5498 Form 2011

What is the 5498 Form

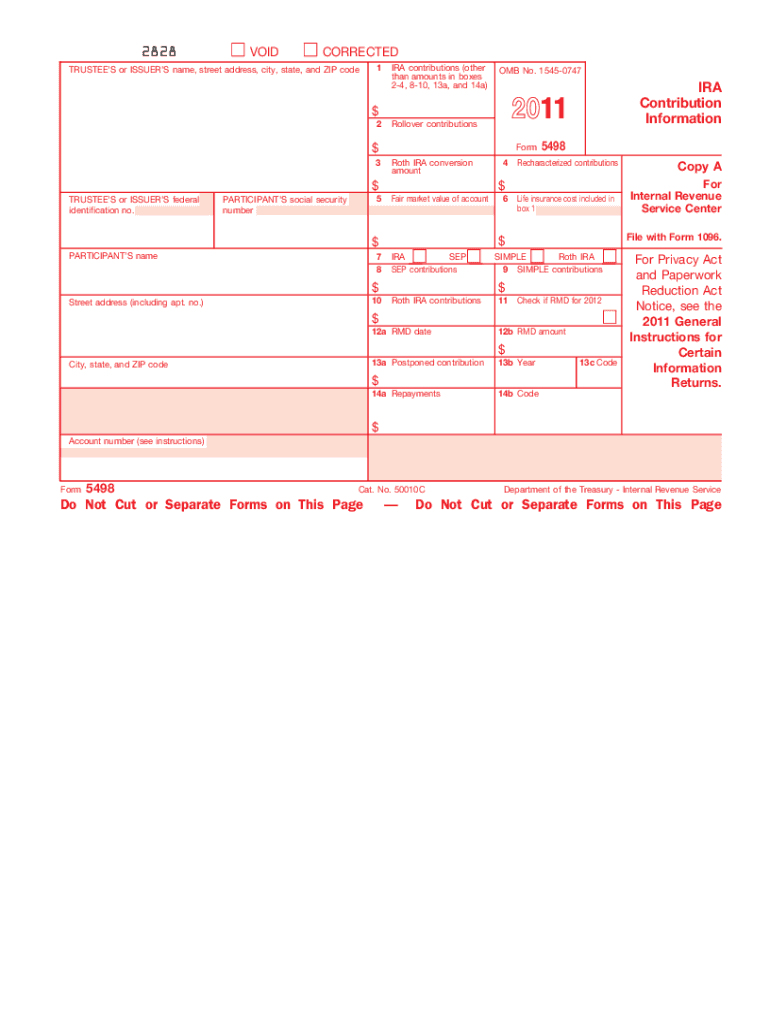

The 5498 Form is an IRS document used to report contributions to individual retirement accounts (IRAs), including traditional IRAs, Roth IRAs, and simplified employee pension (SEP) IRAs. Financial institutions are responsible for filing this form on behalf of account holders. It provides essential information regarding the total contributions made during the tax year, the fair market value of the account at year-end, and any rollovers or conversions that occurred. This form is crucial for taxpayers to accurately report their retirement savings and ensure compliance with IRS regulations.

How to obtain the 5498 Form

The 5498 Form can be obtained directly from your financial institution or the IRS website. Most financial institutions automatically provide this form to account holders by May 31 of each year. If you need a copy for your records or for tax preparation, you can also download it from the IRS website. Ensure that you have the correct tax year version, as forms may vary slightly from year to year.

Steps to complete the 5498 Form

Completing the 5498 Form involves several steps to ensure accuracy:

- Gather necessary information: Collect details about your IRA contributions, including the type of IRA and the amounts contributed during the tax year.

- Fill in personal information: Enter your name, address, and Social Security number in the designated fields.

- Report contributions: Indicate the total contributions made to your IRA, including any rollover contributions or conversions.

- Review for accuracy: Double-check all entries to ensure they are correct and complete.

- Submit the form: If you are filing it yourself, follow the submission guidelines provided by the IRS.

Legal use of the 5498 Form

The 5498 Form serves as an official record for the IRS regarding your retirement account contributions. It is legally binding and must be completed accurately to reflect your financial activities. The form helps ensure compliance with tax laws, and discrepancies can lead to penalties. It is essential to retain a copy of the form for your records, as it may be needed for future tax filings or audits.

Filing Deadlines / Important Dates

The deadline for financial institutions to file the 5498 Form with the IRS is typically May 31 of each year. However, account holders should keep in mind that contributions to IRAs can be made until the tax filing deadline, which is usually April 15. This means that if you make contributions close to the deadline, you may receive your 5498 Form after you have already filed your taxes. It is advisable to keep track of contributions and consult the form when preparing your tax return.

Form Submission Methods (Online / Mail / In-Person)

The 5498 Form can be submitted in various ways, depending on whether you are the financial institution or the account holder. Financial institutions typically file the form electronically with the IRS. If you are an individual taxpayer, you may need to include the information from the 5498 Form when filing your tax return, but you generally do not need to submit it directly to the IRS. Instead, keep it for your records. If required, you can also mail a paper copy to the IRS, following the specific mailing instructions provided by the IRS for your tax situation.

Quick guide on how to complete 5498 2011 form

Effortlessly Prepare 5498 Form on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources necessary to swiftly create, modify, and eSign your documents without delays. Manage 5498 Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign 5498 Form effortlessly

- Locate 5498 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign 5498 Form to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 5498 2011 form

Create this form in 5 minutes!

How to create an eSignature for the 5498 2011 form

How to make an electronic signature for your PDF document online

How to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What is the 5498 Form and why is it important?

The 5498 Form is an IRS tax form used to report various types of contributions to individual retirement accounts (IRAs). It is crucial for account holders to ensure their contributions are accurately reported for tax purposes and to verify their contributions on their tax returns.

-

How can airSlate SignNow help with the 5498 Form?

With airSlate SignNow, businesses can easily prepare, send, and eSign the 5498 Form securely. Our platform streamlines the document workflow, making it simple to manage all forms related to IRA contributions with efficiency and ease.

-

Is there a cost associated with using airSlate SignNow for the 5498 Form?

airSlate SignNow offers a cost-effective solution for managing the 5498 Form, with flexible pricing plans to suit the needs of businesses of all sizes. You can choose a plan that fits your budget while gaining access to powerful features designed for document management.

-

What features does airSlate SignNow offer for the 5498 Form?

AirSlate SignNow provides features such as eSignature, document templates, and real-time collaboration to streamline the completion of the 5498 Form. These tools help reduce errors, save time, and enhance the overall efficiency of managing tax-related documents.

-

How does airSlate SignNow ensure the security of the 5498 Form?

The security of your documents, including the 5498 Form, is our top priority. airSlate SignNow employs advanced encryption methods and complies with industry standards to ensure that your sensitive information remains safe and secure throughout the document signing process.

-

Can I integrate airSlate SignNow with other software for managing the 5498 Form?

Yes, airSlate SignNow offers integrations with various software applications to enhance your workflow for managing the 5498 Form. This allows for seamless data transfer and synchronization across platforms, improving productivity and efficiency.

-

What are the benefits of using airSlate SignNow for the 5498 Form?

Using airSlate SignNow for the 5498 Form provides numerous benefits, including increased efficiency in document handling, reduced turnaround times, and enhanced compliance with IRS regulations. Our user-friendly interface makes it easy for businesses to focus on what matters most—growing their accounts.

Get more for 5498 Form

Find out other 5498 Form

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself