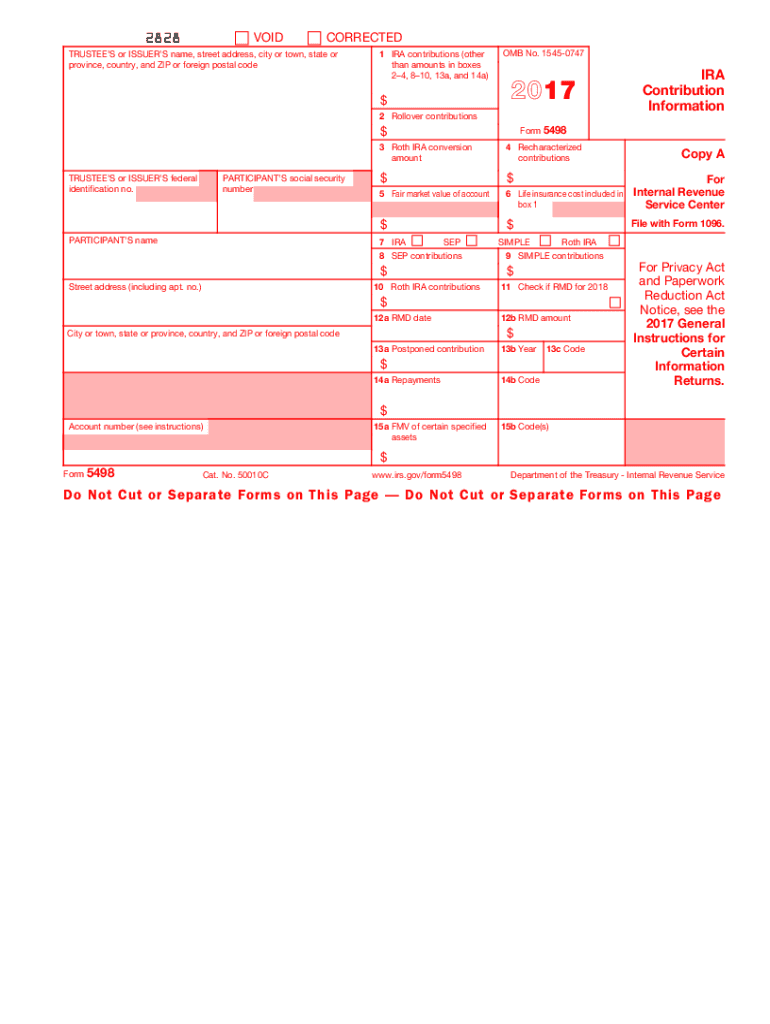

Irs Form 5498 2017

What is the IRS Form 5498

The IRS Form 5498 is a tax document used to report various types of contributions to individual retirement accounts (IRAs). This form is essential for taxpayers who have made contributions to their IRAs, including traditional IRAs, Roth IRAs, and SEP IRAs. The form provides important information about the account holder's contributions, rollovers, conversions, and the fair market value of the account as of December thirty-first. Understanding this form is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the IRS Form 5498

Using the IRS Form 5498 involves several key steps. First, account custodians or trustees are responsible for completing and filing the form with the IRS. They must report contributions made by the account holder throughout the tax year. Taxpayers should receive a copy of this form by May thirty-first of the year following the tax year in which contributions were made. It is important for taxpayers to review the form for accuracy, as the information reported can affect their tax returns and eligibility for certain tax benefits.

Steps to complete the IRS Form 5498

Completing the IRS Form 5498 requires careful attention to detail. Here are the steps involved:

- Gather necessary information, including the taxpayer's name, address, and Social Security number.

- Collect details about the IRA account, such as the account number and the type of IRA.

- Document all contributions made during the tax year, including any rollovers or conversions.

- Enter the fair market value of the account as of December thirty-first.

- Ensure all information is accurate and complete before submitting the form.

Key elements of the IRS Form 5498

The IRS Form 5498 includes several key elements that are important for both the IRS and the taxpayer. These elements include:

- Contributions: Total contributions made to the IRA during the tax year.

- Rollover Contributions: Amounts rolled over from other retirement accounts.

- Conversions: Any conversions from traditional IRAs to Roth IRAs.

- Fair Market Value: The value of the IRA account as of December thirty-first.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 5498 are crucial for compliance. The form must be filed by the account custodian or trustee by May thirty-first of the year following the tax year in which contributions were made. Taxpayers should ensure they receive their copy of the form by this date to verify the information before filing their tax returns. Additionally, it is important to note that while the form is due in May, contributions to IRAs can often be made until the tax filing deadline, typically April fifteenth.

Legal use of the IRS Form 5498

The legal use of the IRS Form 5498 is governed by IRS regulations. This form serves as an official record of contributions to IRAs, which can impact tax liabilities and eligibility for tax deductions. Failing to accurately report contributions can result in penalties or disallowed deductions. It is essential for both custodians and taxpayers to understand the legal implications of the information reported on this form to ensure compliance with federal tax laws.

Quick guide on how to complete irs form 5498 2017

Prepare Irs Form 5498 effortlessly on any gadget

Digital document management has gained popularity among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to acquire the appropriate format and securely keep it online. airSlate SignNow equips you with all the necessary resources to create, edit, and eSign your documents swiftly without delays. Handle Irs Form 5498 across any platform with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest way to edit and eSign Irs Form 5498 without any hassle

- Locate Irs Form 5498 and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign function, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of submitting your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing fresh copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and eSign Irs Form 5498 and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 5498 2017

Create this form in 5 minutes!

How to create an eSignature for the irs form 5498 2017

How to generate an eSignature for the Irs Form 5498 2017 in the online mode

How to generate an electronic signature for the Irs Form 5498 2017 in Google Chrome

How to create an eSignature for putting it on the Irs Form 5498 2017 in Gmail

How to create an electronic signature for the Irs Form 5498 2017 straight from your smart phone

How to make an eSignature for the Irs Form 5498 2017 on iOS

How to make an electronic signature for the Irs Form 5498 2017 on Android OS

People also ask

-

What is the purpose of Irs Form 5498?

Irs Form 5498 is used to report contributions to individual retirement arrangements (IRAs). It provides the IRS with information regarding the type and amount of contributions made each year and is essential for ensuring compliance with retirement account regulations.

-

How does airSlate SignNow help with Irs Form 5498?

airSlate SignNow simplifies the signing and submission process for Irs Form 5498. Our platform ensures that the document is securely signed and promptly filed, making it easier for businesses to maintain accurate records and stay compliant with IRS requirements.

-

Is airSlate SignNow a cost-effective solution for managing Irs Form 5498?

Yes, airSlate SignNow offers a cost-effective solution for managing Irs Form 5498 and other document signing needs. With a range of affordable plans, businesses can choose the right option that fits their budget while benefiting from our robust features.

-

What features does airSlate SignNow provide for Irs Form 5498?

airSlate SignNow provides features such as electronic signatures, document templates, and real-time tracking for Irs Form 5498. These tools streamline the process, reduce errors, and enhance overall efficiency in managing retirement account contributions.

-

Can I integrate airSlate SignNow with other software for Irs Form 5498 management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and document management software systems. This allows for efficient handling of Irs Form 5498 alongside other business processes, enhancing productivity and data accuracy.

-

How secure is airSlate SignNow for handling Irs Form 5498?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to protect sensitive information included in Irs Form 5498, ensuring that your documents remain confidential and secure throughout the signing process.

-

What are the benefits of using airSlate SignNow for Irs Form 5498?

Using airSlate SignNow for Irs Form 5498 offers numerous benefits, including increased efficiency, reduced paper clutter, and improved compliance with IRS regulations. Our easy-to-use platform allows businesses to quickly obtain signatures, manage documents, and maintain organized records.

Get more for Irs Form 5498

Find out other Irs Form 5498

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe