you're using a desktop, tablet, or smartphone, you can easily access, eSign, and manage your 5498 Form on the go.

Get more for 5498 Form

- Cenikor forms

- Tb documentation form

- Renewal by synergy cerps log american association of critical bb aacn form

- Letter of support for individuals with no income or no form

- Child care classroom refrigerator temperature log form

- Hg new wax intake form hey gorgeous waxing and skin studio

- Micropigmentation consent form

- Face to face physician encounter form

Find out other 5498 Form

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice