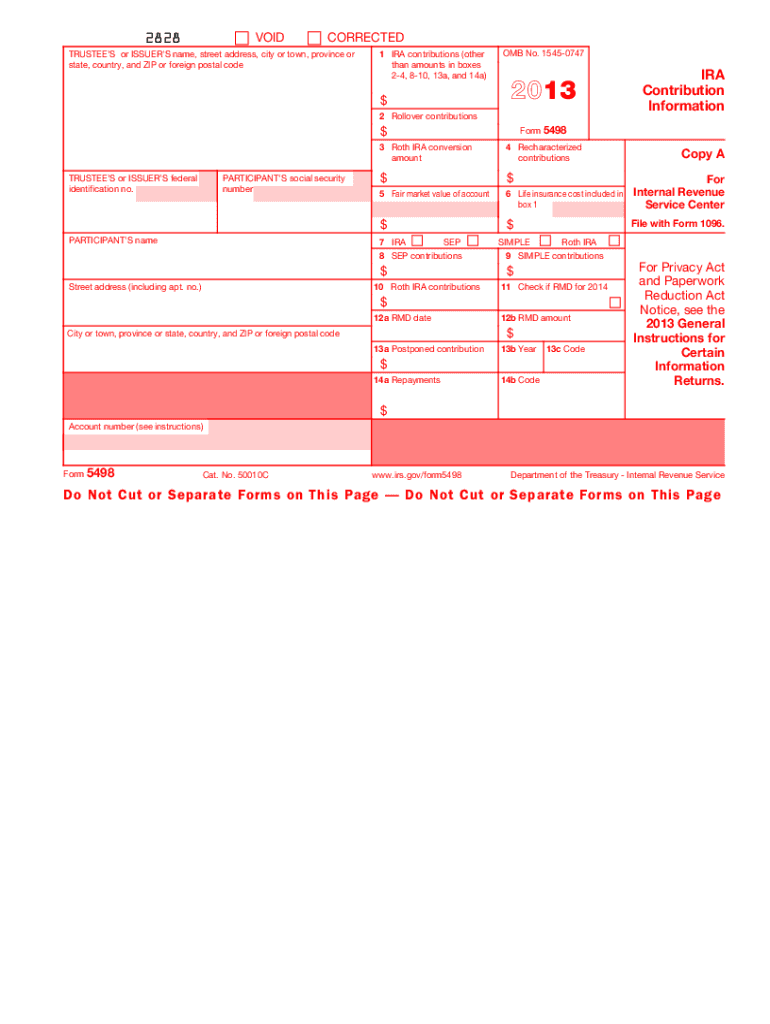

Form 5498 2013

What is the Form 5498

The Form 5498 is an IRS tax form used to report contributions to various types of retirement accounts. This form is essential for individuals who have made contributions to traditional IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs. The information provided on this form helps the IRS track contributions and ensures compliance with contribution limits and distribution rules. Financial institutions typically issue the Form 5498 to account holders and file it with the IRS, detailing contributions made during the tax year.

How to use the Form 5498

Using the Form 5498 involves understanding its purpose and the information it contains. Taxpayers should receive this form from their financial institution, which outlines the contributions made to their retirement accounts throughout the year. It is important to review the form for accuracy, as the information may affect tax returns and eligibility for tax deductions. While taxpayers do not need to submit the Form 5498 with their tax returns, they should keep it for their records as it may be needed for future reference, especially when calculating required minimum distributions (RMDs).

Steps to complete the Form 5498

Completing the Form 5498 requires specific information about your retirement account contributions. Here are the steps to follow:

- Gather necessary documents, including account statements that reflect contributions made during the tax year.

- Identify the type of retirement account (traditional IRA, Roth IRA, etc.) and the total contributions made.

- Fill out the form accurately, ensuring that all required fields are completed, such as your name, address, and Social Security number.

- Verify the information for accuracy, especially the contribution amounts and account details.

- Submit the form to your financial institution, which will file it with the IRS.

Legal use of the Form 5498

The Form 5498 is legally significant as it serves as a record of contributions to retirement accounts, which can impact tax liabilities and eligibility for deductions. It is crucial for taxpayers to ensure that the information reported is accurate and complies with IRS regulations. The form must be filed by the financial institution by the due date, and any discrepancies may lead to penalties or issues with the IRS. Understanding the legal implications of the Form 5498 helps in maintaining compliance and avoiding potential tax-related issues.

Filing Deadlines / Important Dates

For the Form 5498, the filing deadline is typically May 31 of the year following the tax year in which contributions were made. Financial institutions must provide the form to account holders by this date, allowing taxpayers to keep accurate records for their tax filings. It is important for individuals to be aware of this deadline to ensure they receive their forms on time and can address any discrepancies before filing their tax returns.

Who Issues the Form

The Form 5498 is issued by financial institutions, including banks, credit unions, and brokerage firms, that manage retirement accounts. These institutions are responsible for accurately reporting the contributions made to IRAs and other retirement plans on behalf of their clients. Taxpayers should expect to receive this form from their financial institution, typically by the end of May, detailing their contributions for the previous tax year.

Quick guide on how to complete form 5498 2013

Prepare Form 5498 effortlessly on any device

Web-based document management has become widely accepted among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right template and securely save it online. airSlate SignNow equips you with all the features required to create, adjust, and electronically sign your documents promptly without delays. Manage Form 5498 on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to adjust and electronically sign Form 5498 with ease

- Locate Form 5498 and click Get Form to begin.

- Utilize the tools we provide to fill in your document.

- Emphasize signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and press the Done button to save your modifications.

- Choose how you wish to send your form, by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or mislaid documents, burdensome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from any device you select. Modify and electronically sign Form 5498 and guarantee effective communication at every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5498 2013

Create this form in 5 minutes!

How to create an eSignature for the form 5498 2013

How to create an eSignature for your PDF document online

How to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is Form 5498 and why is it important?

Form 5498 is an IRS document used to report contributions to various types of retirement accounts. It's important because it helps ensure compliance with tax regulations and assists taxpayers in tracking their retirement savings.

-

How can airSlate SignNow help with Form 5498?

AirSlate SignNow allows users to easily prepare, send, and eSign Form 5498 securely. Its user-friendly interface simplifies the filing process, ensuring that all necessary information is correctly captured and submitted on time.

-

Is there a cost associated with using airSlate SignNow for Form 5498?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. The cost-effective solution allows businesses to efficiently manage their electronic signatures and document processing for Form 5498.

-

What features does airSlate SignNow provide for Form 5498?

AirSlate SignNow offers features like customizable templates, in-app eSigning, and automated reminders specifically for Form 5498. These features streamline the process, saving time and reducing the likelihood of errors.

-

Can I integrate airSlate SignNow with other software for Form 5498?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, enabling users to manage Form 5498 alongside their existing tools. This integration enhances workflow efficiency and simplifies document handling.

-

What are the benefits of using airSlate SignNow for Form 5498?

Using airSlate SignNow for Form 5498 offers several benefits, including increased efficiency, reduced paper usage, and enhanced security of sensitive information. This digital solution allows businesses to stay compliant with less hassle.

-

How secure is airSlate SignNow for handling Form 5498?

AirSlate SignNow employs advanced encryption and secure access protocols to protect the integrity of Form 5498 and other sensitive documents. This ensures that users' information remains confidential and secure throughout the signing process.

Get more for Form 5498

Find out other Form 5498

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document