Form 5498 2015

What is the Form 5498

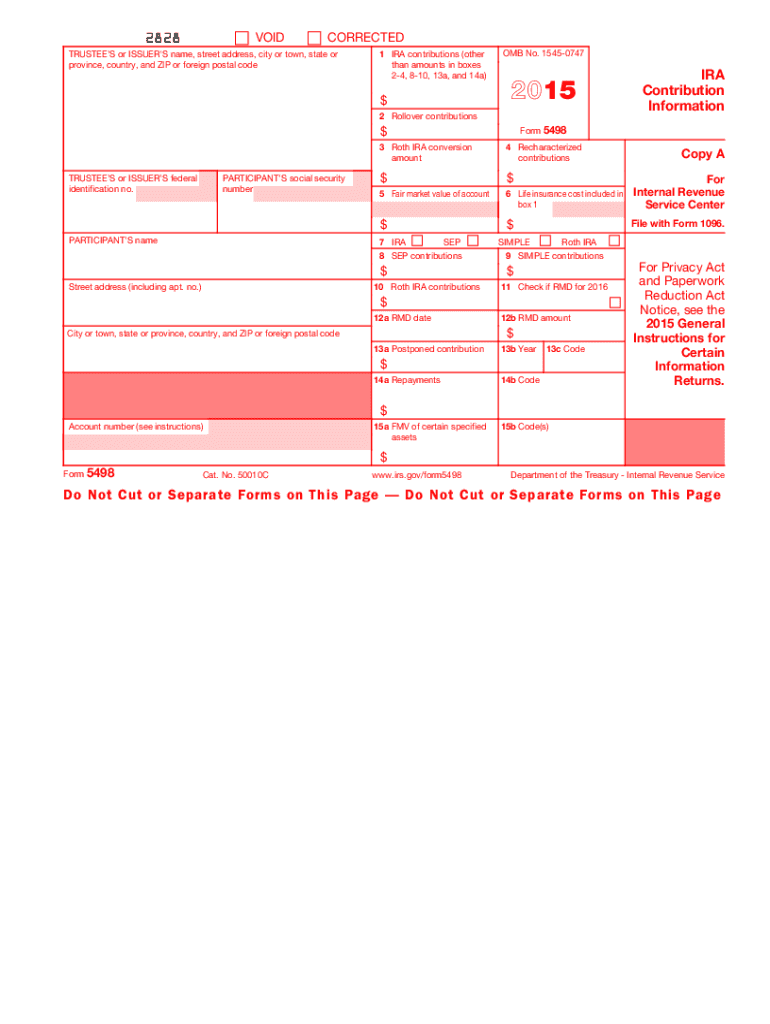

The Form 5498 is an informational tax form used in the United States to report various types of retirement accounts. This form is primarily utilized by custodians of individual retirement accounts (IRAs) to report contributions, rollovers, conversions, and required minimum distributions. The IRS requires this form to ensure that taxpayers accurately report their retirement savings and comply with tax regulations.

How to use the Form 5498

Using the Form 5498 involves several key steps. First, custodians must accurately fill out the form with information regarding the account holder's contributions and account balances. Once completed, the form is submitted to the IRS and a copy is provided to the account holder. Taxpayers use this information to verify contributions and distributions on their tax returns, ensuring compliance with IRS regulations.

Steps to complete the Form 5498

Completing the Form 5498 involves the following steps:

- Gather necessary information, including the account holder's name, Social Security number, and details about the retirement account.

- Fill in the contributions made to the IRA during the tax year, including any rollovers or conversions.

- Indicate the fair market value of the account as of December 31 of the tax year.

- Review the completed form for accuracy before submission.

- Submit the form to the IRS and provide a copy to the account holder.

Legal use of the Form 5498

The legal use of the Form 5498 is governed by IRS regulations. This form must be filled out accurately to reflect the contributions and distributions associated with retirement accounts. Failure to provide accurate information can lead to penalties for both the custodian and the account holder. It is essential to adhere to the guidelines set forth by the IRS to ensure compliance and avoid any legal issues.

Key elements of the Form 5498

Several key elements are crucial when completing the Form 5498:

- Account Holder Information: Name, address, and Social Security number of the account holder.

- Account Type: Types of accounts being reported, such as Traditional IRA, Roth IRA, or SEP IRA.

- Contributions: Total contributions made during the tax year, including any rollovers.

- Fair Market Value: The value of the account as of December 31.

- Required Minimum Distributions: Information on any distributions that must be taken by account holders over a certain age.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form 5498 is essential for compliance. The form must be filed with the IRS by May 31 of the year following the tax year being reported. Additionally, custodians are required to provide a copy of the form to the account holder by the same deadline. Keeping track of these dates helps ensure that all parties remain compliant with IRS regulations.

Quick guide on how to complete 2015 form 5498

Effortlessly prepare Form 5498 on any device

Managing documents online has become widespread among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed materials, as you can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Form 5498 on any platform using the airSlate SignNow apps for Android or iOS and streamline your document-centric workflows today.

How to modify and electronically sign Form 5498 with ease

- Obtain Form 5498 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Craft your signature using the Sign tool, which takes just moments and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to store your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, time-consuming form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 5498 to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 5498

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 5498

How to create an electronic signature for a PDF file in the online mode

How to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

The best way to create an eSignature for a PDF file on Android

People also ask

-

What is Form 5498 and why is it important?

Form 5498 is an IRS form used to report contributions to Individual Retirement Accounts (IRAs). It is crucial for account holders to ensure their contributions are accurately reported to avoid penalties. airSlate SignNow provides a seamless way to eSign and manage documents related to Form 5498 efficiently.

-

How can airSlate SignNow help with Form 5498 submissions?

airSlate SignNow simplifies the process of preparing and submitting Form 5498. You can easily eSign and share the document with relevant parties, ensuring quick compliance and accuracy in reporting. Our platform makes keeping track of such important documents straightforward.

-

Is there a cost associated with using airSlate SignNow for Form 5498?

Yes, there are pricing plans available for airSlate SignNow that cater to various business needs. Each plan is designed to be cost-effective while providing full access to features that facilitate the eSigning of Form 5498 and other important documents. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing Form 5498?

airSlate SignNow offers features such as custom templates, status tracking, and reminders for Form 5498 submissions. These tools enhance your workflow efficiency and ensure that you never miss a deadline. Our platform also enables the safe storage of signed documents for easy retrieval.

-

Can I integrate airSlate SignNow with other applications for Form 5498 management?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline the process of handling Form 5498. Whether you are using accounting software or CRM tools, our platform can connect with them to enhance your document workflows.

-

How secure is airSlate SignNow for processing Form 5498?

airSlate SignNow prioritizes security, ensuring that your Form 5498 and other sensitive documents are protected. We use advanced encryption, secure storage solutions, and access controls to safeguard your information, providing peace of mind for you and your clients.

-

Is there customer support available for issues related to Form 5498?

Yes, airSlate SignNow offers robust customer support to assist users with any issues related to Form 5498 or other functionalities. Our support team is available via chat, email, or phone to ensure you have the help you need for a smooth eSigning experience.

Get more for Form 5498

- Provider after the policy holder has completed and signed please forward this form

- Training source book volume i by federal buyers guide form

- Certified nurse midwife and form

- Request to surrender policy massmutual logintmp form

- Fax completed form to 617 246 5053

- Pt ot slp contracting application provider central form

- Mpc031918 1y 1 f physician group application 419 request for taxpayer identification number and certification form

- Mpc120915 5w cnm cnp contracting application 419 request for taxpayer identification number and certification form

Find out other Form 5498

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement